AAF Wealth Management Q3 Market Insight

The intricacies of market performance are deeply intertwined with various external factors, including inflation, interest rates, political shifts, geopolitical affairs, and natural disasters. This includes, sadly, the current humanitarian crisis in the Middle East. It is heart-breaking to see these events unfold in a region whose people have known such profound suffering for far too long.

In fulfilling our role as Wealth Advisor, our dedicated approach involves a meticulous analysis of these influential variables, enabling us to comprehend current market movements. This comprehensive understanding guides us in strategically diversifying client portfolios, with the dual objectives of optimizing performance and mitigating risk.

The Relevance of Bonds

We have engaged in dialogue with clients recently about the role bonds play in a portfolio. These conversations were prompted by three challenging years for bonds. We regularly revisit rationale for products, particularly those that have largely shown weakness since emerging in a higher inflationary and higher interest rate environment. Below, we outline the important role fixed income specifically plays within an asset-allocated portfolio.

A Source of Diversification

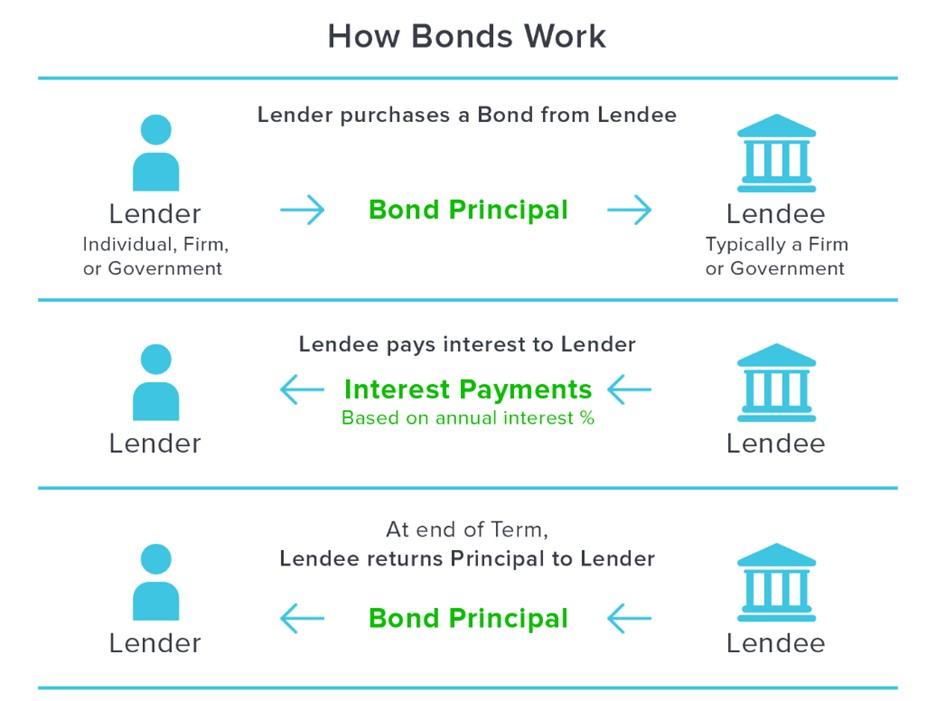

Because bonds have historically delivered low correlations with stock investments, traditional investment managers often layer into their portfolios a variety of different types of fixed income investments diversified by issuer (corporate vs. governmental), length of maturity (short vs. long), credit quality, and geography. Unlike stocks, a significant factor in the expected total return of a bond ties back to the stated interest rate bonds pay throughout their lives, otherwise known as a coupon.

Overall, bonds are typically integrated to absorb shock within a diversified portfolio. Because they deliver a fixed schedule of interest payments, investors treat them as predictable portfolio additions that provide higher income rates than cash. In exchange for this reliable income component, investors eschew price appreciation and focus more on their equity (stock) investments for that component of a portfolio.

