AAF Wealth Management Q2 2024 Market Insights

Note: These market insights were written prior to the weekend’s events. We express our sincere condolences to victims of last weekend’s assassination attempt on Donald Trump in Pennsylvania. It is another unfortunate example of the uncertainties we face on a global scale.

We reaffirm our commitment to our core values of compassion, community care, and treating others as we would like to be treated. These principles guide us as we navigate investment uncertainties. We remain committed to keeping you informed and supporting you in any way we can.

In an ongoing commitment to keep you abreast on a range of issues that might affect your business, AAFCPAs is pleased to share Q2 2024 Market Insights published by AAF Wealth Management, a wholly owned subsidiary of AAFCPAs. This provides investors with an understanding of what’s driven performance of late including big-tech’s dominance, the global political landscape, and mounting national debt along with a glimpse into how the future might look and its upcoming opportunities.

A number of variables influence world markets—from economics and fiscal spending to non-monetary events like natural disasters and hype, e.g., the craze that fueled 2020 meme stocks. During the next several years, one of the largest themes driving short-term returns or fluctuations will likely be significant global political events that have the potential to affect fiscal policy. Included in this are several influential international elections that recently occurred and others that will soon occur along with the U.S. presidential election in November.

Stock Market Leadership Looks Similar to 2023

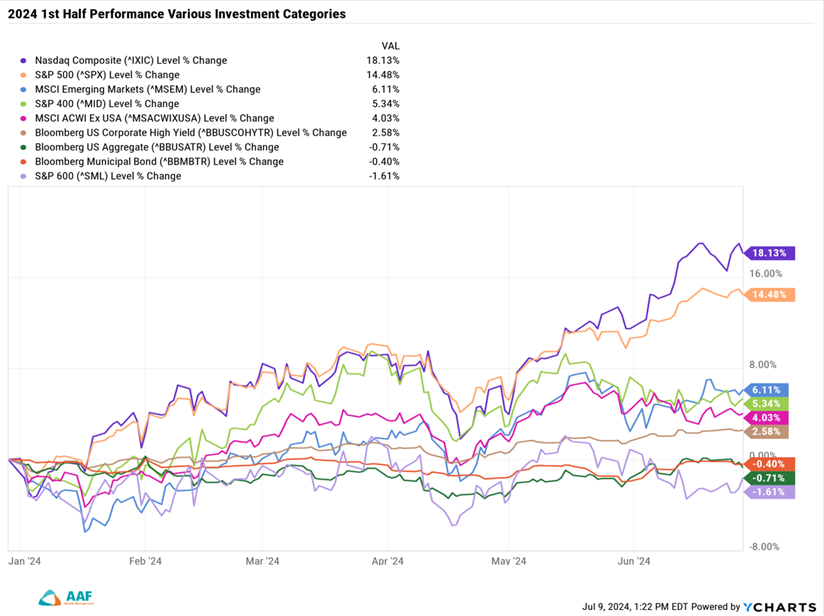

The stock market has continued to grow, though disparity between stocks doing well and those doing very well has remained wide. Nearly all major indices were positive for the first half of the year, while bonds continued to struggle as they have for the better part of the past three years. The only exception has been small company stock (S&P 600), which is at -1.61 percent.

A handful of technology stocks continue to drive a wedge between themselves and the rest of the market. This is most evident in NASDAQ’s outperformance against most other stock categories, as fervor continues for anything related to artificial intelligence. With the Magnificent 7 up anywhere between 10 percent (Microsoft) and 132 percent (Nvidia) through the first six months of the year, their performance continues to drive the more tech-centric indices to which they belong. Tesla is the only stock in that group producing a negative return, -29 percent, through the first half of the year.

Thinning Market Leadership

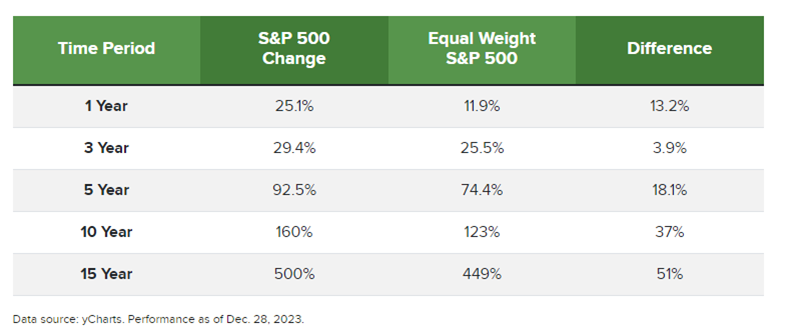

While the NASDAQ garnered most of the headlines this year, the S&P500 (SPX) has also quietly generated strong performance. Still, returns have been largely driven by the index’s current structure as a market capital weighted benchmark versus a function of the broader economy it represents.

