Investment Performance – 2022 Recap.

As we look back on 2022, there are things for which we can be grateful, but market performance is certainly not one of them.

Investment Performance – 2022 Recap.

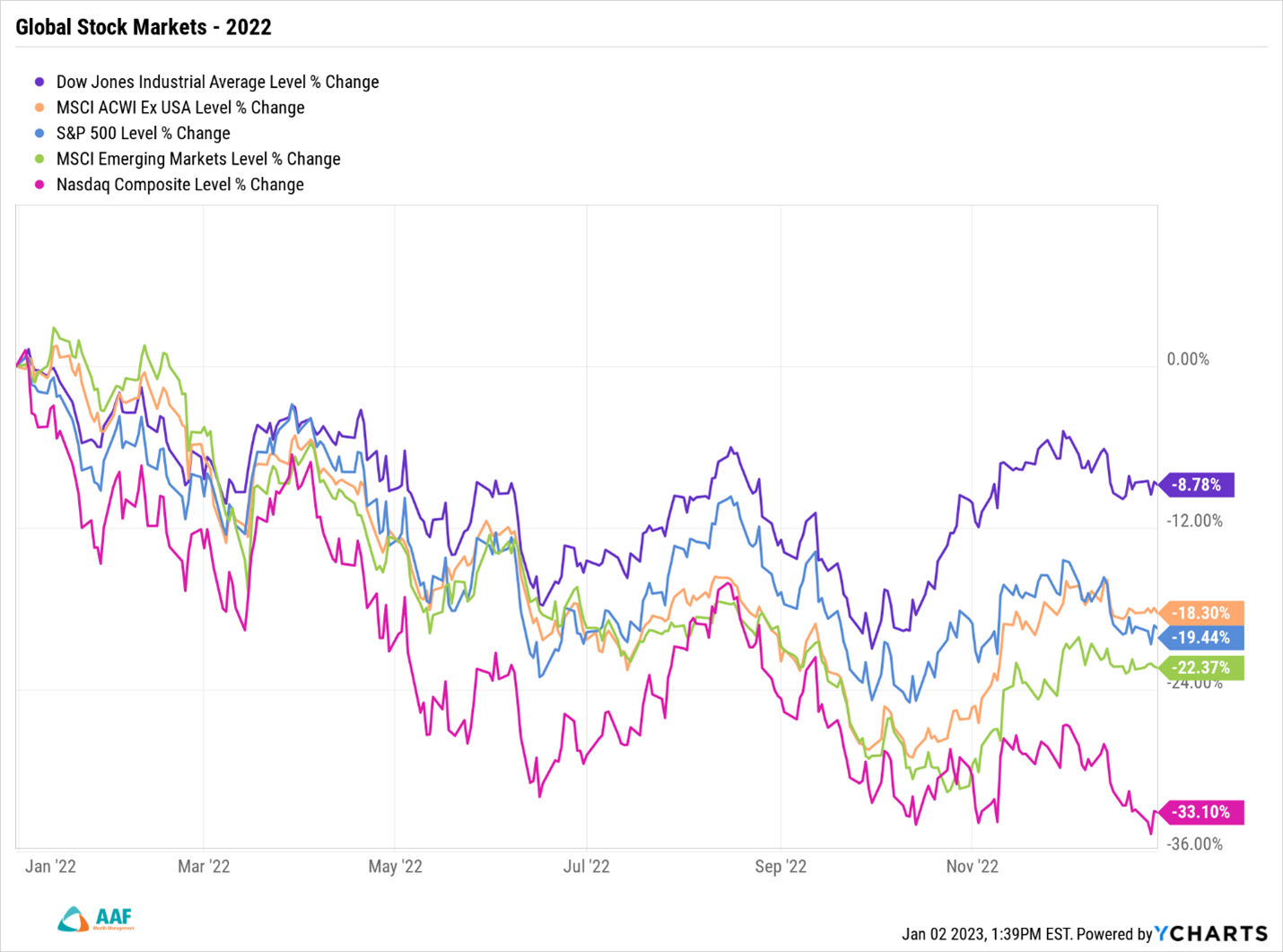

Around the world, few markets provided positive performance in what turned out to be the worst year for US investors since the Great Financial Crisis of 2008. While stocks largely ended the year on a stronger note than which they began, there were significant periods of weakness that occurred at various times throughout the year.

