AAF Wealth Management’s Q3 2022 Market Perspective

A PROLOGUE TO THE STORY…

As we sat down to pen this latest quarterly newsletter, we couldn’t help but think of the opening scene of the movie The Big Short (2015).

“IT AIN’T WHAT YOU DON’T KNOW THAT GETS YOU INTO TROUBLE. IT’S WHAT YOU KNOW FOR SURE THAT JUST AIN’T SO.” – MARK TWAIN

The film, based upon Michael Lewis’ best-selling novel, chronicles the events that led to the Great Financial Crisis of 2008-2009. In the years following the crisis, much attention was given to determine the cause of this near collapse of our economic system. The postmortem identified many contributing factors: subprime lending, immodest investments, deregulation, risk run amok on Wall Street, etc. The overriding theme that bound these all together can best be described as a cumulative failure of public policy.

We now find ourselves in an unpleasant, familiar place, with speculation of a recession related to failed attempts by the world’s central banks to overcome the aftershocks of the global economic shutdown of 2020.

It’s important to set the stage for where we are today by revisiting seminal events that occurred over the past two and half years.

2020 – THE COVID SHUTDOWN & GOVERNMENTAL RESPONSE…

As we reflect on the spring of 2020, we must consider the global response of various governments and central banks to reduce the negative financial impact the pandemic had on so many lives. Within a month’s time, we had gone from operating “business as usual” to living in a locked-down state that prohibited most individuals from leaving their homes.

As economic output essentially dried up, central banks around the world developed stimulus packages to augment income for those who lost their jobs and/or experienced reductions in income. The U.S. alone accounted for nearly $7 Trillion dollars in federal spending, tax cuts, loans, grants, and subsidies. Put another way, approximately 40% of U.S. dollars that exist today were generated in one form or another as a result of the economic issues that tie directly back to the pandemic.

Outside the U.S., the rest of the world’s collective response amounted to another $8 Trillion dollars, bringing the total global response to more than $15 Trillion dollars in aid. Additionally, most central banks lowered interest rates, thereby reducing the cost to obtain capital. Combine these massive amounts of new money in the system, with extremely low interest rates spurring on consumerism, and the backdrop is set for an increase in inflation.

2021 – THE GREAT REOPENING & ROLE OF GLOBAL CENTRAL BANKS…

Optimism was on the rise as we headed into 2021 and cautiously hoped for an economic jump start. Pent up demand and cabin fever unleashed a torrent of spending as we slowly began to resume life as usual. By late spring, economic concerns morphed from worries over the enormous contraction in GDP to debating whether inflation would be transitory or more ‘sticky’ in nature. In a high stakes game that would set the tone for years afterward, investors the world over placed their bets, possibly taking clues from central bankers. As for their part, the U.S. Federal Reserve bet ‘the under,’ so to speak, as Jerome Powell would go on to infamously state that inflation was transitory, a mere by-product of global supply chains having been fouled up. Powell’s transitory premise was built upon the argument that as supply chains returned to normal over time, inflation would abate, and we’d return to our usual ~2.5% level from the 5% reading at that time.

However, as 2021 unfolded, the concerns around inflation continued to ring louder. By year end, the Consumer Price Index (CPI) had reached 7%, leading to the single largest yearly increase in the measure since 1982, thereby forcing the Federal Reserve to finally capitulate and change its tone. The idea that inflation would be a short-lived nuisance was dropped and was replaced with the idea that it had become enemy number one given its ability to derail the nascent economic recovery. Cited as one of the two biggest threats to getting back to maximum employment, Powell stood before Congress in December and committed to breaking the back of inflation in 2022.

