AAF Wealth Management Q4 2023 Market Insight

Last year was eventful both economically and otherwise, from bank failures in March to Fitch’s downgrade of U.S. government debt, a collapse in inflation, and the Federal Reserve signaling it might end rate hikes. In an ongoing commitment to keep you abreast on a range of issues that might affect you and your business, AAF Wealth Management is pleased to share our Q4 2023 Market Insights. AAF Wealth Management is an affiliate of AAFCPAs. These insights reflect on some of the financial developments in 2023 that influenced investment performance and what positive opportunities may lie ahead.

Year-end Recap

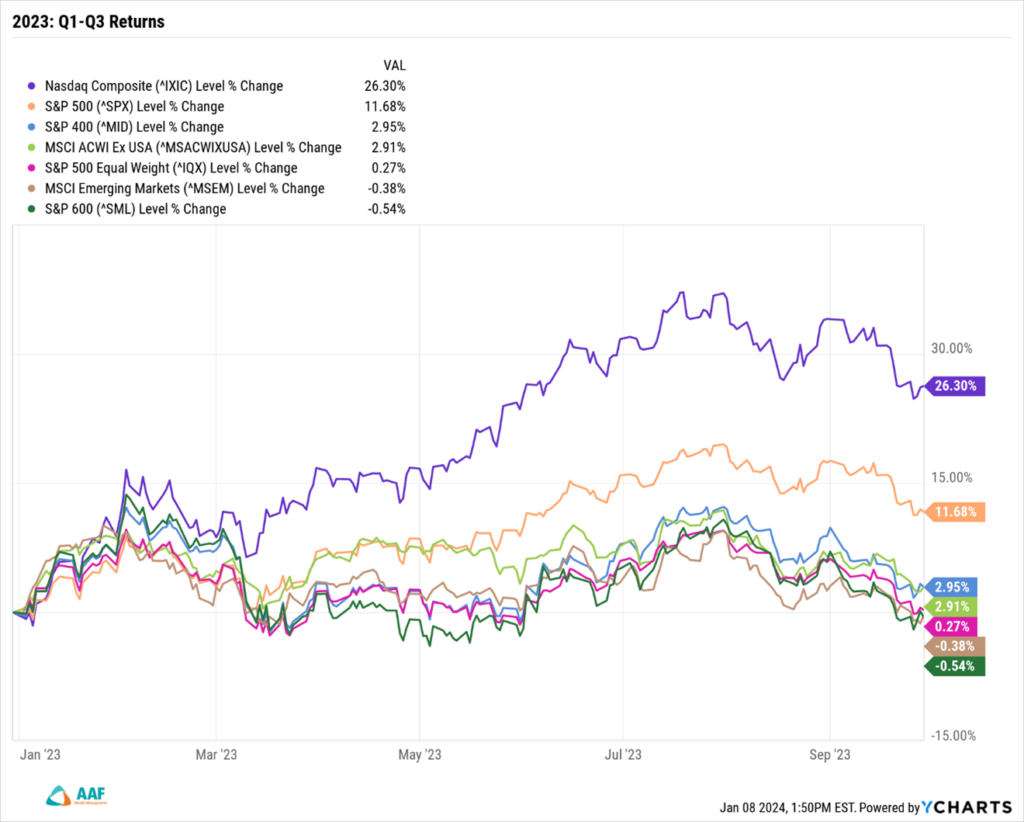

Performance-wise, 2023 was similar to 2022 in terms of how the year started and ended. Without looking closely, investors might assume the year delivered good returns for most of the major indices. But look deeper and you’ll see that positive investment performance for the broader investment community was largely compartmentalized to the fourth quarter, with the majority of stocks generating little to no positive returns during the first nine months.

For major indices apart from the NASDAQ, stocks largely produced returns of less than three percent through the end of September. It was only the NASDAQ, heavily influenced by a handful of tech stocks, that produced strong returns during this period. By early October, the NASDAQ had distinguished itself from other indices by generating positive returns of around 26 percent. But gains were not representative of the entire market and came largely from a handful of familiar tech names.

