AAF Wealth Management Q2 2023 Market Update

This has been an eventful year for U.S. and global economies. As we close the first half of 2023, U.S. consumers have largely witnessed a slowdown on inflation, while the rest of the world continues to wrestle with it. Domestically, though, we are beginning to see the cumulative effects of the past few years’ economic policies. Despite all, the U.S. stock market continued to climb.

The Impact of the Banking Crisis

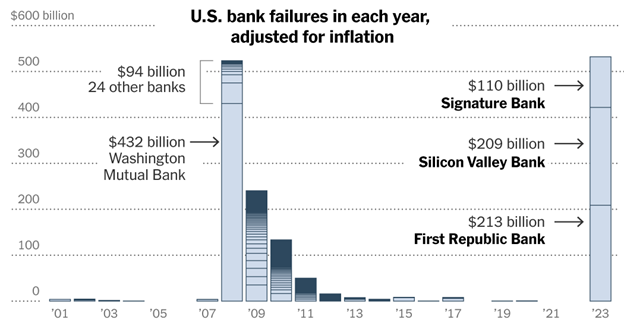

The most significant economic event of 2023 thus far is still the U.S. banking crisis. This past March, Silicon Valley, Signature, and Silvergate Banks failed followed by First Republic Bank in May. While this amounted to just 25 percent in terms of total failures experienced during the great financial crisis of 2008-09, total assets affected in this year’s failures rivaled its predecessor in dollar value.

In response, the U.S. government intervened by temporarily extending blanket FDIC insurance to all financial institutions, thereby bailing out depositors at each failed bank. It also created a new liquidity facility, the Bank Term Funding Program (BTFP), and allowed banks to borrow cash against the value of their underwater fixed income positions for up to 12 months.

As a result, we learned that roughly 45 percent of all deposits held in the U.S. banking system were uninsured by FDIC. This left customers reassessing whether they should work with just one bank if balances exceed the FDIC insurance threshold of $250,000. It also affected businesses that normally maintain large balances to meet payroll. Confidence in the banking system also plunged, as smaller institutions saw large outflows to the “Too-Big-to-Fail” (TBTF) banks. The greater the stress experienced by our small and regional banking system, the more likely we were to see collateral damage. To this day, consumers remain concerned that regional banks, which hold most of the commercial real estate loans in this country, may be sitting on problematic loans.

Time will tell if those loans become problematic, with much tied to the U.S. Federal Reserves’ upcoming interest rate policy decisions. The higher interest rates rise, the more detrimental debt financing becomes to profitability and the more willing lessees may be to take on new leases. Lower profitability for Commercial Real Estate (CRE) balance sheets generally translates into value downgrades for existing loan portfolios, as well.

The Fed Holds Interest Rates

For the first time in 15 months, the Fed did not raise the Federal Funds Rate (FFR) in June, choosing to hold interest rates at the current level of 5.00 to 5.25 percent. It had previously raised the FFR ten times in a row between March 2022 and May 2023. With a cautious inflationary outlook, the Fed has paused to see what effects their efforts will have on the economy. As of yet, there have been no negative effects on the employment front. In fact, hiring remains strong and employers have not begun to cut headcount as many feared.

The approach taken by the Fed in the second half of the year will be key to determining how the economy fares. If too heavy handed, it has the potential to drive the economy into a recession by hiking the cost of financing above levels most would be willing to accommodate for everything from mortgages to personal and corporate financing. If too light handed, inflation could reignite, forcing it to hike rates even higher.

The Debt Ceiling Raises Concerns

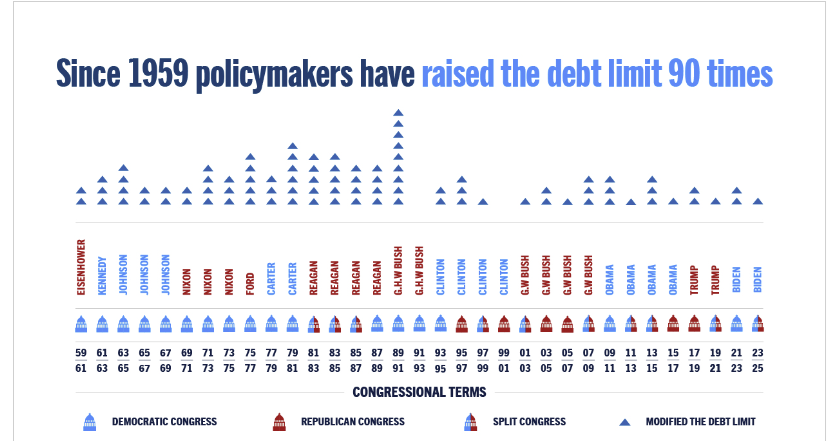

Also making headlines this quarter was the debt ceiling, as Democrats and Republicans clashed to include their own agenda. As months passed, concerns rose that this could lead to a drop in GDP, with potential job losses for up to two million people followed by cascading credit and stock market drops worldwide should the instrument underpinning much of the world’s financial systems fail to pay its interest owed to bondholders.