2022 – THE FED GETS TOUGH…

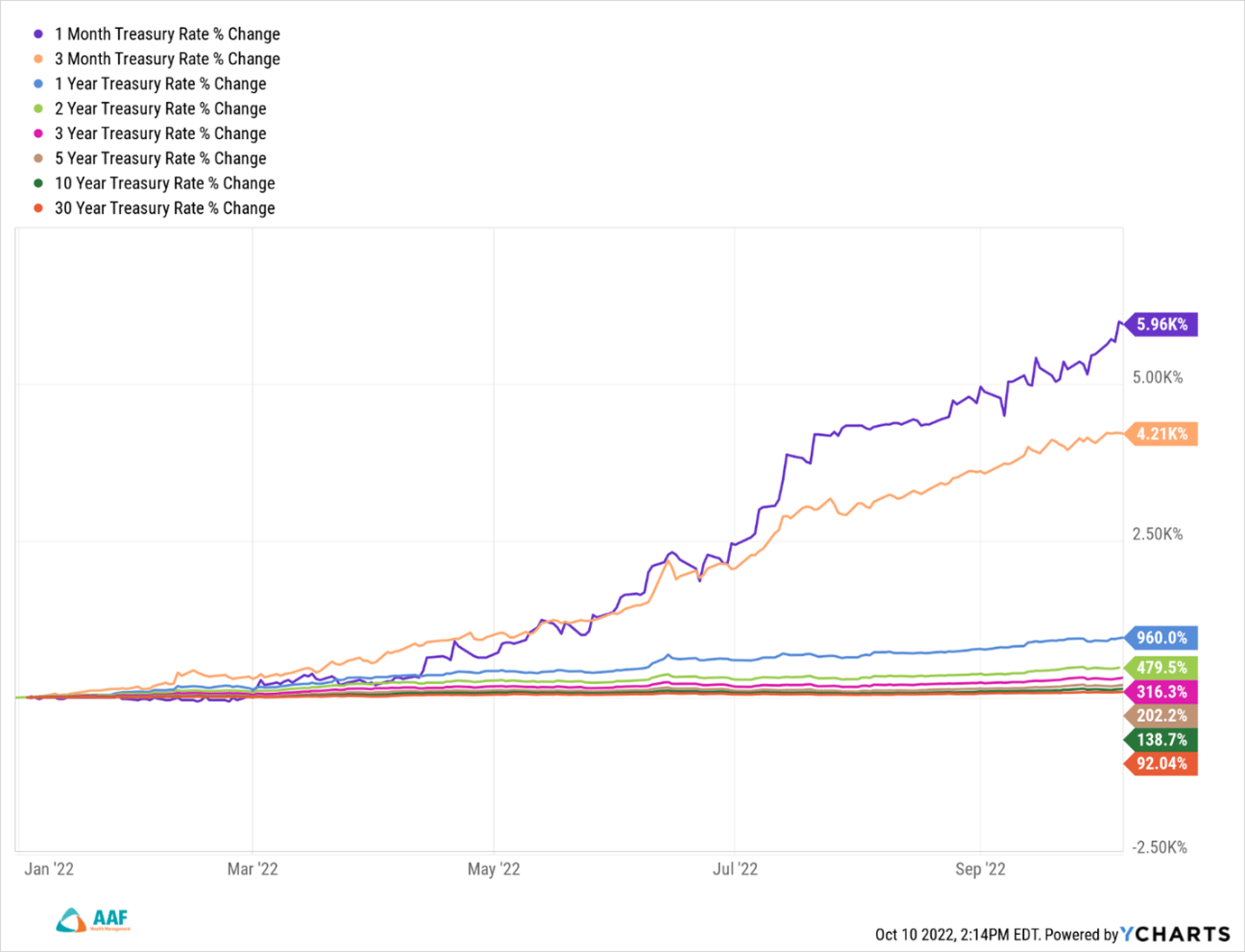

In January of this year, the markets began to account for an inflationary environment. True to their word, the Federal Reserve raised the Federal Funds Interest Rate by 0.25% in March and followed suit during the next four FOMC meetings (Federal Open Market Committee) thereafter (graph below).

.png?upscale=true&width=1220&height=286&upscale=true&name=WM%201%20(2).png)

Additionally, the Fed undertook an entirely new program known as Quantitative Tightening (QT). In short, QT is the process whereby the Fed discontinues open market purchases of government bonds and unwinds their own balance sheet to stop suppressing interest rates. This program was started in earnest in June, thereby allowing for the combination of these three actions to not only increase short-term borrowing costs, but also allow the longer-term bond market to find its proper level for longer duration rates. The cumulative actions of the Fed have been nothing short of historic in their attempts to quell inflation; and the markets, be they equity, fixed income, commodity, housing, and even currency related, have all taken notice.