Market Cap Weighted indices, as opposed to equal weighted indices, allocate more dollars to the biggest companies in their ranks. With approximately 31 percent of the SPX’s composition held in just seven names, those companies, e.g., the Magnificent 7, take 31 cents of every dollar invested in the S&P500 Index and their performance has a disproportionate effect on the index’s overall returns. The remaining 493 names in the SPX were basically flat for 2023 and are up only about five percent this year.

While the wide divergence during the past few years is evident in most of the current day financial press, the phenomenon of uber-large companies driving markets isn’t new.

Today’s investor should keep in mind that continued outperformance will likely revert to the mean over time. This is where actual or potential change in political regimes may begin to present itself in global markets. Consider how we got where we are today and how this may help to set the stage for future possibilities.

Government Intervention: 2009–2021

The Magnificent 7’s dominance over the past 15 years is tied to an extremely low interest rate environment since the markets crash in 2008–2009. The U.S. government kept interest rates extremely low as a way to jump-start the economy. This aimed to assist struggling companies and consumers who needed to get their financial houses back in order.

Mechanically, the programs that were put in place to hold rates low did so by purchasing bonds in the open market. But unintentionally, the technology subsector above all others benefitted from those low interest rates, as the promise of growth appealed to investors. This was true, at least, until 2020 and pandemic lockdowns.

Tech stocks performed well from the Spring of 2020 through 2021, as much of the world’s economy ran through ecommerce purveyors (Amazon), as entertainment was primarily digital (Netflix), as advertising came through social media (Meta), and as the hardware necessary to provide this lifestyle was handled by a few firmly ensconced leaders (Microsoft, Apple, and Nvidia).

Government Intervention: 2022–Present

Once vaccine availability broadened and social distancing loosened, spending and inflation began to heat up. Meanwhile, the U.S. Federal Reserve raised interest rates to quell a white-hot economy faced with an ever-increasing cost of living.

The Fed began hiking rates in 2022, moving the Federal Funds Rate from 0.0 to 5.5 percent by the summer of 2023. In 2022, Magnificent 7 stocks experienced significant drawdowns due to fears of higher rates. Apple, the best performer of the group, was down more than 40 percent at one point with Meta anchoring the low-end in performance with drawdowns by as much as -73 percent. The same names came roaring back just as dramatically in 2023 as investors sought bargains in the market that might provide growth opportunities. The recession narrative only fueled this momentum. Expectations of a growth slow-down during a recession led investors to Magnificent 7 stocks due to their perceived growth-oriented nature.

Today, any talk of a recession is drowned out by exuberance for all things artificial intelligence and what that might mean for humankind in the future—hence big-tech’s dominance.

Government Intervention: Going Forward

Any significant changes in political or government policy will likely cause changes in stock market leadership. Beyond the U.S. political landscape, the following elections could potentially drive markets in 2024 and beyond.

- In 2022-2023, we saw Georgia Meloni (Italy) and Geert Wilders (Netherlands) ascend to power under the auspices of a return to Conservative austerity via what has been labelled far right election promises.

- In 2023, we saw the election of Javier Milei (Argentina) under a strong right-leaning Libertarian party with promises to cut inflation, which rose by thousands of percent over the past decades. Since taking office, Milei reduced government debt by roughly 50 percent as he slashed 70,000 government jobs to cut overhead expenses.

- Last week, the UK’s Labour Party, which is center left, overtook the Conservative Tories, who oversaw the country for 14 years. Promises of increased government spending immediately followed in response to the UK’s stagnant economic growth since Brexit was enacted nearly eight years ago.

- In France, the far-left New Popular Front defeated the Marine Le Pen’s far-right Rassemblement National party. Jean Luc Melenchon, leader of the incoming party, promised to make good on doubling France’s top marginal tax rate from 45 to 90 percent, increasing the minimum wage, and expanding government pensions and welfare benefits all while decreasing the retirement age.

What each of these changes brought or promises to bring are significant adjustments in fiscal policy that have lasting effects on interest rates, inflation, and the viability of each country’s ability to fund their operations via debt markets.

The U.S. presidential election is in four months. Fiscal policy will likely differ dramatically based on the winner of the election. From tariffs to fiscal stimulus, debt elimination programs to tax rate increases, policy changes can affect how our economy runs and the ever-increasing amount of national debt amassed.

Public sentiment often sways stock prices in the short term, as we vote with our money on what we perceive to be the best idea at present. Over the longer term, however, the market will weigh the fundamentals of any given investment, clarifying realistic long-term fundamental value drivers from trendy fads and popular ideas. Stocks popular today will not be popular forever. But the markets adapt to the economy, creating new winners over time.

The Role of the Federal Reserve

Central to all of this is the role the U.S. Federal Reserve plays in driving liquidity into the system. For months, the market has waited for news of lower interest rates and the Fed has stalled under the concern that lower rates, if implemented too soon, may fan the flames of inflation. At the same time, the Fed would like to lower rates to help the banking system, which has been subjected to impaired balance sheets largely due to the Fed’s systematic rate hikes in 2022 and 2023.