At their lows, 4 of the 5 major stock indices fell at least 25% or more before rallying through year end. Only the Dow Jones Industrial Average failed to reach that same threshold, with intra-year losses falling to -21% at their worst by late September. By the time the ball had dropped in Times Square on New Year’s Eve, markets notched their final tally for the year, and most of the steepest losses were recovered. The lone exception to this “relative strength” witnessed in the 4th quarter was the technology stock-laden NASDAQ which finished out the year on a low note, down 33% from where it started in January.

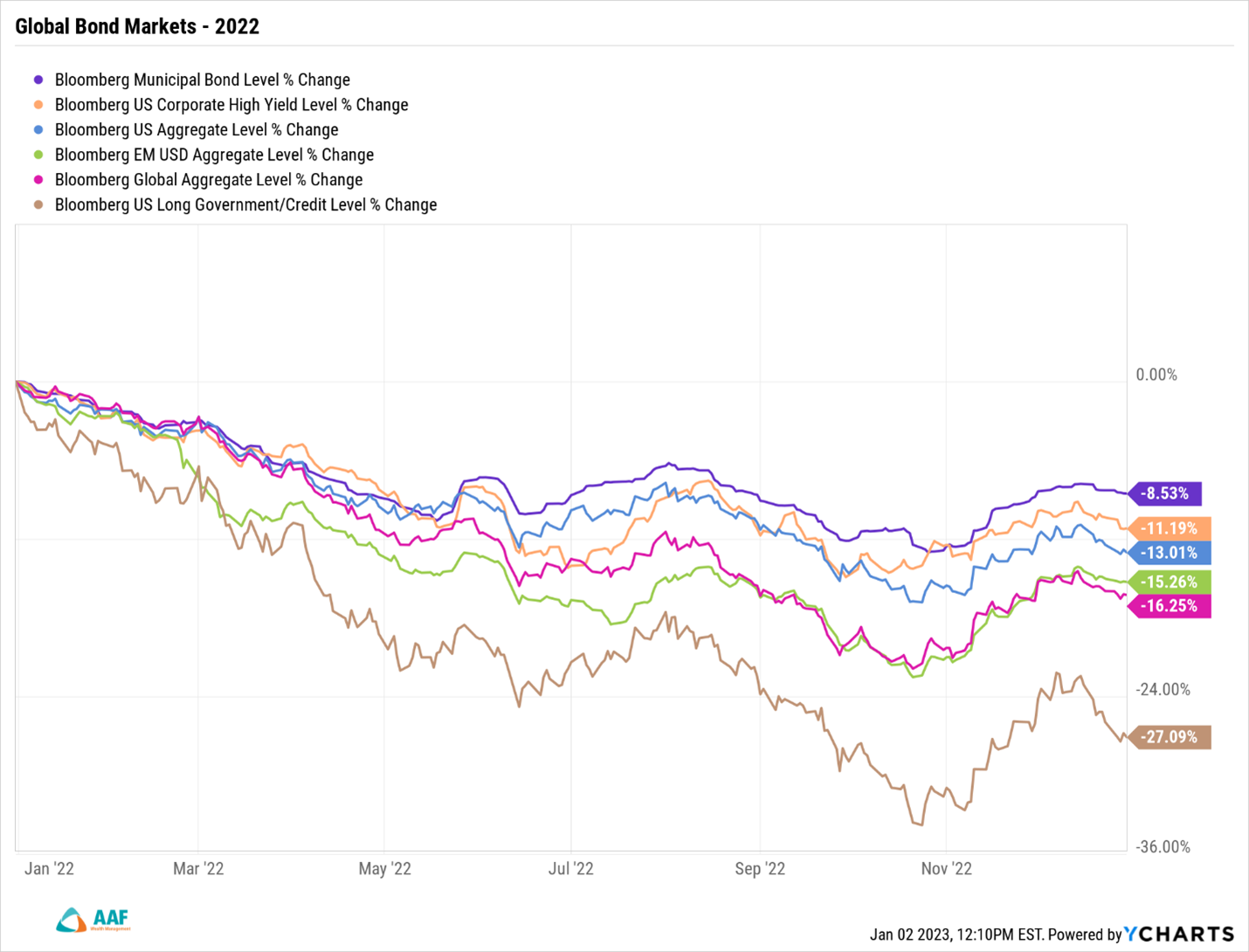

Normally, when we see a year with stock returns as bad as these, bonds tend to ride to the rescue, providing some relief. Unfortunately, it wasn’t to be in 2022, as various fixed income proxies failed to provide ballast last year. It didn’t matter if the names in question were corporate, municipal, or federal bond related, higher or lower (junk) quality names, or even international in nature, bonds fell at an alarming rate.

2022 & The Failure of Diversification

In the world of investment terminology, diversification is a word that often gets used, but for which there are a multitude of meanings. In the minds of investment advisors, diversification is the process by which dissimilar investments are brought together into a holistic portfolio to reduce risk. Based upon the research of Harry Markowitz and his Nobel Prize winning research in the 1950s, diversification has shown a propensity for reducing overall portfolio volatility by combining various investments that have low or negative correlations to one another. For advisors, the methodology used is the focus of the endeavor. That’s not to say that investment professionals aren’t concerned about investment performance, but rather, they generally know that history is on their side for reducing risk, when the time-honored processes are implemented and portfolios are constructed properly.