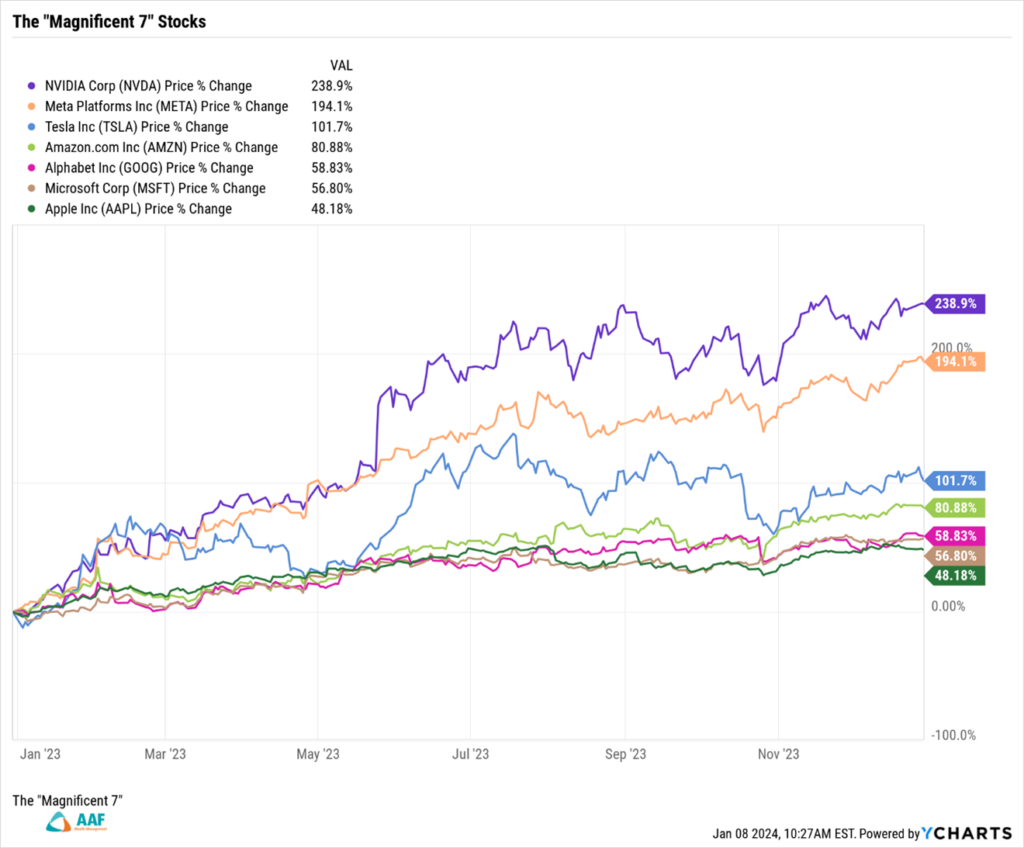

The Magnificent 7

A handful of household names coined the Magnificent 7 (i.e., Apple, Microsoft, Amazon, Meta, Nvidia, Tesla, and Google) drove the majority of broader market equity returns in 2023. These names also took some of the largest losses in the market in 2022. While their performance in 2022 was disappointing, it improved significantly in 2023. Investors were optimistic about these companies because they believed the economic growth was slowing down and these companies would be better equipped to handle a challenging global economic situation if it were to occur. Returns for the Magnificent 7 ranged from the merely terrific, e.g., Apple’s 48 percent return, to downright spectacular, e.g., Nvidia’s 238 percent return by year end.

Not All Stocks Are Created Equal

While those investing in a handful of stocks could rejoice, much of the investment community waited for anything meaningful. The NASDAQ overall had a relatively weak showing for the first nine months of the year. A quick glimpse into the composition of the S&P 500 further illustrates the effect a handful of names have on a broader index when a small number of companies receive a disproportionately large share of every dollar invested. While composed of the 500 largest and most well-known stocks in the U.S., nearly 30 percent of the S&P 500 is tied to The Magnificent 7. This means $0.30 per $1.00 investment made in the S&P 500 index goes into seven companies with the remaining $0.70 distributed among the other 493. These seven companies have an outsized effect on an index that many consider an appropriate tracking mechanism for U.S. markets as a whole.

To better understand how the majority of market components faired, all names in the S&P 500 must be weighed evenly. In doing so, we see returns middling for the first nine months of the year. The pink line below labeled S&P 500 Equal Weight (IQX) shows how an equal split methodology trailed the S&P 500 benchmark by approximately 11 percent. With returns of 0.27 percent, the market remained nearly flat for the first three quarters of 2023.

