AAF Wealth Management Q3 2024 Market Insights

AAFCPAs is pleased to share the following Q3 2024 Market Insights published by AAF Wealth Management, a subsidiary of AAFCPAs.

While world markets were relatively calm, we saw a bit more volatility this quarter in the investing and political arenas. Coming out of an uneventful first half of the year, the combination of more realistic earnings outlooks, softer employment expectations, and a significant reversal in the strength of the Japanese Yen launched the second half off with a bang. This forced investors to question their positioning in late July/early August just as unexpected political shifts were being made around the U.S. elections in November.

This quarter, we hope to provide readers with a greater understanding of those events and why it reawakened some volatility, which may persist as we close out the year.

Q3 Performance Overview

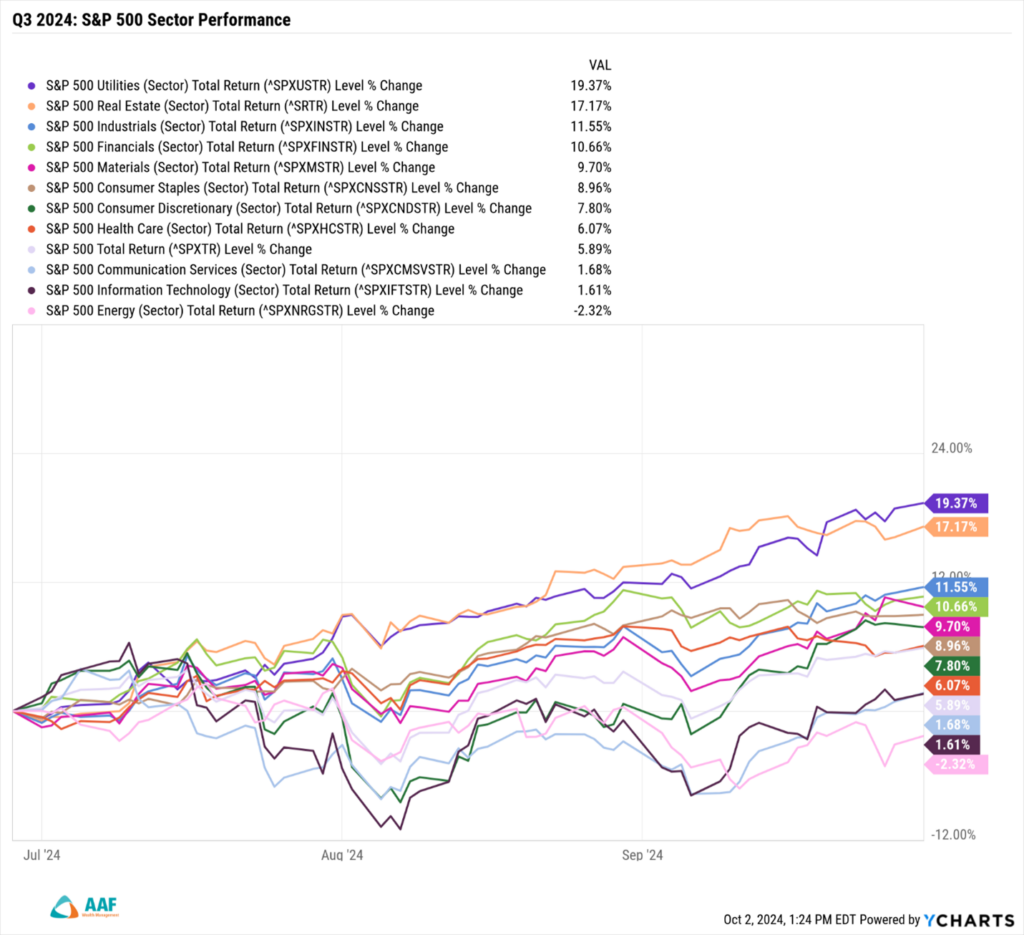

The third quarter saw smaller companies and international names steal much of the S&P 500’s thunder following years of dominance by larger U.S. companies. Smaller stocks, as represented in the Russell 2000 index, saw Q3 increases of +9.27 percent followed by mid-sized U.S. companies (Russell 2500) around +8.75 percent, broad-based international markets (MSCI ACWI-ex USA) around +8.17 percent, and large U.S. centric names represented in the S&P 500 with positive returns around 5.89 percent. Even the bond market awakened as the Bloomberg Aggregate Index (5.20 percent) and Municipal sectors (2.71 percent) showed positive performance.

