Community Investment Tax Credits: Donors Investing Over $1K in CDCs Realize Significant Tax Benefits

The Community Investment Tax Credit (CITC) was established as a way to incentivize Commonwealth residents to invest in community development corporations (CDCs). The CITC program allows taxpayers to realize considerable tax savings when they make a qualified investment (cash contribution) in a CDC’s community development plan.1

Donor Benefits

The CITC is an outstanding tax incentive for both individuals and corporations who are inclined to donate $1,000 or more, with an annual cap of $1 million in credits. Donors are eligible to receive a Massachusetts tax credit equal to 50% of the total qualified investments for the tax year in which the investment was made. The credit must be taken in the year the qualified investment was made, and any amount in excess of the taxpayer’s tax liability may be either refunded or carried forward to offset future tax liabilities. This credit is available for tax years 2014 – 2019.

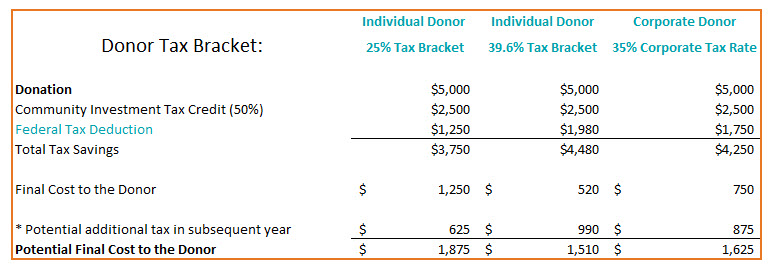

Donors that meet CITC qualifications are able to make significant financial contributions to the community with less of an impact to your wallet. For example, if you contribute $5,000 to a CDC, you will receive a partial benefit on your income tax return. In addition, you receive a refundable Massachusetts tax credit for 50% of your contribution (see Figure 1: illustration of Tax Savings). This Massachusetts refundable CITC is significant as Massachusetts does not traditionally allow deductions for general charitable contributions.

Figure 1: Illustration of Tax Savings

*Note: Since State taxes are deductible for Federal purposes, the reduction in current year tax (benefited by the credit) may lead to less deduction in the subsequent year. Accordingly, a donor’s income tax may be impacted in the subsequent year depending on their individual tax situation. Please consult with your tax advisor for questions regarding the tax impact.

Further Leverage Your Contribution

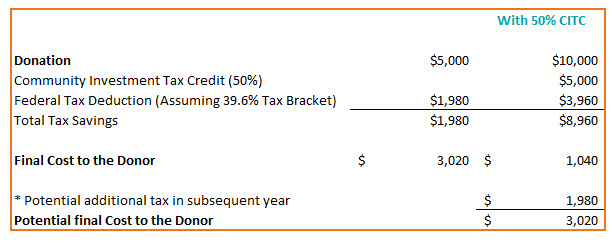

CDCs are able to further leverage private contributions, and greatly increase their ability to impact the communities they serve. Consider a current donor who writes a check for $5,000 to a CDC. Assuming that the donor was in the 39.6% tax bracket, the impact on their wallet before the CITC was $3,020. With the 50% CITC, the same donor may happily continue to support the CDC with the same end cost, but they are able to increase their initial donation to $10,000 without changing their net cost (see Figure 2: illustration of Ability to Increase Impact).

Figure 2: Illustration of Ability to Increase Impact

Obviously, this additional support is welcomed by the CDCs and the communities they serve. But, there is a benefit for the giver and the receiver. For the individual who is charitably inclined, they are able to combine their desire to do good with their desire to save on taxes.

The Community Investment Tax Credit (CITC) was signed into law by Governor Deval Patrick on August 6, 2012 as part of a larger economic development bill called An Act Relative to Infrastructure, Enhanced Competitiveness and Economic Growth in the Commonwealth. This Act and the CITC program are helping to enhance the economy and job growth in Massachusetts. Residents of the Commonwealth benefit from a host of development initiatives, including: affordable housing, job training, business development, neighborhood revitalization and other vital economic development projects.

Qualifying CDCs

The Massachusetts Department of Housing and Community Development (DHCD) is responsible for administering and allocating the CITCs to the certified CDCs located throughout the Commonwealth. As part of the application process, a CDC must submit its community investment plan detailing its activities, programs and goals for 3-5 years. The selection and allocation process favors CDCs with strong track records and the best community investment plan.

Donors have three ways to get involved and participate in this great program:

- Donate to a specific CDC of your choosing. (A complete list of participating CDCs can be found on DHCD’s website).

- Donate to theUnited Way of Massachusetts Bay and Merrimack Valley’s (United Way) Community Partnership Fund and have your donation distributed to CDCs across the state. The United Way has been chosen by DHCD to administer CITCs the on behalf of the CDCs.

- Donate to one of the community support organizations that have been designated to provide training and technical assistance to CDCs, including:Massachusetts Association of Community Development Corporations (MACDC) and Local Initiatives Support Corporation (LISC).

AAFCPAs encourages donors to consider supporting high impact community development through this advantageous tax credit program. The Community Investment Tax Credit program is helping to provide economic opportunities and vital services to many neighborhoods across the Commonwealth by empowering donors to do more with their funds through reduced tax liability.

If you have any questions or need additional information, please contact your AAFCPAs Partner, or Matthew Troiano at 774.512.4022, mtroiano@nullaafcpa.com.

1Note: An important consideration when determining the qualified investment amount is whether any goods or services were provided by the CDC in exchange for the taxpayer’s contribution. If goods or services were provided, then the fair market value of the goods or services provided must be reduced from the cash contribution in determining the qualified investment amount, unless deemed insubstantial (less than $102).

2There may be Alternative Minimum Tax considerations for future years.