In the minds of most investors, diversification is usually viewed more from the end results that the process achieves, i.e., the bottom-line performance. As the average investor usually has very little input into the portfolio management process, it follows logically that shareholders should be focused on the portfolio performance. Analogously, most people who dine out normally do so in order to focus their attention on a good meal, as opposed to worrying about the preparation that the kitchen takes in order to get the food onto their table.

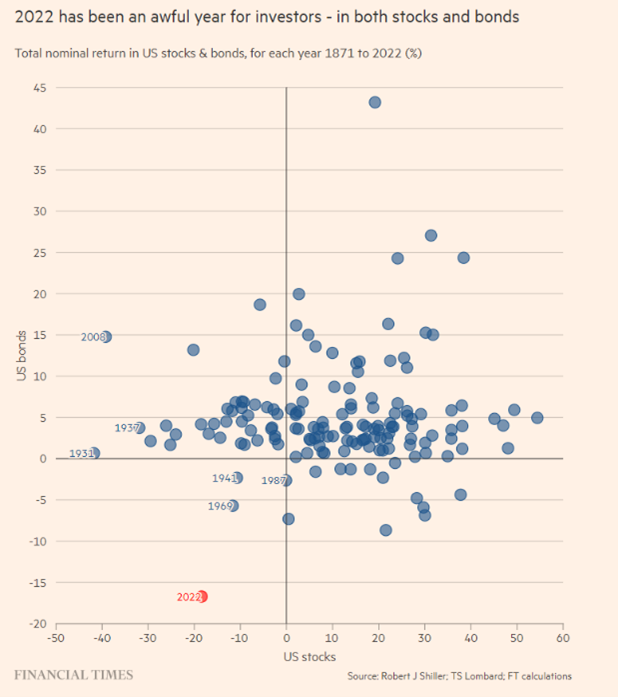

Regardless of which way a person may view diversification and processes employed, 2022 was a let-down. Last year ranked among the worst performing years over the past 150 in terms of how poorly stocks and bonds performed at the same time. As mentioned above, diversification is meant to reduce correlation among investments, and by and large the process usually works. 2022 provided a roadmap, however, for how bad things could get when a once in a lifetime (hopefully) set of events come together to overwhelm the financial markets.

As viewed on the scatterplot chart, the red dot (2022) shows unparalleled negative correlation of stocks and bonds over the past 150+ years. For those who may be unfamiliar with this type of graph, performance of stocks runs from negative to positive (left to right) on horizontal axis, and for bonds vertically, as you move down the axis indicating positive to negative returns. Ideally, we’d like to see a big red dot in the upper right-hand quadrant of the chart, not the bottom left.

The question that so many people have asked is ultimately why 2022 unfolded the way it did, and what do we expect in 2023. In short, the combination of rapidly rising interest rates, much higher and stickier inflation than expected, and an extremely determined US Federal Reserve combined to roil the markets in ways that we haven’t witnessed in quite some time. While everyone knew the Fed was going to act, few expected them to move at such a quick and unrelenting pace in their intent.