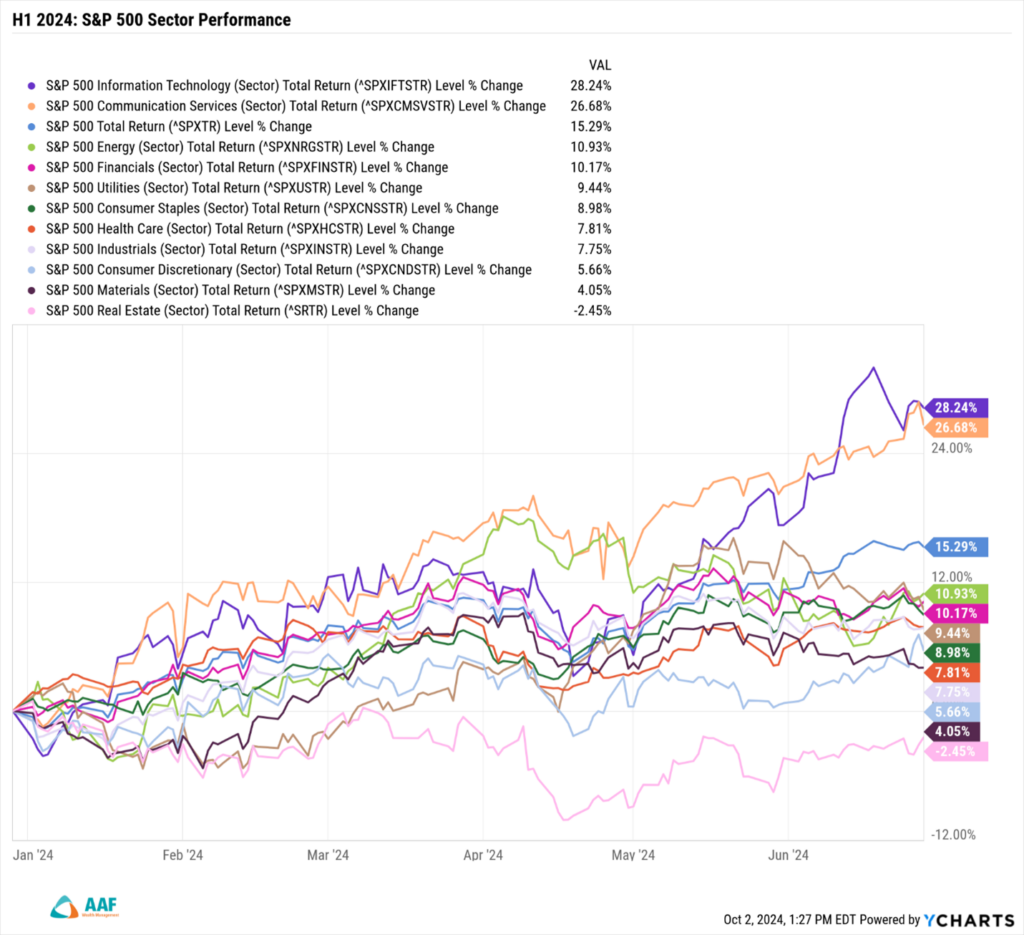

Overall, Q3 was a stark reversal from the first six months of the year when the S&P 500 outperformed the same international markets by more than nine percent, mid-cap names by +13 percent, and smaller-sized companies by more than 13.50 percent. Likewise, bonds (both municipal and corporate) saw negative returns of -0.40 percent and -0.70 percent, respectively.

This disparity in returns from small to larger-sized companies can be explained more precisely with a closer look at the 11 individual sectors that comprise the market.

