From the Desk of Carmen Grinkis – October 2023

Clients often come to us because of some kind of transition or challenge. They may be heading into retirement, navigating a divorce, or coping with the loss of a loved one. In all these cases, there is so much more to consider than how investments are performing.

Especially as we age, we find ourselves building or rebuilding a foundation for the next stage of life. This always introduces significant emotion, as we begin to think about whether we’ve achieved our goals and lived a meaningful life. What has been left undone, and how can we enter this next phase with that sense of accomplishment and fulfillment that we all hope to enjoy?

We view part of our role as being an integral aspect of your support system during times like these. We work to ensure the practical details of life don’t get in the way of the big picture or, even better, help you move forward.

There are myriad considerations beyond investments and income: health coverage, long-term care, family communications, and legacy planning. The list goes on. They are all important elements. However, one item we frequently see as a challenge is the accessibility of Medicare, especially with changes to relevant tax law.

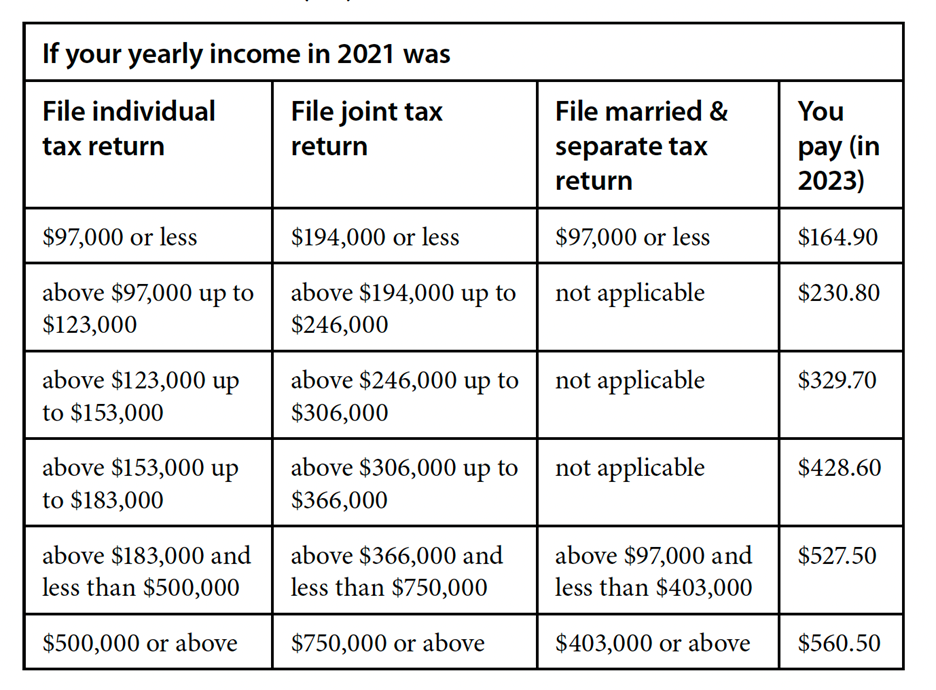

As a part of our financial planning relationship, we take an ongoing look at how income affects Medicare costs and surcharges. We apply a unique planning tool to your tax return to analyze and make transparent your current and anticipated tax brackets (income tax, cap gains tax) and potential Medicare surcharges called IRMA (Income Related Monthly Adjustment).

With some proactive planning, these surcharges can be reduced using various advanced strategies related to when and how you take your income. For example, if you sold your house in 2021, you likely generated more income than usual through the sale. While that is only a one-time occurrence, two years later (in 2023), Social Security will notify you that you must pay additional Medicare costs based on the increase in income.

This can be particularly challenging for widows/widowers. They not only lose a second income source from Social Security when their spouse passes, but they may also be subject to additional Medicare surcharges.

Here’s a chart that shows how Medicare costs can quickly scale up:

We think ahead about issues like these, so we can remove unwelcome surprises from situations that are already difficult enough. Your goal is to live your best life, and ours is to make that as achievable as possible.

As always, I welcome your questions, whether about these issues or other circumstances arising in your life. Please reach out at any time!

Carmen

*AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.