…AND THE MARKET RESPONDS

With hopes dispelled about inflation being transitory, investors began to reposition their portfolios for a more drawn-out fight. Forced to reconcile higher and higher monthly CPI prints with data possibly showing recession, and yet an incongruously strong job market, many investors chose to shoot first and ask questions later, bringing us up to present day.

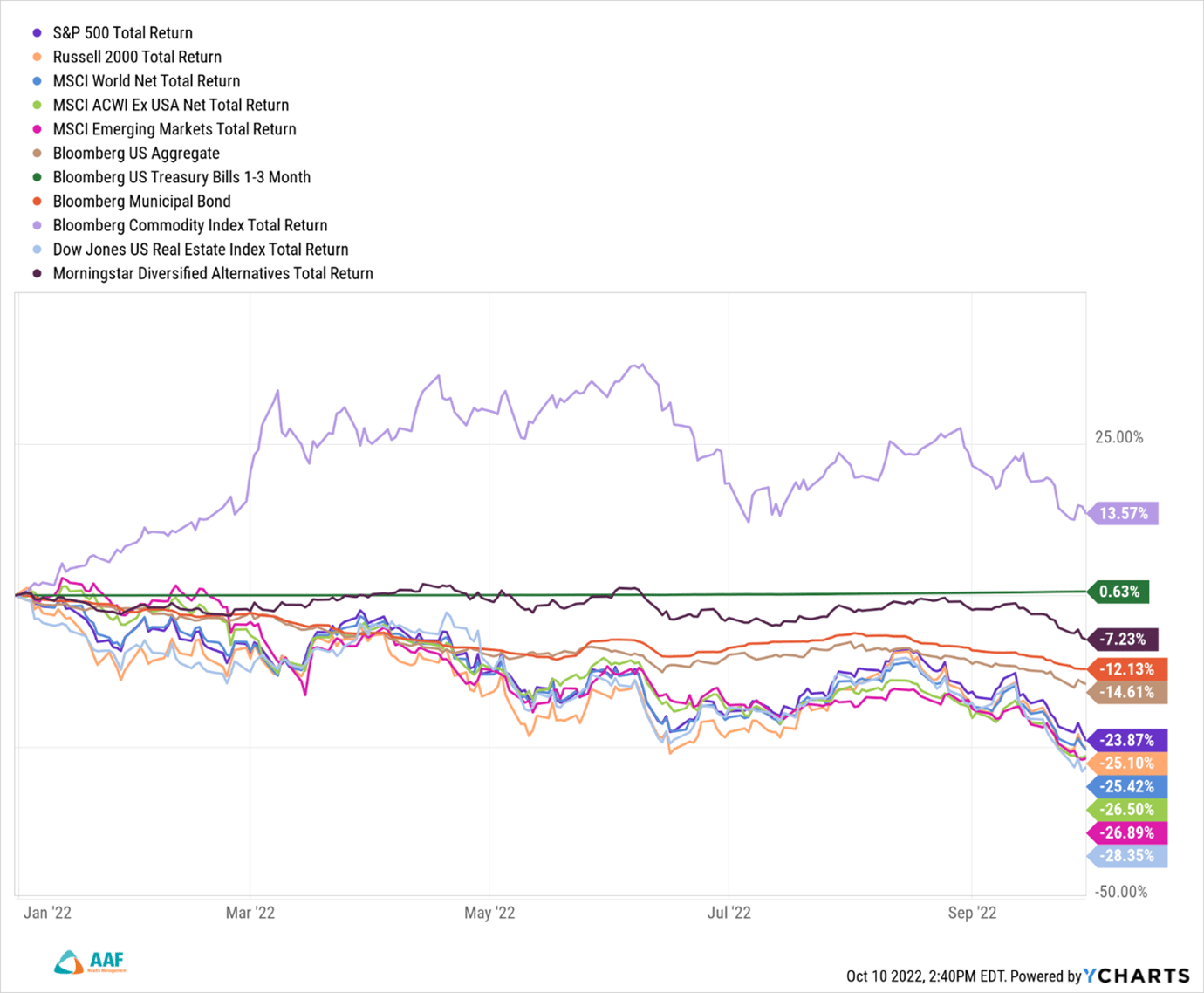

With fears of inflation becoming more entrenched, we witnessed a rarity in the markets where both bonds and stocks have sold off at the same time. And not only have both asset classes taken on losses this year, but we’re at the point where both equities in general, and certain categories of fixed income instruments are down more than 20% year to date. For the first time on record, the US Treasury market has failed to serve as a hiding place for risk as interest rates have risen at an unfathomable pace. You don’t need to be an expert in the nuances of the bond market to understand that a 5,960% change in 1 Month U.S. Treasury rate is something out of the ordinary.

As for stocks, while the prevailing thought normally is that equities may offer the only real opportunity to maintain purchasing power in an already high-cost world, many investors have eschewed that notion for fear that stocks, too, may also become less attractive to “cash is king” alternatives, as the interest rates on fixed investments (CDs, money markets, etc.) have posted their most attractive yields in more than a decade and a half. With a “bird in the hand” mentality having become the norm this year, nearly every major category of investments, save commodities, have sold off.

Unfortunately, we are now bearing witness to one of the worst years on record for a properly diversified portfolio. In fact, at this point in the year, 2022 is registering as the 5th worst investment year on record since 1793.

OUR RESPONSE TO 2022…

It is times like this when investors question their approach to making money in the markets, putting history aside, and instead wondering if THIS time actually IS different.

No one knows when this slide will end, but if history is an indicator, the markets will return to their longer-term averages. In the interim, AAF Wealth Management continues to maneuver our portfolios in defensive ways to try and absorb as much of the economic pain as we can while we wait for the recovery. Specifically, we have taken steps both earlier in the year (January), as well as more recently (in August) to position away from both longer-term bonds and high multiple growth stocks, in favor of short duration and stable, high quality balance sheet assets.

