Net Asset Classification Considerations for Nonprofits Implementing the Financial Statement Presentation Standards

AAFCPAs advises nonprofits in assessing the impact of the new Accounting Standards Update (ASU) No. 2016-14, Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities, and we provide guidance throughout the transition process. ASU 2016-14 affects nonprofit organizations in all industries (i.e. healthcare, affordable housing, social services, foundations and education) and is effective for fiscal years beginning after December 15, 2017 (CY 2018 or FY 2019).

Net Asset Classification

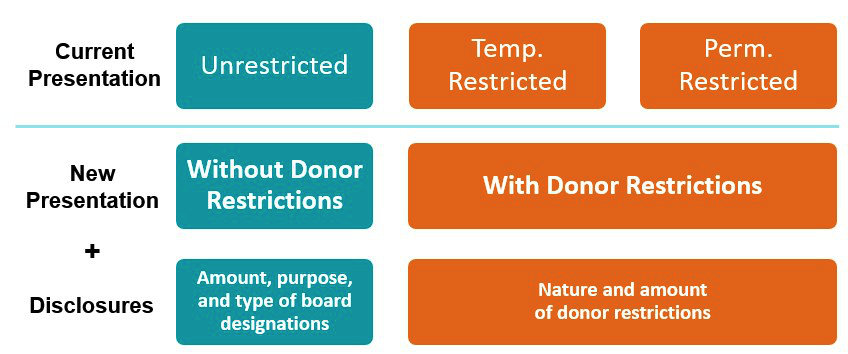

One of the most significant changes to nonprofit financial statement presentation is the reduction of net assets from three classes to two: with donor restrictions, and without donor restrictions.

ASU 2016-14 requires nonprofits to report the total of each of the two classes in a statement of financial position. In order to provide useful information to financial statement users, nonprofits are allowed to further disaggregate the two net asset classes. For example, under the net asset with donor restrictions category, nonprofits may present the following as separate line items either on the face of the statement of financial position or in the notes: net assets perpetual in nature, purpose restricted and/or time restricted net assets, or underwater endowment. This will help in distinguishing various types of donor-imposed restrictions. For the net asset without donor restrictions category, a nonprofit may wish to list out any board-designated net assets or net assets invested in property and equipment.

Implementation Considerations

During the implementation phase, AAFCPAs advises nonprofit clients to determine the degree of disaggregation information to be presented in the financial statements that is best to communicate the organization’s plan for use of the resources. Nonprofits should also consider whether there is a need to adjust the organization’s reporting system or policies and procedures in order to accommodate the new terminology and presentation.

Board-Designated Net Assets

ASU 2016-14 also requires nonprofits to provide information about the amounts and purposes of board-designated net assets, if any, either on the face of the financial statements or in the notes. Common purposes for the board-designated net assets are capital projects, operating reserve, liquidity reserve, quasi-endowments, contingency funds, specific programs and future projects.

Implementation Considerations

During implementation, nonprofits may want to revisit their existing board designations for appropriateness and ensure they properly present the Board’s intentions for the use of the organization’s unrestricted resources. Furthermore, the new standard also requires nonprofits to disclose the appropriations and similar actions that result in self-imposed limits on the use of resources without donor restrictions. A nonprofit’s governing board is now allowed to delegate the designation decision to internal management, and such designations are considered to be included in board-designated net assets.

During the implementation, nonprofits should ensure that their existing policies and procedures for board-designated net assets include: (1) processes for gathering information to meet the disclosure requirements, (2) appropriations and similar actions for the use of board-designated net assets, and (3) delegation to internal management, if desired.

AAFCPAs is available to advise clients on reviewing and updating accounting policies and procedures to reflect any changes, including solutions for processing information and producing financial reporting in line with the new reporting standard. Learn more. >>

If you have any additional questions about how the new ASU will impact you, please contact Matt Hutt, CPA, CGMA, at 774.512.4043, mhutt@nullaafcpa.com; Hui-Ting Grady, CPA, at 774.512.4106, hgrady@nullaafcpa.com; or your AAFCPAs Partner.