Q1 2024 Performance Report and Market Insights

In an ongoing commitment to keep you abreast on a range of issues that might affect your business, AAFCPAs is pleased to share Q1 2024 Market Insights published by AAF Wealth Management, a wholly owned subsidiary of AAFCPAs. These insights reflect on some of the financial developments in the first quarter of 2024 that influenced investment performance. Those include the Federal Reserve, interest rates, the potential results of ongoing sticky inflation and strong job creation reports, and other influences on the market including existing commercial real estate loans, how they’re dealt with, and how rate cuts might materially affect both the markets and the banking system. We also look back at the past few years’ similarities (and differences) and how the last 24 months brought us to where we are today to fully understand the full impact of these influences. Finally, as many are focused on the upcoming presidential election, we hope to shed some light on how this might play out in the financial markets.

Q1 2024 Recap

While we tend to think of investment performance as linear, i.e., bound by quarters and years, securities returns actually flow from one day to the next and build momentum over time. To fully understand the first three months of 2024 and how we got here, we first need to look back at 2023.

On the whole, 2023 ended on a strong note similar to the year prior. In fact, last year’s strongest performing stocks got their start in the fall and early winter of 2022. Those names, formerly known as the FAANG stocks, were rebranded the Magnificent 7.

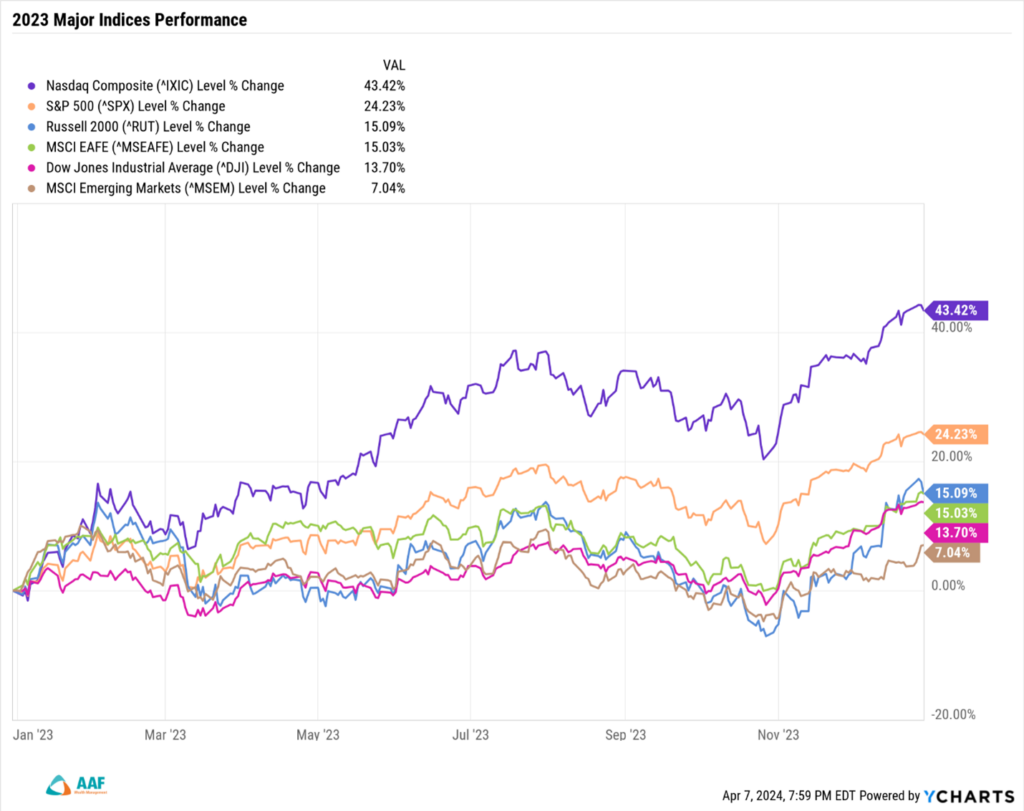

Without the Magnificent 7 (Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla), the markets would have provided lower returns in 2023 overall. While most major averages ended the year on a positive note, the clear leader was the Nasdaq, which posted a 43.4 percent return driven largely by the Magnificent 7 companies. The S&P 500, by far a more diverse index than the tech-centric Nasdaq, also generated strong returns (24.2 percent), as its composition leans heavily toward the same companies. The Magnificent 7 comprises approximately 30 percent of the S&P 500’s constitution.

Performance on indices tracking smaller companies, international stocks, and more industrial related names (Russell 2000, MSCI EAFE and Emerging Markets, and the Dow Jones Industrial Average, respectively) benefited in the final quarter of 2023 as broader market participation took hold once it was apparent that the U.S. was interested in lowering interest rates across the entirety of the fixed income curve despite a backdrop of continued economic growth.

Entering 2024, most investors held that the Magnificent 7 would continue to dominate as they had during the 15 months prior. The market had every reason to believe this—especially amid Janet Yellen’s attempt to reduce long-term rates via the Treasury Department’s Quarterly Refunding Auctions (which brings new bonds to market to provide funding for government spending) and Jerome Powell’s prediction that the Federal Open Market Committee would begin to cut rates sometime in 2024.

What the markets delivered, however, was a different outcome entirely. In January, these formerly impenetrable names began to slip. Soon the Magnificent 7 had been rebranded the Magnificent 3, with hopes that the group might be held up by Microsoft, Meta, and Nvidia alone.