A Look At Individual Sectors

Within the investing world, market capitalization (i.e., company size) is often associated with certain sectors. The technology sector is largely driven by some of the biggest, most well-known names in the world (Apple, Google, Amazon, etc.), while other sectors, such as Real Estate, tend to be heavily skewed toward mid-sized firms. As we look at this quarter’s reversal between the first and second half of the year, we saw direct ties between market cap and sector play out in a pronounced way. It’s also likely that some of the change in leadership was directly tied to changes occurring in the political arena as well, as the notion of a democratic or republican victory in November drove performance in different ways.

With interest rates expected to fall in Q3, the Real Estate sector enjoyed a strong comeback. From losing approximately 2.50 percent in the first half of the year to generating a positive 17 percent gain by the close of September, Real Estate names enjoyed the biggest absolute positive turnaround of the year. With a preponderance of small and mid-sized companies comprising the sector, Real Estate played an important role in how market capitalization leadership changed mid-year. A closer look at leaders and laggards shows that the top three sectors during the first half of 2024, i.e., Technology, Communications, and Energy, fell to become the three bottom performers in Q3.

The reversal of the Technology and Communications sectors was not entirely surprising, especially given the sectors’ strong outperformance was interrupted in late July by more measured earnings expectations. Despite very strong Q2 reporting of earnings and revenue, investor enthusiasm for the Magnificent Seven has largely been fueled by extremely high expectations. More measured outlooks were inevitable, as the Magnificent Seven earnings calls presented tempered forward guidance figures. Paired with a strong resurgence of Kamala Harris as she became the Democratic nominee and the possibility of federal intervention in the form of anti-trust legislation against Google and Nvidia, the pieces came together for short-term upheaval. All in all, conditions were aligned to shift the first half’s leaders well before other macro factors came into play.

Japan’s Role In Global Finance

While U.S. stocks have largely stolen the show this year, Japan has played a role in the story as well. Japan’s currency, the Yen, has provided historically inexpensive financing for professional money managers for roughly 15 years. Specifically, professional investors borrowed at zero (or near zero) interest rates and used funds to invest in U.S. markets—particularly Magnificent Seven stocks.

Given the low cost to carry those loans and to reinvest proceeds in other foreign markets, the Carry Trade, as it’s called, funded a large part of Magnificent Seven stocks’ outperformance since early 2009.

In the past few years, as it grew apparent that efforts to revitalize a sluggish Japanese economy weren’t taking hold, Yen value began to fall relative to the U.S. dollar to the point where the Bank of Japan had to intervene with a show of confidence by supporting their local currency. It just so happened that this intervention occurred almost simultaneously with the Magnificent Seven’s second quarter earnings calls during the last week of July. The final straw that broke the camel’s back came in the form of a disappointing jobs report released by the U.S. government the last Friday in July.

These combined events drove the Japanese TOPIX stock market down approximately 25 percent in a few days, thereby setting off a chain reaction of volatility throughout the world’s markets in early August as investors sold highly appreciated Tech and Telecom stocks, repaid loans in Japanese Yen, and temporarily reversed the slide Yen/Dollar pair trade.

The most widely accepted proxy for volatility, the volatility index (VIX), saw an historic rise only witnessed a few other times in the past 20 years, i.e., leading up to the Great Financial Crisis of 2008/09, the U.S. government’s loss of its AAA rating on treasury paper, the “Volmageddon” volatility spike of February 2018, and the effect of COVID on the market in March of 2023.

While never a prediction, rising periods of volatility (as represented by the VIX index value increasing above the mid-20s) have historically persisted for months before settling back down. While we acknowledge volatility can feel unsettling in the short term, we remind investors that, as we approach the U.S. presidential election in a few weeks, the possibility of further volatility would not be surprising.

U.S. Economic Outlook and the Federal Reserve’s Response

In more substantive economic news, U.S. Gross Domestic Product (GDP) has remained strong this year. For the first half of 2024, GDP expanded from 1.40 to 3.00 percent between Q1 and Q2. The full year’s expectations are now approximately 2.40 percent despite an expected slowdown from the first to second half of 2024. This slowdown is projected to carry into 2025, when GDP could slow to approximately 1.70 percent year-over-year. This cooling from 2024 to 2025 is part of the reason why the Federal Reserve decided to finally cut interest rates at their September Federal Open Market Committee (FOMC) last month.

