Nonprofit Organizations Now Eligible for the Main Street Lending Program

AAFCPAs would like to make nonprofit clients aware that the Federal Reserve announced changes to its Main Street Lending Program to “provide greater access to credit for nonprofit organizations such as educational institutions, hospitals, and social service organizations.”

Which Nonprofits Are Eligible?

The Main Street Lending Program is now open to tax-exempt organizations established under either 501(c)(3) or 501(c)(19) of the Internal Revenue Code. However, footnote number 2 in each of the Loan Program Term Sheets says that “other forms of organization may be considered for inclusion as a Nonprofit Organization under the Facility at the discretion of the Federal Reserve.”

What are the Eligibility Criteria for Nonprofits Under the Main Street Lending Program?

- The Nonprofit has been in continuous operation since January 1, 2015;

- Is not an Ineligible Business listed in 13 CFR 120.110(b)-(j), (m)-(s);

- Meets at least one of the following two conditions;

- Has 15,000 employees or fewer; or

- Had 2019 annual revenues of $5 billion or less;

- Has at least 10 employees;

- Has an endowment of less than $3 billion; and

- Has total non-donation revenues equal to or greater than 60% of expenses for the period from 2017 through 2019.

What Types of Loan Options are Available for Nonprofits?

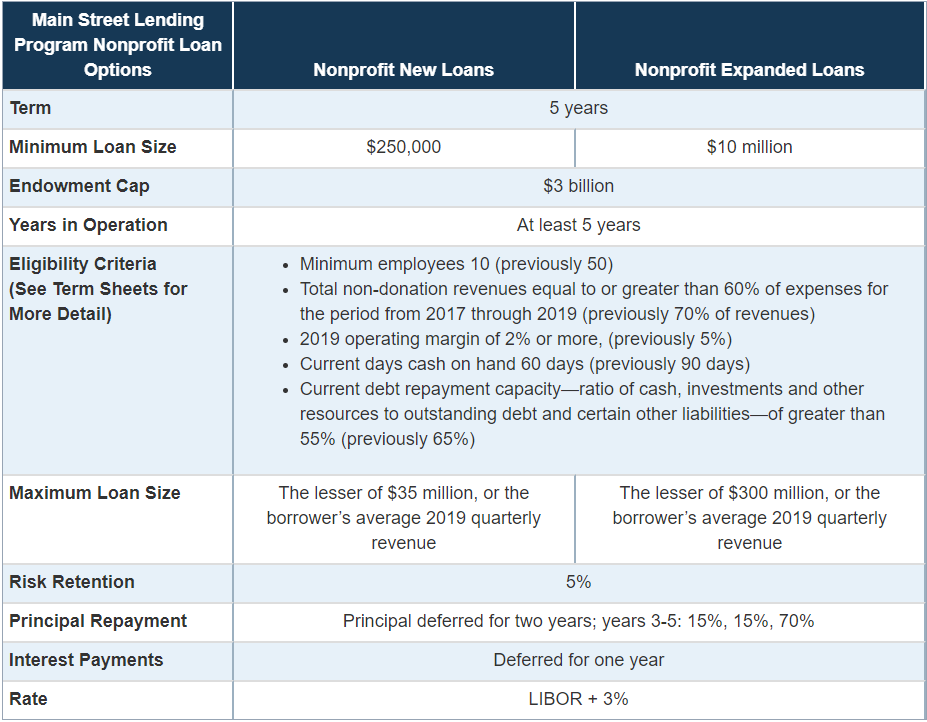

Nonprofits are eligible for two Main Street Loan options: Nonprofit New Loans and Nonprofit Expanded Loans, as outlined in the chart below. The terms for both loan programs are 5 years, with interest payments deferred for one year, principal deferred for two years, and years three through five requiring 15%, 15%, and 70% principal paid back.

What are the Minimum and Maximum Loan Sizes for Nonprofits Under this Program?

The minimum loan size for the Nonprofit New Loan program is $250,000, and the minimum loan size for the Nonprofit Expanded Loan program is $10 million. The maximum loan size for the Nonprofit New Loan Program is the lesser of $35 million, or the borrower’s average 2019 quarterly revenue. The maximum loan size for the Nonprofit Expanded Loan Program is the lesser of $300 million, or the borrower’s average 2019 quarterly revenue.

The chart below outlines additional details:

How can a borrower apply for a Main Street Program Loan?

Prospective borrowers can apply by contacting an Eligible Lender, as defined in the FAQs.

Is collateral required for Main Street loans?

Unlike PPP loans, collateral may be required for Main Street Loans. Borrowers that have other secured debt may be required to secure Main Street Loans so that these loans are not subordinate to the borrower’s other secured debt.

Are there any requirements for borrowers to maintain payroll and retain employees?

Yes, per the FAQs, borrowers should make “commercially reasonable efforts and undertake good-faith efforts to maintain payroll and retain employees during the term of the loan.” Had the borrower already laid-off or furloughed workers as a result of the COVID-10 pandemic, they are still eligible to apply for Main Street Loans.

What do we advise?

AAFCPAs advises clients to consult with your AAFCPAs Partner to discuss your unique facts and circumstances in order to determine which financing is right for you.

As always, AAFCPAs will continue to monitor COVID-19 related developments and keep you informed as significant changes occur or provisions become clarified. If you have any questions please contact: Christopher Consoletti, Esq. at 774.512.4180, cconsoletti@nullaafcpa.com; or your AAFCPAs Partner.