3 Ways to Plan for your Grandchildren’s Financial Future

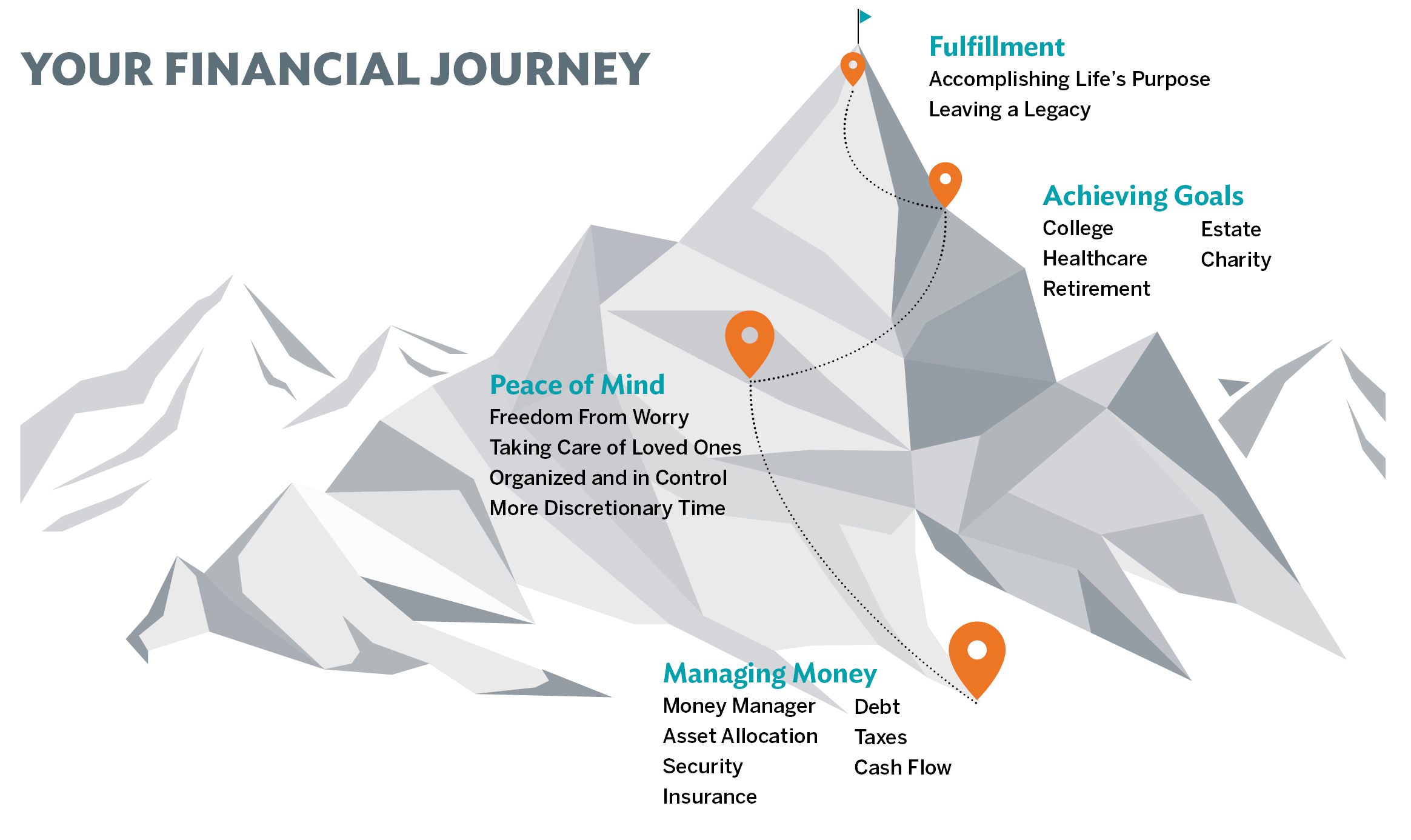

For many of our clients, taking care of loved ones and leaving a legacy is an important part of your financial journey. The arrival of a grandchild marks the beginning or expansion of a new generation. There is a sense of magic as the baby represents the family projecting far into the future. These new bundles of joy, and tiny likenesses of ourselves, usually prompt discussion about how grandparents may help set the child up for a strong financial future.

