Navigate Finance Team Disruptions and Ensure Continuity

An abrupt change or turnover in the finance function requires a swift and strategic response. Losing a key figure in the department, for example, may leave your company vulnerable, creating an immediate need for financial oversight and leadership. Similarly, rapid or substantial growth can heighten operational complexity, demanding immediate attention.

Beyond sudden disruptions, other situations also call for quick, strategic action. Neglected financial records, mergers or acquisitions, or new regulatory requirements often necessitate an accounting or financial cleanup. This involves updating the company’s records, correcting discrepancies, organizing records, and ensuring regulatory compliance. Cleanup is also critical when transitioning to a new accounting system or preparing for a compliance audit or external reporting needs.

AAFCPAs recommends the following strategic responses to help address immediate needs while minimizing disruption.

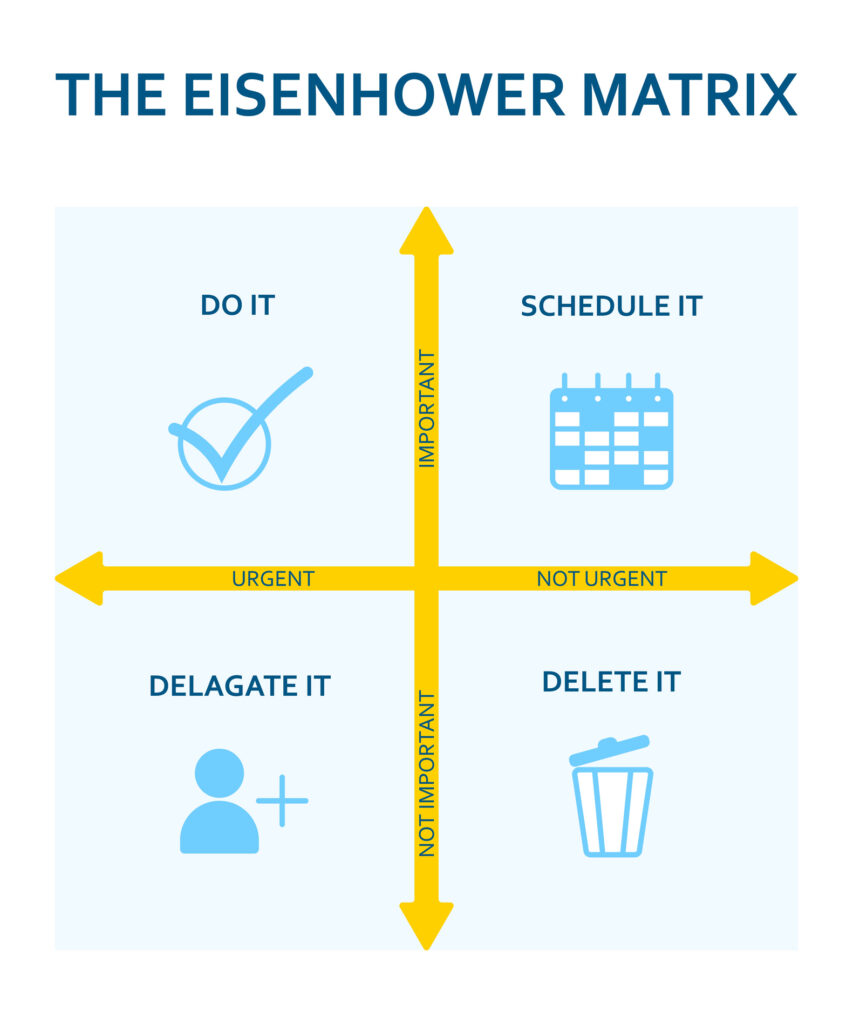

Prioritize Immediate Projects. Identify and assess your organization’s most pressing needs. (Think the Eisenhower Matrix.) Focus on critical deadline-driven projects that demand immediate attention, such as quarter and year-end closes, compliance audits, investor or board of director requests, bank or financial institution reporting deadlines, or system integration plans. Look too at other mission-critical items like payroll processing, pressing accounts payables, and accounts receivables. Allocating resources to high-priority initiatives may help avert further complications and stabilize operations, allowing the organization to regain control over its financial and operational health before issues arise or escalate. Consider delaying or restructuring non-priority projects and maintaining a backlog list of items to address once resources are stabilized.

Consider Internal Redeployment. Internal redeployment may quickly and effectively fill gaps left by departing executives or help manage sudden increases in workload. While this may initially feel like added pressure on your existing team, it can foster cohesion and morale by offering employees new challenges and opportunities for growth within the organization. Someone in the operations team, for example, could step in and take the lead. During redeployment, you’ll also want to pay particular attention to internal controls and safeguards. In time, this approach can build employee resilience, create leadership opportunities, and ensure smoother transitions during periods of disruption.

Enhance Communication and Collaboration. Because finance disruptions affect the entire organization, keep communication channels open and encourage departments to collaborate to ensure a unified response—particularly when redeploying staff to fill gaps. Regular meetings to discuss progress, roadblocks, and opportunities for cross-functional support keep teams aligned. Clear, consistent communication prevents misunderstandings, keeps goals in focus, and helps organizations adapt quickly to shifting priorities or urgent demands.

Engage External Expertise. When internal resources are insufficient, external consultants or outsourced accounting teams may provide the support you need to address staffing gaps, new compliance or audit requirements, or rapid growth. Outside experience and insight can help organizations efficiently navigate complex situations. Businesses may consider outsourcing solutions to remedy financial discrepancies, organize neglected records, or ensure compliance with new and unexpected regulations, so internal teams stay focused on critical tasks. By leveraging outsourced resources, problems can be handled swiftly and effectively, minimizing disruptions to core functions. This can help to overcome shortages of qualified accounting professionals or in-house skill gaps. It also eliminates employee management frustrations, training expenses, and turnover, providing an opportunity for a fresh look at process and technology solutions.

Abrupt changes call for a proactive and adaptable mindset. Organizations must prioritize projects, reallocate resources, and seek external assistance as necessary. Fostering a culture of agility and responsiveness helps businesses not only manage unforeseen challenges but also emerge stronger and more resilient than ever.

How We Help

AAFCPAs’ Outsourced Accounting & Fractional CFO practice provides comprehensive finance staffing solutions that address capacity and skills gap challenges. Our services include transactional accounting, financial cleanup, short- and long-term staffing support, staff training, and advisory support across all levels to stabilize your finance function. We offer a scalable workforce that expands or contracts based on your immediate and ongoing needs.

By collaborating with clients, we devise solutions to enhance financial processes, deliver targeted training for existing staff, and ensure operational continuity during transitional periods. Our commitment extends beyond filling gaps to focus on empowering your team with the skills and knowledge necessary for sustained success. We help clients achieve the stability and expertise they need to propel their business forward.

If you have questions, please contact Destiny J. Flood, CPA, Partner, Commercial Outsourced Accounting & Fractional CFO at 774.512.4151 or dflood@nullaafcpa.com, Lauren M. Duplin, CPA, Partner & Consulting CFO at 774.512.4095 or lduplin@nullaafcpa.com—or your AAFCPAs Partner.