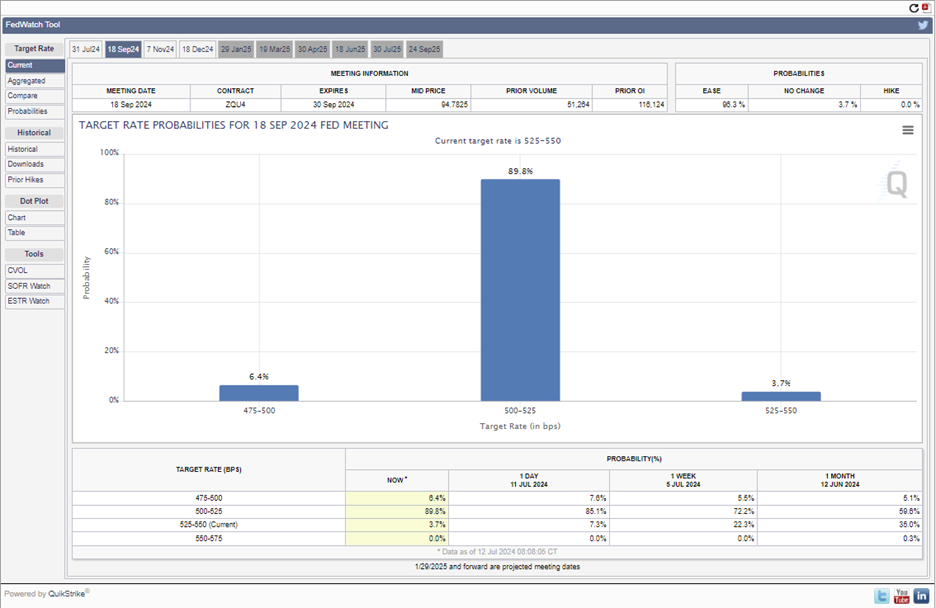

The Fed will meet four more times in 2024: July, September, November, and December. There is little likelihood (less than five percent per the market’s calculation) that the Fed will make any move in July. While this has been evident for several months now, it was underscored in a statement by Jerome Powell on July 9 indicating he would like to see inflation come down even more before implementing any changes. Even still, the market has assigned a 96.3 percent chance of a cut in September, which is positive.

Impact on Investments

Jobs numbers have slowed and CPI has both flattened and cooled. With the exception of an unexpected rise in the June Producer Price Index (PPI), which reflects increased production costs, inflation seems to be largely coming down from the elevated levels of the past few years. New manufacturing orders, new housing starts, and many other statistics indicate we are in the later stage of the cycle. These are tell-tale signs that the Fed usually looks to when deciding to reduce rates. So it is very likely the Fed will cut its short-term interest rate at some point to soft-land the economy as we continue to slow.

Unless we find ourselves in a deep recession, however, the Fed will be hard pressed to lower rates significantly. The component of inflation that has remained stickiest, i.e., wage inflation in the services sector, has presented the biggest challenge in moving forward.

While rates will likely come down in the short run, this can have profound investment ramifications. We should not count on rates staying down for a long period, as the world is still driven by deficit spending policies that can force rates to rise again.

In a country with $34.85 trillion in national debt, to which another $1 trillion is added every four months, the amount of debt we incur matters—especially as it pertains to interest rates we pay on treasury obligations that are used to pay our bills. A full third of the treasuries we sell globally are sold to non-U.S. residents, and that number has decreased for the past five years partly fueled by geopolitical events. Longer term, interest rates will likely need to rise to continue enticing borrowers to purchase our debt. But as of now, the U.S. is still generally viewed as the safest bet globally.

As for how structural deficits—those tied to the bond sales we use to keep the U.S. growing—will lead to investment opportunities, the answer could be any combination of the following.

- The rise of the Real Economy: For some time, tangible assets have been under-invested in, offering an opportunity for growth as we attempt to reconfigure into a greener economy.

- Electrification of the Grid: This could translate into more electric vehicles, solar panels, and ESG-related improvements that drive prices for materials and resources higher as we work to decrease our carbon footprint.

- Industrial Companies: These are companies needed to remake the world, specifically those responsible for actual machinery used to create new infrastructure (Caterpillar and John Deere) and for the development, production, or transportation of materials used in construction (steel and cement companies, trucking, and railways).

- Natural Resources: Most of the world’s raw building materials do not come from the U.S. but instead from emerging markets in countries around the world that might not have had flourishing markets throughout the last decade. Now, these countries could see expanded opportunities as they gain greater importance in the exporting of materials for this 21st century global modernization effort.

- Artificial Intelligence: This translates into the obvious, i.e., chips and AI-related tech companies, as well as the power sources required to run the machines involved in AI-related endeavors. Case in point: Amazon’s recent purchase of Talen Energy’s nuclear powered data center in Pennsylvania to power its AWS services unit.

Outlook

Upcoming elections may have a short-term sway on the markets. But Wall Street has not faired differently under one party versus the other in the longer term. With that in mind, we advise that investors take a long-term approach to investing, finding unique opportunities as they arise while hedging bets and reducing risk where appropriate.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.