Meals & Entertainment Deduction Reverts to Pre-TCJA Law

As of January 1, 2023, the meals and entertainment deduction has reverted to previous guidelines under the Tax Cuts and Jobs Act (TCJA). Put differently, the 100 percent deduction for food or beverages provided by a restaurant has officially expired.

The IRS advises that a 50 percent limit on meal expenses applies if that expense is otherwise deductible and is not covered by an exception. Exceptions will still exist under the applicable code section (IRC §274). This includes expenses for meals treated as compensation or recreational employee activities.

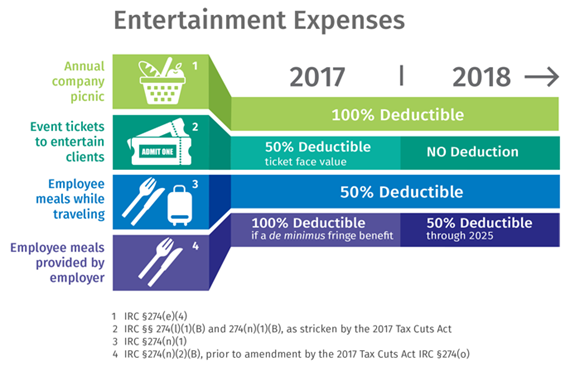

The following infographic simplifies guidance.

Also updated for the 2023 tax year is an adjusted applicable percentage for bonus depreciation on qualifying property. More specifically, for property placed in service after December 31, 2022, and before January 1, 2024, an 80 percent deduction is allowed in lieu of the previously available 100 percent deduction.

If you have questions, please contact Tyler Champagne, CPA, MSA, Tax Manager at 774.512.9012 or tchampagne@nullaafcpa.com—or your AAFCPAs tax advisor.