With the Federal Reserve declaring war on inflation in December of 2021, they increased the Federal Funds Rate six times last year, leading investors to sell bond positions en masse for the fear that rising interest rates would devalue their bond holdings on real return basis. Like their equity counterparts, few if any categories of bonds provided any respite from the drudgery of stock returns.

2023: Expectations for More Normalization in Policy

Statistically speaking, it would be quite a feat for both the stock and bond markets to string together back-to-back years like what we experienced in 2022. That’s not to say there won’t be volatility this year, nor it is impossible that stock or bond markets could witness poor performance on a relative basis. What it does mean is that the expectation of extreme volatility in both stock and bond markets is not likely to repeat when the final trading day of the year comes to a close next December.

Referencing the scatterplot above, it’s highly unlikely we see a 2nd year, back-to-back, with positively correlated negative performance for long term bonds and stocks.

Where 2022 was a year characterized by the US Federal Reserve embarking upon a string of rate increases, 2023 will likely be defined by the opposite response, as the Fed slows and eventually stops the hiking process of the Federal Funds Rate. We may not see a rate cut in 2023, but it’s very possible that the combination of inflation beginning to slow and/or decrease, coupled with a less tight jobs market in the second half of this year provides the opportunity for the Fed to end their hiking cycle.

Our expectation is that 2023 brings with it new opportunities when all is said and done. We feel that a normalization of the yield curve will likely develop over the coming months, the strong US dollar will start to reverse course in the intermediate term, and stock markets will eventually stabilize as it becomes apparent that the world has begun to deal with the effects of higher inflation for the time-being. In order to navigate what is likely to be a year of change, we will be watching various economic data points for signs of where the economy is trending (GDP, PMI, CPI, etc…) as well as more micro-related data points at the industry, sector, and individual company level. These clues will prove instructive for how AAF Wealth Management builds and manages portfolios over the coming year.

Make no mistake, we are planning to make meaningful changes in 2023 to both avoid and capitalize on the events that we expect to see unfold over the coming months. Change will be a process that takes time to develop within portfolios, however, “V” shaped reversals are not common in our business. In layman’s terms, the markets work through changes in direction through a series of fits and starts, and the groundwork is often laid over a period of months: think of the chop of markets back and forth as new regimes take hold, and yesterdays’ leaders cede control to these newer names. We expect this to be the case in 2023, as the world contends with slowing economic growth and activity.

Ultimately, most of the world is waiting to see if the much debated, and also the most highly called recession of all time, comes to fruition. With so much conflicting data at present, we’re not about to call it a forgone conclusion that a deep recession is imminent. The thing about markets and economic releases that is so confounding is that markets often do the exact opposite of what everyone expects. If in fact recession does come to bear in 2023, it will be singularly the most heralded and called recession of all time. And for what it’s worth, that’s not usually how recessions have historically started.

Our goal, much as we were able to do in 2022, is to provide clients with better relative performance than our benchmarks . Taken on gross basis, our various model portfolios beat their respective benchmarks across the board for 2022. And while we’d love to deliver absolute positive performance (i.e., never see a decrease in value), it’s unfortunately unrealistic. Even the world’s greatest investors (Warren Buffet, George Soros, Peter Lynch) had years where their performance was negative on an absolute basis. The goal, for anyone who takes an active approach, is to provide better risk adjusted performance than that of a benchmark, competitor, or peer, and that’s what AAF Wealth Management is striving to deliver again in 2023.

Changes In 2023: Secure ACT 2.0

Apart from the daily swings in stocks and bonds, there are quite a few changes that investors can start to plan for and implement on the planning front. With the passage of the SECURE ACT 2.0, Congress has authorized sweeping changes to contribution limits in retirement accounts, how and when required minimum distributions are taken, and even how other vehicles such as 529 college plans are utilized. The net effect is that there are substantive changes to the way our clients invest, for themselves and other family members, that can be capitalized on as we go through this year and beyond. We urge you to read our recent blog (Secure Act 2.0 & the YE Spending Bill) and speak with your AAFCPAs Partner about how this impacts you.

*AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.