AAF Wealth Management has provided three strategies below for your consideration to help support a strong financial future for your grandchildren.

529 Education Savings Plans

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code.

- With a 529 plan, grandparents may save for their grandchildren’s education while taking advantage of income and estate tax planning benefits. These investments are considered an immediate gift from your estate, and thus lower your estate tax upon death. In addition, 529 plans are not considered taxable income to the beneficiary grandchild.

- 529 plans may be used for the beneficiary’s future qualified higher education expenses – tuition, mandatory fees and room and board. Withdrawals from education savings plan accounts can generally be used at any college or university, including sometimes at non-U.S. colleges and universities. Education savings plans may now also be used to pay up to $10,000 per year per beneficiary for tuition at any public, private, or religious elementary or secondary school.

- 529 plans are investment accounts and can grow overtime. Grandparents may typically choose among a range of investment portfolio options, which often include various mutual fund and exchange-traded fund (ETF) portfolios and a principal-protected bank product. These portfolios also may include static fund portfolios and age-based portfolios (sometimes called target-date portfolios). Typically, age-based portfolios automatically shift toward more conservative investments as the beneficiary gets closer to college age.

- Changes are being made to the Free Application for Federal Student Aid (FAFSA) calculation, and students will no longer be asked about cash gifts from grandparents (along with non-custodial parents and anyone else outside of the custodial household). This means, your grandchild will no longer be required to disclose the grandparent’s 529 plan in their financial aid calculation until the funds are withdrawn. The new, simplified FAFSA shall take effect on July 1, 2023 and will apply for the 2023-24 award year and each subsequent award year.

- Visit invefstor.gov for 10 Questions to Consider Before Opening a 529 Account.>>

Uniform Trust to Minor Account (UTMA)

Uniform Transfers to Minors Act (UTMA) account is an account into which grandparents may set aside assets for a minor grandchild’s benefit.

- These “custodial accounts” allow grandparents to save and invest money until the grandchild reaches a certain age, which varies by state (usually 18 or 21). At that time, control of that account and all its assets must be transferred to the grandchild.

- Money put into a custodial account is an irrevocable gift to the minor named as beneficiary on the account—the custodian must ensure that it is invested or used for the minor’s benefit.

- Between the age of 18 and 25 (it varies by state) legal control of the account must be turned over to the beneficiary, who can then use the money for any purpose they choose. Grandparents cannot control what the funds are used for once they are transferred to the grandchild.

- UTMAs are taxable investment accounts with no contribution limits. Earnings from these investment accounts are taxable to the grandchild annually.

- These contributions are considered an immediate gift from your estate, and thus lower your current income tax liability, and estate tax upon death.

- Your grandchild’s financial aid may be adversely affected by these custodial accounts. UTMAs are considered assets owned by the child, not gifts like 529 plans.

Trusts

- Trusts come in many forms, and they can be complex, arduous, and costly; however, they allow the most control over the use of the assets, even after you pass/leave your earthly body.

- Grandparents may stipulate use and timing of funds placed in a trust.

- These contributions are considered an immediate gift from your estate, and thus lower your current income tax liability and estate tax upon death.

AAFCPAs advises clients to evaluate their estate tax strategy now as proposed legislation would eliminate many of our best tools and strategies to preserve wealth.

These are just a few of the options to consider. As with all gifting strategies, there are unique facts and circumstances to consider, including but not limited to annual exemptions versus lifetime gifting limits. In addition, when choosing the right option, it’s important to consider your goals and needs as well as that of the grandchild.

If you have questions about gifting strategies or tax planning, please contact Kevin Hodson, AIF®, Wealth Advisor at 774.512.4173, khodson@nullaafwealth.com; Joshua England, JD, LLM at 774.512.4109, jengland@nullaafcpa.com; or your AAFCPAs Tax Partner.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.