Burden calculations: How to allocate your indirect cost pools to specific jobs

Indirect costs are a necessary part of doing business and a factor unavoidably impacting your company’s profit margins. It is important for contractors to allocate indirect costs to specific jobs in order to truly understand your true cost structure. In an earlier blog, I illustrate how Ready-Access to True Costs Will Guide Profitability. Read more>>. If indirect costs are not budgeted and allocated appropriately, contractors may have false expectations or present skewed results of job performance.

“While allocating indirect costs will not change gross profit, it will change how jobs are reported and provide a more accurate reporting on factors affecting profitability.“

Burden is a practical and meaningful method of allocating your indirect costs to specific jobs. Contractors allocate a cost pool by applying a burden rate or rates. Your burden rate(s) provide a truer picture of total costs than direct costs alone.

Budgeting for direct costs is generally easy. Typically you will obtain specific bids for subcontractors & materials, and then estimate direct labor based on experience. These direct costs are then attributed to a specific job, incurred if/when you work on that project.

Budgeting for indirect costs, on the other hand, can be somewhat less straightforward because these costs are often not readily apparent.

Some examples of indirect costs include:

- Indirect labor (downtime, vacation, sick, holiday)

- Supervision

- Tools & equipment

- Supplies

- Rent

- Vehicle related expenses

- Insurance

- Repairs & maintenance

- Depreciation

Join Our Mailing List

As an educational resource, we are committed to keeping you up-to-date on industry news and best practices in regulatory updates, finance, business, technology security and timely news in your industry.

While some of these costs may be fixed, such as rent and depreciation (if no fixed asset additions or disposals), most of these costs are variable and will fluctuate.

Establish a burden rate

Your individual burden rate is a vital component to profitability, and your calculations should be reviewed every six months or so to account for changes in the components. In order to calculate your burden rate, common practice is to estimate the indirect cost pool and divide it by labor hours (to arrive at a rate) or by labor dollars (to arrive at a percentage).

Additionally, if you have an equipment intensive company (i.e. excavation, site work), and your indirect cost pool consists of a significant amount of depreciation, repairs, maintenance, fuel, and excise tax, you should consider developing an equipment burden rate in addition to a labor burden rate. Similar to labor burden, you would identify the indirect cost pool and divide by equipment hours and allocate those costs into jobs using an hourly equipment burden rate.

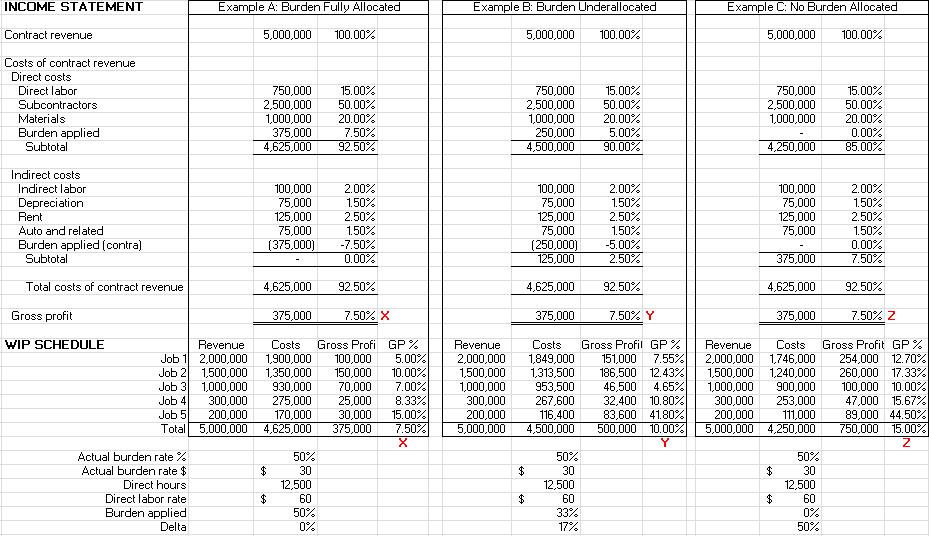

The Illustrative Example Demonstrates the Impact on the Work-In-Progress (WIP) Schedule When Burden is Exact, Under and Over-Applied

In Example A, the entire indirect cost pool has been fully allocated to projects. This is nirvana, but let’s be realistic: companies rarely spend the time and energy to go back and allocate all of their exact indirect costs. However, in this example you can see the gross profit on the income statement of $375,000 or 7.5%, ties directly into the WIP schedule (x). This provides an ideal financial picture of how jobs performed during a given reporting period.

In Example B, the indirect cost pool is under allocated. There is approximately $125,000 of indirect costs that were not allocated to projects. This resulted in the income statement still reflecting $375,000 or 7.5% of gross profit (this will not change), but the WIP schedule is reflecting $500,000 of profit or 10% (y).

As you can see, this variance can be misleading to the users of the reports and show an inaccurate portrayal of the job’s performance.

In Example C, none of the indirect costs have been allocated and it magnifies the issues described in example B. In this example, the income statement remains unaffected; however, the WIP schedule reflects $750,000 or 15% of gross profit (z) showing the jobs are more profitable.

As mentioned in an earlier blog, the WIP schedule is one of the most critical reports and a fundamental dashboard used to provide strategic insight for informed decision making. Read more>>. For contractors, the WIP can look vastly different depending on how burden is applied.

While allocating indirect costs will not change gross profit, it will change how jobs are reported and provide a more accurate reporting on factors affecting profitability. Burden is an important part of your cost structure, providing owners, estimators, project managers and accounting staff with more accurate financial metrics and benchmarks to guide pricing and profitability.

AAFCPAs’ construction team has specialized insight and industry knowledge to help you reduce costs and improve profitability in a fiercely competitive market. Our specialists are available to analyze your operations, including burden calculations, or develop burden rates to optimize performance and profitability.

If you have any questions or need additional information, please contact Dan Stanhope, CPA, MSA at 774.512.4134, dstanhope@nullaafcpa.com.

This article appeared in The Professional Contractor (TPC), a quarterly magazine published by the Association of Subcontractors of Massachusetts.