The Current Environment

Since we emerged from the COVID lockdowns in late 2020, bonds have not provided the same return for which investors have grown accustomed. With interest rates significantly higher since 2022, bond investors have been reluctant to invest in anything other than short-term oriented instruments. Concerned about the potential of lingering higher inflation, bond investors have focused on a possible loss of purchasing power in exchange for payments that would not arrive for several years via the fixed coupons offered by bonds.

This “bird in the hand/two in the bush” mindset led to the underperformance of fixed-income assets during the past three years as investors sold longer duration, core bond portfolios and chose money markets, CDs, and shorter-term treasuries instead. We believe we are closer to the end of the rate hiking cycle than we are to the beginning. As such, we may begin to see the benefits of what bonds can do within the backdrop of falling interest rates.

With this in mind, AAF Wealth Management sets our sights on 2024 and what many believe may be a strong environment for total return investing in fixed income products should rates begin to move back downward.

Bond Performance Year-to-date

Fixed income investments have not performed as well as expected in 2023. In fact, those holding bonds saw more portfolio volatility than those who did not. After a disappointing 2022, a rebound for bonds was expected this year under the premise of deeply oversold levels that did not meld with the economic fundamentals of issuing companies.

Prevailing view of the fixed income macro environment was equally positive, with federal fund rates expected to reach their peak in early 2023 followed by rate cuts. However, a combination of the strong job market paired with lingering inflation has held back decisions to cut interest rates, thereby providing strong headwinds for fixed income so far in 2023.

The Federal Reserve issued four hikes this year, bringing the federal funds rate from 4.5 to 5.5 percent. With so much upward movement in yields, it is not surprising that we almost experienced three successive bank failures in one week given most banks held balance sheets significantly impaired by losses in their bond portfolios.

When we look at market volatility, we understand why bond investors might have been nervous in March of 2023. Recent bond market volatility started to manifest in the derivatives markets, which serve as a hedge for professional bond investors. The MOVE Index (shown below) is largely known as the bond market’s fear gauge, similar to the VIX Index for stocks. Readings in the MOVE Index show how concerned bond investors were earlier in the year, with the gauge recording its second highest reading in the past 20 years and only the September through December 2008 period showing higher readings.

Given this concern, it is not surprising to see various bond types falling short once again. U.S. Municipal Bonds, U.S. Corporate Bonds, and Global Bonds fell in 2023, with negative returns ranging from -2 to -3 percent YTD through the beginning of October.

Though this was not nearly as steep of a drop as last year, we experienced three years of negative returns in a row. This is unusual for traditional asset allocated minded investors. Coming off of a negative 2021 along with historically poor performance in 2022 and, now, a third year of underperformance, investors have naturally begun to question why we stick with fixed income in most portfolio allocations.

The Result of Past Hiking Cycles

If bonds have failed to provide the one benefit most investors require of them—i.e., positive annual returns—why continue to hold them? This is a perfectly acceptable question to ask.

Investors began to move to cash and cash-like instruments this past year and a half as increasing interest rates became more attractive for short-term instruments. It is likely those same vehicles will begin to follow traditional fixed-income investments as rates plateau and begin to move downward again. It is also likely we will see a change in Fed policy by the end of 2024, with the Federal Reserve signaling that we are close to completion in this hiking cycle due to the economy showing some signs of cooling.

In truth, the Federal Reserve can only push short-end rates so far for so long before they break the economy and negatively affect labor markets. As the cost of capital becomes ever more expensive, businesses and consumers will eventually look for ways to rein in costs, which eventually expedites an economic slowdown. With a slowdown comes lower rates and a more favorable bond environment.

