CFOs Bring Clarity to the Financial Situation

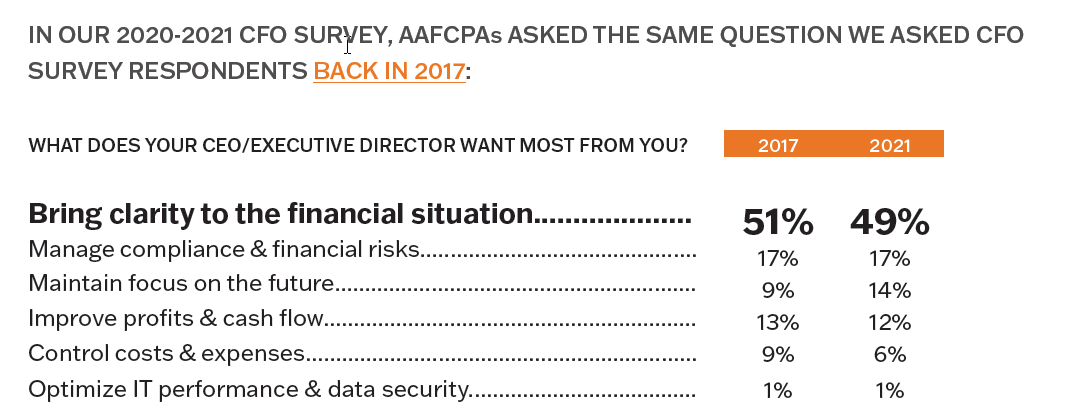

In our 2020-2021 CFO Survey, AAFCPAs asked respondents the same question we asked back in 2017: What does your CEO/Executive Director want most from you?

CFOs are unquestionably responsible and accountable for interpreting and presenting analytics related to financial metrics. The major change is about what the concept of “bringing clarity” means.

Financial metrics were traditionally used as lagging indicators that confirmed long-term trends. Profit and revenue growth are examples of “descriptive” data that tell corporate leadership where a company has been, how it has performed, and may point to long-term trends. Those are typically easy to identify, measure, and compare against others in your industry, which makes lagging indicators very useful.

Leading Key Performance Indicators (KPIs) are becoming more prevalent. “Predictive” metrics (which measure progress toward goals) and “prescriptive” metrics (which point to needed change) show potential next steps. This data helps tee up a forward-looking vision—a focus on the future—leading to a clearer understanding of how to manage resources to achieve better outcomes.

Our survey revealed that CFOs may need to shift focus from Descriptive metrics to Predictive and Prescriptive – a change that requires CFOs to make more meaningful correlations between financial and non-financial metrics.

Read more Insights from CFOs on Data Use.>>