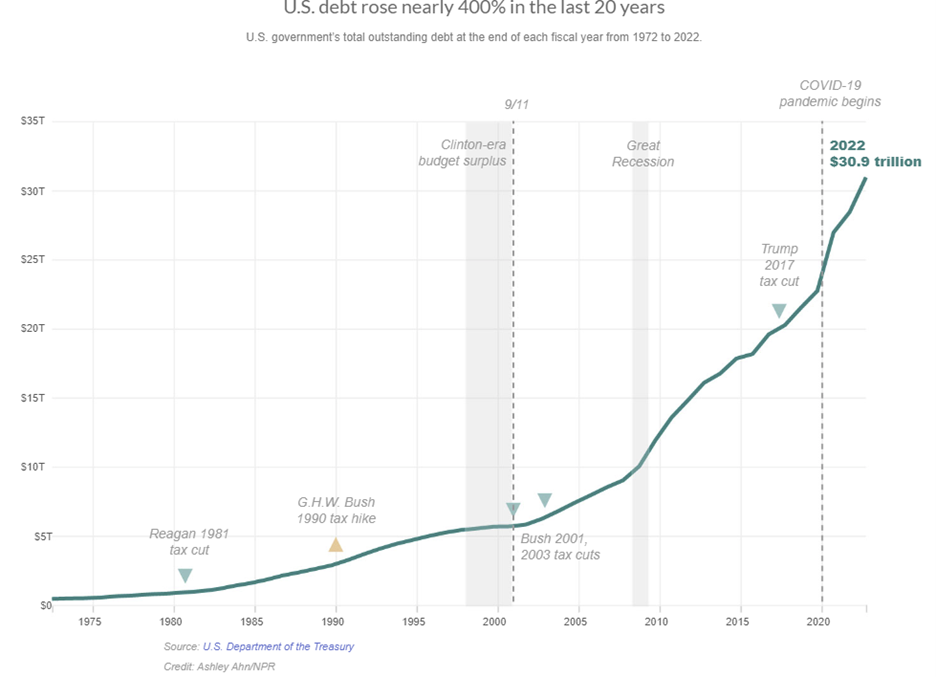

At the heart of the debt limit was an explosion of debt accumulated during the past 50 years, which is largely due to entitlement program spending and defense as well as interest on government debt. In the end, a resolution was reached in the last hour allowing the government to continue operations.

The rise in debt accumulated in our recent history is substantial and is expected to cause issues in the future unless politicians are willing to address it.