This FOMC decision marked a significant shift, as the Federal Reserve for the first time in nearly five years cut its overnight rate, i.e., the Federal Funds Rate (FFR), by 0.50 percent, bringing the cost of short-term borrowing down from 5.25-5.50 to 4.75-5.00 percent. Another 0.50 percent cut is expected this year along with a full one percent by the end of 2025, with the Federal Reserve taking the position that inflation has been contained and refocusing efforts on maintaining the jobs market, now their primary concern. Trading has remained fairly calm in the wake of the announcement, given this was long expected by investors, with most news already priced into current market valuations.

While the size of the rate cut (0.50 percent) was larger than most expected, it did not reflect pessimism on behalf of the Fed’s committee members, per their own admission. Rather, they wanted to get out ahead of any potential economic slowdown that might occur moving forward as they attempt to soft land the economy after it has been overheated the last few years.

Recent job figures in September showed a much stronger reading than anticipated, making the Fed’s job more difficult. As such, economists and market participants will likely keep an eye on the next few months’ reports, as they may hint as to when the Federal Reserve might make another move to the FFR. With the stronger jobs report in hand and unemployment unchanged at 4.10 percent, the market will likely debate the merits of the Fed’s 50bps cut last month and question how many more cuts could be in store going forward. As we head into the election, the Fed’s month-to-month reliance on data points will only serve to heighten investor reactions and possibly drive volatility, as previously discussed.

The Rest of the World

Israel/Middle East

While hostilities have now broadened beyond Palestine to involve Lebanon, Yemen, and Iran, investment ramifications have remained largely unaffected despite a devastating humanitarian impact. Market impacts have been largely contained to those Middle East shipping lanes maritime companies use to cut through the straights of North Africa on their way to Europe and the West. Freight line contract pricing has also experienced a large spike in costs; however, oil, which is where most investors tend to focus in this region, has remained fairly rangebound between $70 to $90 a barrel. In some ways, these current operations in the Middle East have played out similarly to what occurred in 2022, when Russia invaded Ukraine. In the early days of that conflict, world securities markets witnessed broad sell offs as investors focused on the initial shock of what Russia’s actions would mean. Over time, however, disruptions in commodities prices largely came to dominate most of the volatility markets witnessed, as oil, wheat, and other products associated with the two countries became the focus of markets.

China

China plays a significant role in global markets, particularly in terms of whether world GDP increases or stagnates. As the number two economy on the planet, China’s ability to manufacture goods and services—and export those products around the world—drives everything from inflationary pressures related to shipping channels to commodity prices and the direction of interest rates here in the U.S. Therefore, one potentially large issue that looms over global markets involves whether China will be able to pull itself out of the economic malaise that began in the Spring of 2020 with COVID lockdowns.

Formerly, China was the second largest buyer of treasury paper (after Japan), providing constant liquidity to U.S. government efforts to manage its economy. As a former large buyer of U.S. debt, China’s role in providing funds to the U.S. government helped to keep a steady bid in the treasury market for decades, aiding the U.S. government’s ability to finance its operations at a low cost. However, in the past few years, between a conscious effort to discontinue the same level of investment in U.S. paper (driven by myriad political factors) and the country’s own need to prop up a weak Yuan currency, China’s willingness to lend money to the U.S. has sharply decreased.

At present, China has begun to make significant changes to its economy, pulling out all stops as they attempt to inject ample liquidity into their system to reignite what has historically been a fast-growing economy. Should China successfully jump start its economy, it will go a long way toward ensuring the rest of the world is able to continue growing.

Wrap-up

As we head into the final quarter of the year, we remind our readers to keep a long-term mindset and investment approach. With U.S. presidential elections just around the corner, there will no doubt be media tying the election outcome to the U.S. economy’s future. In reality, though, neither party has held a lock on U.S. stock performance outcomes. What may matter going forward will be expectations around inflation and employment levels as we move into Q4 2024.

If you have questions, please contact Kevin P. Hodson, CMT, CAIA, AIF®, Wealth Advisor at 774.512.4173 or khodson@nullaafwealth.com—or your AAFCPAs Partner.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.