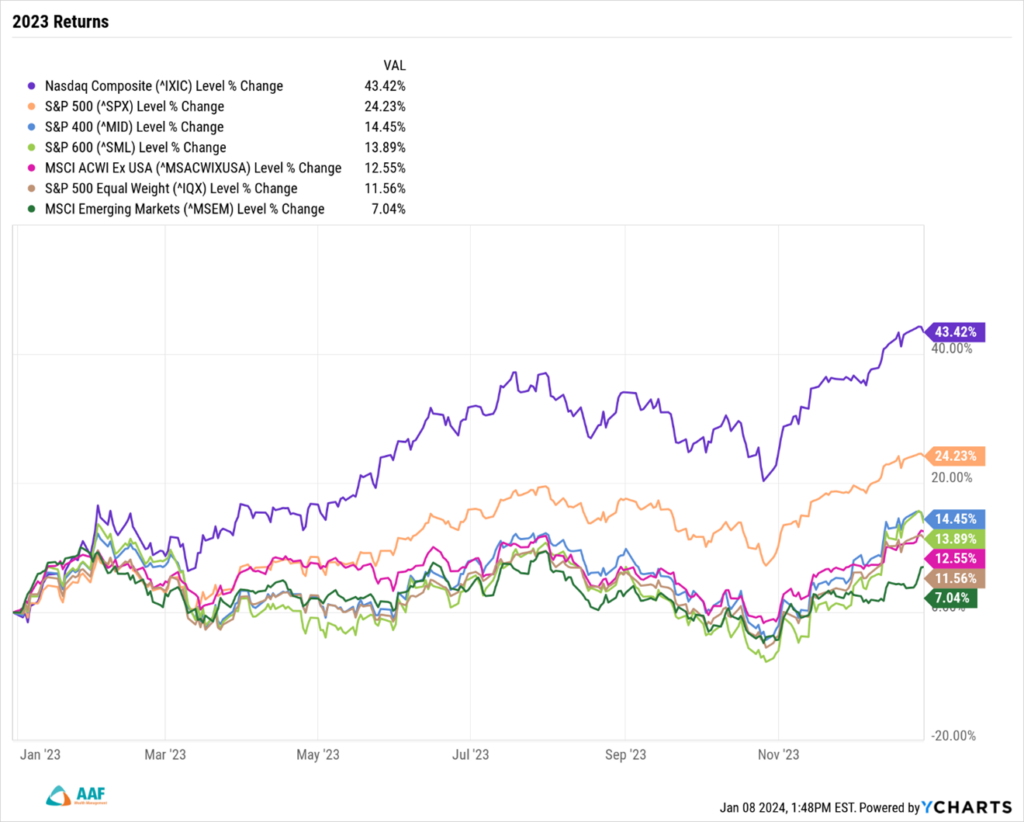

But as was the case in 2022, the fourth quarter saw a change in position as stocks began to generate strong returns.

During the last three months of 2023, most of the major indices rose to double digit positive returns as investors grew more confident in both the stock market as well as economic growth—and as the Federal Reserve hinted at ending their policy of hiking interest rates. Adding to this came better than expected job, unemployment, and inflation data, all of which lifted investor expectations in Q4 and resulted in one of the strongest multi-week stretches for markets in decades.

By year end, tech stocks (NASDAQ) were up by more than 43 percent while broader indices in U.S. (SPX 24 percent) and international markets (MSCI ACWI 12.55 percent) were up as well, leaving only emerging international markets at less than double digit returns, albeit still positive (7.04 percent).

The Ups and Downs

While markets delivered good tidings in time for the holidays, some situations demanded our attention: most notably, the Israeli/Hamas conflict that surged on October 7th. While this has fast become a humanitarian tragedy, financial markets largely absorbed the news as they did in 2022 when Russia began its invasion of Ukraine. In both situations, as personally distressing as they are to all of us, financial markets sold off initially as investors grew uncertain about the potential wider repercussions of conflict in the Middle East. Yet within weeks, stocks did recover as investors grew more confident that financial aspects of the situation would likely be limited in scope.

Interest Rates Peak

Contributing to the market’s fourth quarter rally was a peak in the 10-year U.S. Treasury Note (10Yr) Yield on October 23rd. April 2022 marked the first time since 1983 that the 10Yr rate broke a long-standing resistance level that kept upward rates in check for nearly 40 years. Since that time, most fixed income investments and stocks have struggled to find footing in what has become a higher cost world.

With positive inflation data, jobs reports, and unemployment trending in the right direction, the Fed began to signal an end to its higher-for-longer Federal Fund Rate (FFR) policy. In turn, traders and investors alike stopped selling the 10Yr note and began buying as rate cut expectations became the main market focus. This change in momentum drove the 10Yr yield down to 3.783 percent as investors raced to lock in higher rates.

Meanwhile the change in interest rates strongly influenced bond performance, with longer term bond investments surging by more than 21 percent. As of the latest readings, the market priced in six rate cuts in 2024, which could bring the FFR down to around four percent by year end.

Stocks Surge

Stocks benefitted as well, with increased performance, as noted earlier, and in breath of participation. Stock investors tend to favor lower versus higher interest rates, as the cost of capital drops for companies, thereby improving margins. With an end potentially in sight for what has become the fastest and steepest rate hiking regimes in modern history, investors flocked into equities.