The Market Reacts: Q2 Performance Recap

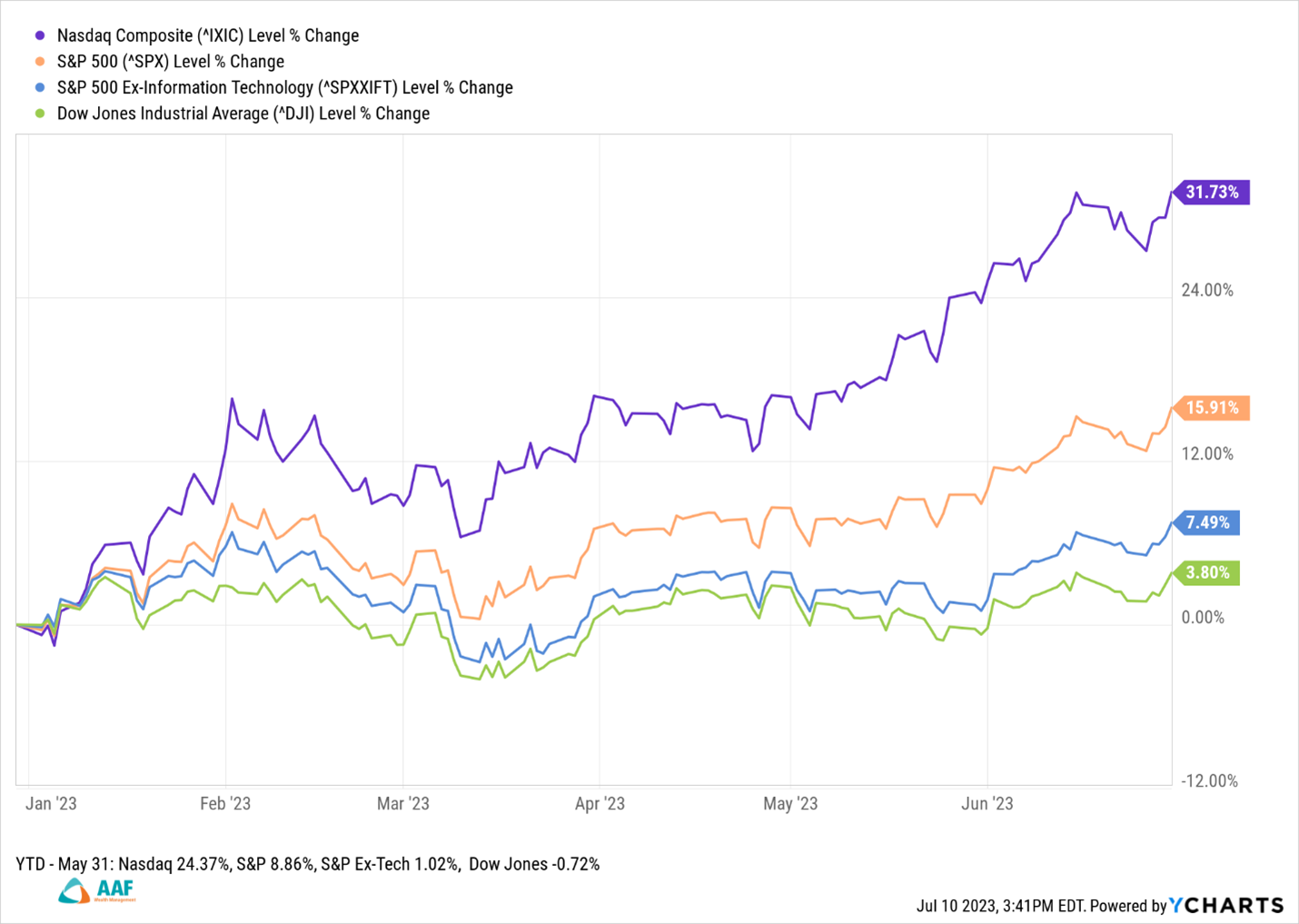

Numerous factors were at play during the first half of 2023, many of which have been known to negatively affect the markets. Nevertheless, the Dow Jones Industrials, S&P 500, and NASDAQ performed between 3.8 percent to nearly 32 percent for the first six months of the year. By contrast, if tracked through the first five months, performance was more muted for non-NASDAQ stocks, with the Dow posting a negative return of -0.72 percent and the S&P 500 up just 8.86 percent.

When we look closely at U.S. stocks from either timeframe, we see that a handful of tech companies have driven this year’s rally. Stripped of technology brands, the S&P 500’s performance through May 31 was just 1.02 percent and 7.49 percent through June 30.

It has only been in the last month that we notice more breadth in the market, as non-tech names enter the rally. It is likely not a coincidence that both the debt ceiling debate and the decision to hold interest rates both occurred last month, clearing the way for more investor exuberance.

Looking Ahead

As we move into the second half of 2023, we will concentrate on a handful of important dates. Specifically, the Fed’s Federal Open Market Committee (FOMC) is scheduled to meet four more times this year—once in July, September, early November, and mid-December. Decisions made during these meetings will likely drive not only market performance but also the strength or weakness of the economy, as key interest rate decisions are implemented along the way. Per Chairman Jerome Powell’s most recent testimony to Congress in June, the “central bank has a long way to go” to bring inflation closer to the Fed’s goal of two percent.

While the Consumer Price Index has dropped considerably year over year from 9.1 percent in June 2022 to 3.0 percent in June 2023, it is still higher than the Fed’s intended target. At FOMC’s last meeting in June, minutes show rate hikes should be expected in the second half of the year. Almost all FOMC voting members agreed that the path of least resistance in rates is higher, with 16 of 18 members believing at least a one-quarter percent hike was likely and 12 of 18 believing two hikes were justifiable.

