Individual Tax Provisions of the Federal CARES Act

AAFCPAs would like to make our clients aware of the impact to individual taxpayers through the Coronavirus Aid, Relief and Economic Stimulus (CARES) Act legislation. The CARES Act was signed into law by the President on Friday March 27, 2020. There has been significant discussion on the impact of the COVID-19 pandemic on the economy and working individuals, the CARES Act is a sweeping governmental response to the pandemic. AAFCPAs has analyzed the Act and put together a summary of the provisions which will impact individual clients.

Top 5 Takeaways:

- The Act provides $1,200 to Americans making $75,000 or less ($150,000 in the case of joint returns and $112,500 for head of household) and $500 for each child, to be paid “as rapidly as possible.”

- The Act waives certain penalties and eases required minimum distributions to make it easier for taxpayers to access their retirement savings, should they need it.

- The Act makes changes to charitable contributions, allowing an above-the-line tax deduction for charitable contributions of up to $300 for the tax year beginning in 2020. Also, CARES suspends and adjusts other limitations on contributions.

- The Act provides a 6-month suspension on payments on student loans held by the Department of Education and allows individuals to exclude a certain amount of payments made by an employer on their behalf.

- The Act provides a 60-day moratorium on foreclosure actions of certain mortgages.

Individual Rebates/2020 Credit

As part of the CARES Act, Congress has created a rebate of up to $1,200 ($2,400 for joint filers). The mechanism for paying these rebates is an advance of a refundable tax credit. Beginning in 2020, “eligible individual” taxpayers can benefit from a tax credit equal to the sum of: (i) $1,200 for single filers ($2,400 for those filing a joint return) plus (ii) an amount equal to the product of (a) $500 multiplied by (b) the number of qualifying children. However, the aforementioned tax credits will be “phased-out” by 5% of the amount by which such eligible taxpayer’s adjusted gross income exceeds: (i) $150,000 for joint-filers, (ii) $112,500 for heads of household, and (iii) $75,000 for all other types of filers.

How May We Help?

At AAFCPAs, our clients’ well-being is our top priority, and during these challenging times our goal is to provide our clients with timely, fact-based advice to help ease their minds. We have a wealth of knowledge on the implications of tax credits on individual taxation and wealth. We developed a specialized Task Force dedicated to analyzing the CARES Act. This team includes senior leadership and advisors from diverse segments of our organization, and they are poised to step in and help you understand the impact on your individual situation. In a time where there is an enormous amount of uncertainty, we remain available to provide clients with expert planning and strategies to assist in adapting in these challenging circumstances.

Do I Qualify?