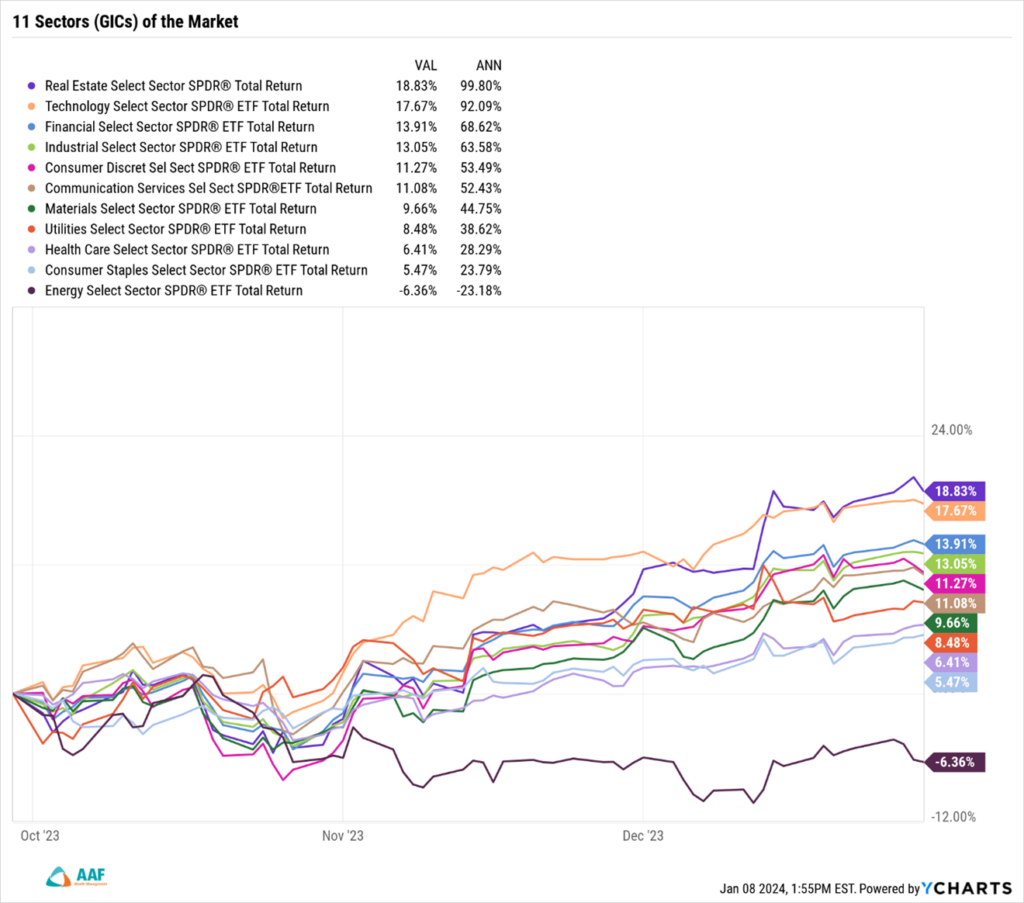

A healthy stock market is one in which a variety of companies participate. Absolute participation in terms of total companies driving the market is typically needed for an advance to take hold. Contributions from varying sized companies and by those in various industries can go a long way in maintaining a strong, resilient market.

We prefer to see broad participation from many different types of stocks, and this is what occurred. In Q4, 10 of 11 General Industry Classification (GIC) sectors increased in return from where they stood prior to October 1st. Energy was the only industry that delivered a negative return during the last quarter of 2023. Five of the other 11 sectors, which had negative performance leading up to Sept 30th, achieved positive returns during the final stretch of 2023.

2024 Outlook

As we enter the new year, we do so with optimism. We may not only benefit from a strong Q4 2023, but there’s also a reason to be optimistic that the period of low corporate earnings is behind us, and the possibility of lower interest rates is on the horizon. Inflation, too, remains moderate.

Election years have often been positive for investors. In fact, 20 of the last 24 election years brought about positive returns on the S&P 500, providing an 83 percent win-rate.

We continue to monitor factors impacting client portfolios, adjust strategies fittingly, and provide updates as appropriate. We hope 2024 brings you prosperity and success.

AAF Wealth Management is a boutique Registered Investment Advisor (RIA) firm serving high net worth individuals and families. As an affiliate of AAFCPAs, Inc., we leverage shared knowledge with New England’s preeminent CPA and Consulting firm to provide insightful planning that considers the full range of tax implications to our clients’ financial lives. If you have questions, please contact Kevin P. Hodson, Wealth Advisor at khodson@nullaafwealth.com or 774.512.4173—or your AAFCPAs partner.

*AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.