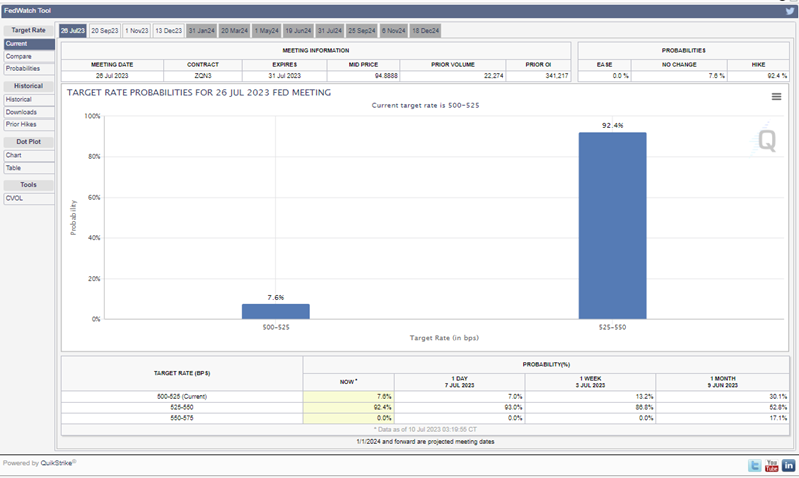

The Fed’s pause this past June was largely the result of its willingness to step back and take in what its previous 10 hikes had accomplished versus a tacit belief that inflation is coming down to manageable levels. In fact, there is a 92 percent chance that the Fed will raise the target interest rate 25 basis points in July, with a 22 percent chance it will increase by 50 basis points by September.

As the U.S. remains cautious on inflation, most central banks around the world have continued to hike key short-term rates in an attempt to curtail higher than acceptable levels of inflation.

Investor Expectations Begin to Turn

Investor sentiment is beginning to gain in strength as noted by the markets’ broad expansion since early June. A lack of volatility and what many investors perceive as two important all clear signals—the debt ceiling resolution and the Fed’s pause in June—have enticed many investors back into the market.

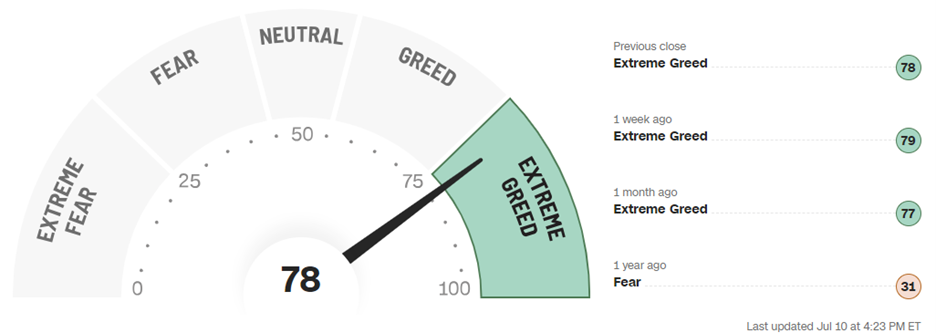

CNN’s Fear and Greed Index, a fairly reliable indicator of sentiment, has also been working its way to the greedy side over the past several months, possibly signaling a short-term market cool off. While the Fear & Greed Index may be useful in projecting short-term market shifts, it has not proven successful in forecasting longer-term trends.

What’s Below the Surface?

We believe the best approach to understanding where the market is headed requires a combination of both a bottom’s up approach to understanding companies and sectors and a top-down, broad-based understanding of the global macroenvironment in which all companies operate.

When viewed from the lens of overall stock market participation, i.e., a top-down approach, the more stocks breaking out to new highs over short, intermediate, and long-term timeframes, the more a case could be built for underlying market strength. When looking to stocks that comprise the S&P 500, the percent of companies exhibiting strength across various timeframes above has risen. For the most part, it appears that the bear market last year may have reached its bottom in October 2022.

In fact, just last week, the S&P 500 entered a new bull market, as the index rose more than 20 percent from its low last October. The key to keeping this momentum rolling will be for the markets to recover any near-term losses in the short run in relatively short order. Any backsliding below the index level of 4315 might suggest there is more at play than just a regular cooling off, given the strong move during the past nine months.

All in all, the momentum built over the past several months can take a lot of effort to reverse, something a bout of short-term volatility could not accomplish. As such, we’re constructive on the U.S. stock market at this point and look forward to continued gains in the second half of 2023.

Wrap Up

It appears any weakness in the economy will be pushed out to 2024 baring any strange economic data in the next quarter. Strong job numbers continue to underpin the economy even as fewer people hold ready reserves of cash in their bank accounts. And with the likely resumption of student loan payments on tap later this summer, consumer spending might take a hit.

That said, a potential recession does not necessarily mean it would be a long, drawn-out event inflicting severe market damage. It is possible the market chops back and forth given the environment and works its way up slowly over time. The key to everything is whether the Fed has a handle on this economy and whether it can usher in the soft landing it believes possible. Should that happen, the market’s bottom last October might turn out to be the bottom of this market cycle. As such, we remain optimistic on 2023 and will keep an eye on the Fed.

If you have questions about your investments or personal financial plan, please contact Kevin P. Hodson, Wealth Advisor at khodson@nullaafwealth.com or 774.512.4173—or contact your AAFCPAs partner.

*AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.