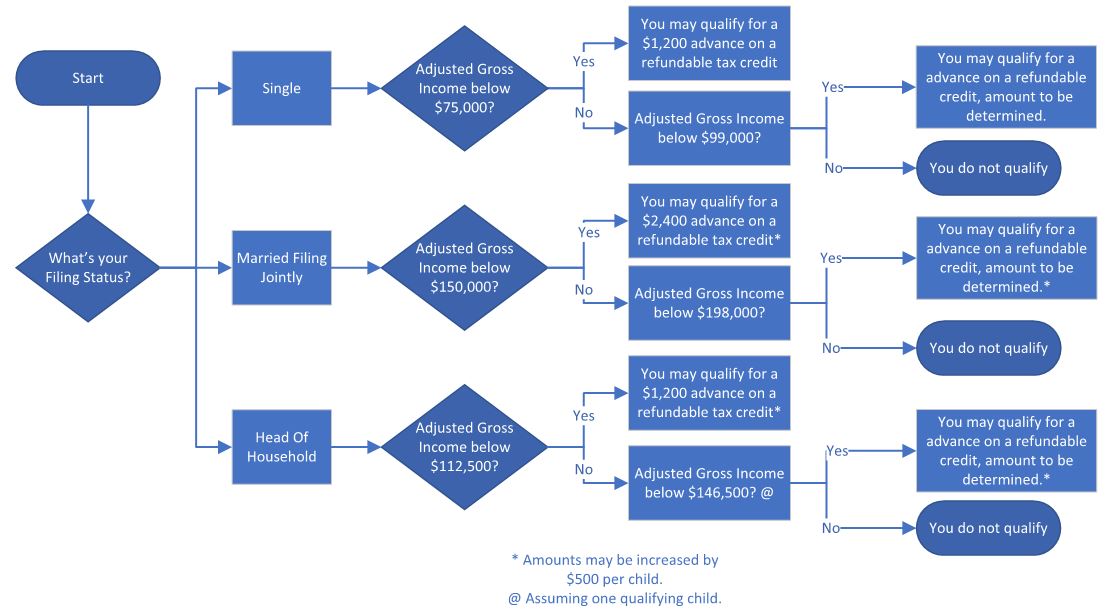

While understanding if you will qualify for the credit can be challenging, we’ve put together a simple chart to give a broad overview. Further, the Act specifies which tax year will be used in this calculation, and this will depend upon your particular filing timeline. Your particular facts and circumstances will impact this calculation and clients are encouraged to reach out to your AAFCPAs Tax Partner to better determine the best course of action. Please note: non-resident aliens, those eligible to be claimed as a dependent on another’s return, and trusts or estates are not eligible for this credit.

Timeline and Considerations

The Treasury has not released a timeline of the payments, but they have indicated payment will take place “as rapidly as possible.” AAFCPAs encourages clients to consider the following in mind as you consider this potential payment.

- Have you experienced (or are you expecting) significant changes in income between your 2018, 2019, and 2020 Tax Returns?

- Have you filed your 2019 tax return, and if not, should you?

- Have you moved, changed banks, had a child, or otherwise had personal changes since your last filed tax return?

Process to Apply?

There is nothing you need to do to take advantage of this program. The Treasury will be using information on file to pay you if they determine you will be granted an advance of this refundable credit. While there is no process to take advantage of this program, it would be wise to plan carefully for the use of the advance. Please contact your AAFCPAs Partner or Wealth Advisor if you have questions on your specific tax or wealth management situation.

Retirement Fund Use and Waiver of RMDs

The CARES Act waives the 10% penalty for early withdrawals up to $100,000 from qualified retirement plans for coronavirus-related distributions. A coronavirus-related distribution is one made on or before January 1, 2021 to an individual (or their spouse or dependent) diagnosed with COVID-19 with a CDC approved test, or to an individual who experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, having work hours reduced or being unable to work because of lack of child care due to COVID-19. The distributions will be subject to regular income taxation over a three-year period, and taxpayers may recontribute the withdrawn amounts to an eligible retirement plan within three years without regard to that year’s annual cap on contributions.

The CARES Act also waives all required minimum distributions (RMD) for 2020, regardless of whether the taxpayer has been impacted by the pandemic.

Charitable Contribution Deduction

As part of the CARES Act, there have been a few modifications to the treatment of charitable contributions for individuals. The CARES Act encourages individuals to contribute to qualified charitable organizations in 2020 by relaxing some of the limitations on charitable contributions.

- Applies to Taxpayers who DO NOT itemize: Individuals are allowed to take a deduction of up to $300 of cash contributions, whether or not the taxpayer itemizes deductions.

- Applies to Taxpayers who itemize (or non-individuals): For individuals, the 50 percent of adjusted gross income limitation is suspended for 2020. For corporations, the 10 percent limitation is increased to 25 percent of taxable income. This provision also increases the limitation on deductions for contributions of food inventory from 15 percent to 25 percent.

Student Loan Interest Suspension

Payments on student loans held by the Department of Education are suspended for 6 months, and the Secretary of Education shall suspend all involuntary collection activities during the period of payment suspension.

Student Loans Paid by Employers

The CARES Act provides for an exclusion of up to $5,250 from income for payments made by an employer of an employee’s education loans. The loan must have been incurred by the employee for the education of the employee (a loan incurred to pay for the education of an employee’s child would not qualify). The payment can be made to the employee or directly to the lender. The $5,250 cap applies to both the new student loan repayment benefit as well as other education assistance (e.g., tuition, fees, books) provided by the employer under current law. The exclusion applies to any student loan payments made by an employer on behalf of an employee after the date of enactment and before January 1, 2021.

Foreclosure Moratorium and Consumer Right to Request Forbearance

- The Act prohibits foreclosures on all federally-backed mortgage loans for a 60-day period beginning on March 18, 2020 and provides up to 180 days of forbearance for borrowers who have experienced a financial hardship related to the COVID-19 emergency.

- Applicable mortgages include those purchased by Fannie Mae and Freddie Mac, insured by HUD, VA, or USDA, or directly made by USDA.

The tax practice of AAFCPAs will continue to monitor communications from the IRS, the Treasury Department, and the MA DOR. We will keep you informed as changes occur or become clarified.