And even though we’re not inclined to simply sell and go to cash, we do make tactical changes to try and reduce the financial pain we and our clients are experiencing.

From a broad perspective, our reallocations have generally fallen into the following categories:

- Reducing the duration of our bond positions to minimize interest rate sensitivity

- Reducing US growth exposure in lieu of more defensive, value-oriented stocks

- Adding both to the total percent invested in, as well as the number of alternative investments within the portfolio

- Reducing international emerging markets exposure

- Adding international high dividend exposure

- Increasing defensive positioning in late cycle sectors, such as Health Care

- Adding to alternative fixed income positions via exposures in floating rate loans, preferred stocks, and convertible bonds

Additionally, clients for whom we manage taxable accounts, we seized the opportunity to reduce taxation (in this year and/or the future) by tax loss harvesting via sales of securities that were showing negative returns. While unpleasant to view on a statement, losses can be used to offset future taxable gains, and with a heritage closely tied to the world of tax and accounting, we are very cognizant of the tax opportunities available to our clients in a year like 2022.

LOOKING FORWARD FOR GLIMMERS OF HOPE…

As stewards of our clients’ money, our job is to scan the horizon for risk & opportunity, and as much as possible position for storms as they arise. While certainly not an easy task this year, we do continually monitor the economic landscape for changes in earnings estimates, interest rates, GDP, inflation, and the like.

Over the following week or so, earnings season will begin in earnest and companies will start to declare their business results for Q3 2022. It’s with a keen eye that we monitor these releases for data points that may give clues as to where this year is trending, and how we should subsequently position portfolios for the future.

With all sincerity, we understand the concerns investors may be feeling and share in their frustrations with the market’s performance this year. As professional investors, clients chose to hire us for our ability to make calm, rational decisions to help with the long-term growth of their assets. To that end, we continue to survey the investment landscape.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.