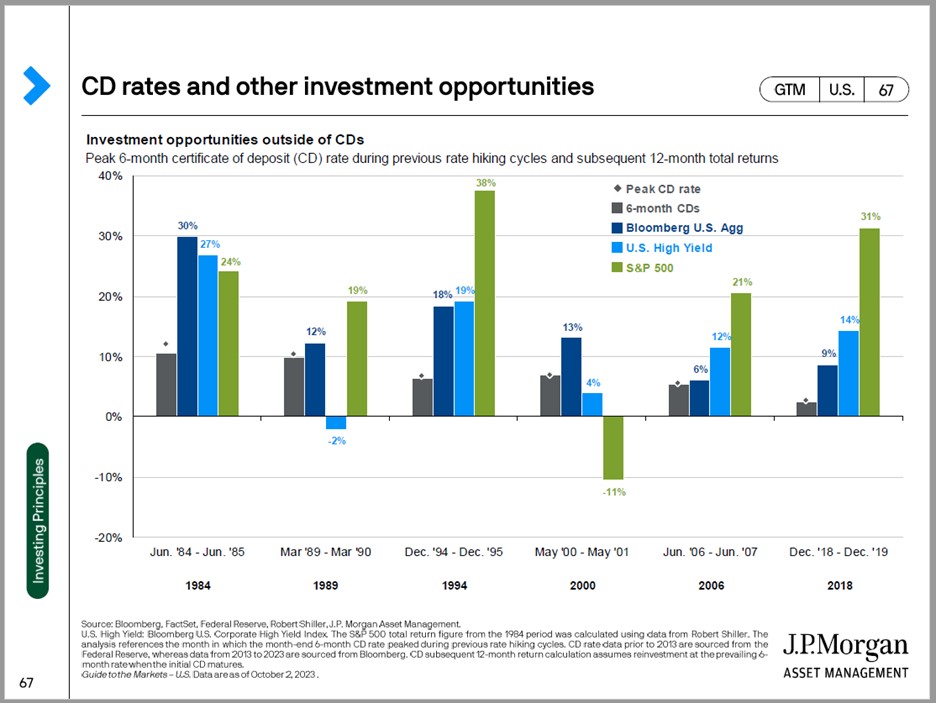

With history as our guide, we can look back over the past 40 years for evidence of how former hiking cycles ended and led to subsequent bond performance in the following 12-month periods. During each of the past six rate hiking cycles, bond investors who held through the end of their respective hiking cycles would have been rewarded handsomely.

The below chart depicts the difference in returns between buying a short-term CD at the peak of the rate cycle vs. what the U.S. Aggregate Bond Index (AGG)—i.e., the proxy for high-quality investment-grade U.S. and high-yield bonds—and the S&P 500 would have generated in returns over the following 12 months. The dark blue bar, representing the AGG, meaningfully outperformed short-term cash and CD-like investments in each case. Investors would have also been rewarded had they stuck to their longer-term investment plan in companies as opposed to trying to side-step volatility in the bond market.

What We Advise

While no one knows for certain where we are in the rate cycle, it is probable that we are on the cusp of change and are likely setting up for a similar scenario to past experiences.

It is unlikely bond markets will continue to generate negative returns year after year. Bonds perform an essential function in the corporate world, which is to provide a financing mechanism to help companies grow and develop. This need will not go away irrespective of where rates head in the future.

AAF Wealth Management has worked to maneuver our portfolios in a way that takes advantage of fixed income opportunities while avoiding pitfalls. We continually take steps to adjust the duration of the bond portfolio and to take advantage of what we believe will be the end of a hiking cycle before long. We expect that any signs that the Federal Reserve intends to ease interest rates will be met with buying.

For investors who have expressed interest, we have also used individual bond ladders to help protect the timing of cash flow needs so individual bonds come due as obligations arrive. For clients with predictable income needs, individual bonds can provide a valuable service in portfolios while also eliminating bad behavior that affects investors in mutual funds and other pooled vehicles.

If you have questions about your investments or personal financial plan, please contact Kevin P. Hodson, Wealth Advisor at khodson@nullaafwealth.com or 774.512.4173—or contact your AAFCPAs partner.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.