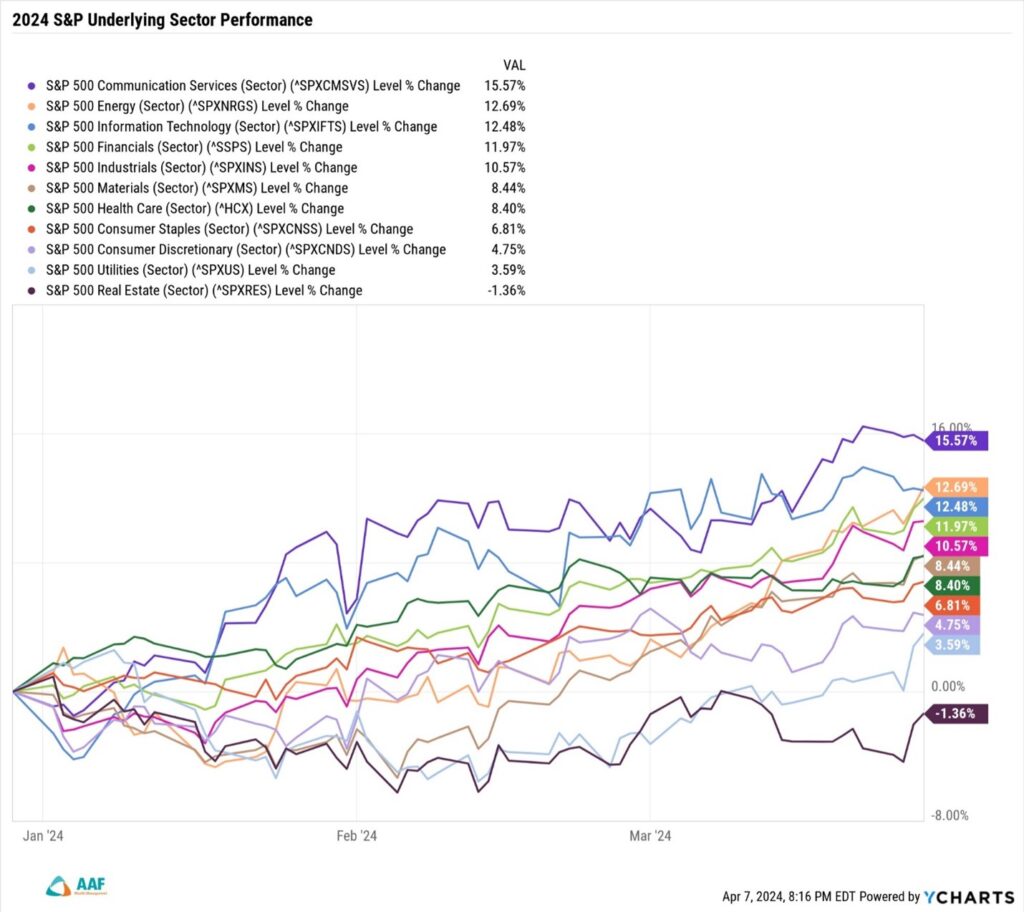

Meanwhile, market performance began to broaden. Sectors that had taken a back seat to those high performers were starting to outperform. Energy, Financials, and Industrial stocks took their place among top sector performers in Q1 2024. While Communications and Technology still placed in the top five performers through the end of March, performance for the majority of those two sectors was driven by the stellar performance of Meta and Nvidia respectively—not from the rest of the stocks in the sectors. Even Materials and Health Care names posted better than eight percent returns in Q1, as investors rediscovered there was more to the market than a handful of popular stocks.

2024 Expectations

Why the change of heart after months of dominance by the Magnificent 7? As the public began to understand the chance that rate cuts might be pushed back with each new month of sticky inflation and strong job creation reports, it became clear that cutting interest rates too soon could lead to an inflation resurgence.

The Fed’s dual mandate, jobs and inflation, had been reduced to keeping inflation in check once the job market seemed on solid footing. That said, there appeared to be little chance that Powell and the Fed would cut rates in the near term.

Data in the past three months suggests a stronger economy than what was once expected, awakening sectors most levered to economic expansion. In times of stronger growth and/or stronger inflationary pressures, sectors that align with hard assets, raw materials, and inflationary pressures tend to assert control.

When you couple this data with the Magnificent 7 trading at extremely high multiples on a relative and historical basis, all while much of the rest of the market trades at reasonable levels, you can see why this change in market leadership occurred; it coincided with changes in inflation readings, job creation, and economic growth relative to what Wall Street had expected.

Q2 and Beyond

As we move into Q2, all eyes are on Jerome Powell, the Federal Reserve, and their willingness to keep rates higher-for-longer (H4L). How long the market will accept this new H4L environment is anyone’s guess. But it is clear the Fed is concerned enough about a resurgence in inflation that it has held rates in the 5.5 percent range for nearly three quarters of a year despite ongoing damage higher rates have wrought on bank balance sheets.

Remember, the pain experienced by the banking system in March of 2023 was largely driven by the Fed’s willingness to bring its Federal Funds Rate (FFR) from zero in early 2022 to 5.5 percent last summer. In doing so, long dated bonds held on bank balance sheets were eviscerated, losing upwards of half of their value in some cases and ultimately driving the banking panics that brought Silicon Valley Bank and First Republic down last spring.

While the government responded quickly to ailing banks by standing up its Bank Term Funding Program (BTFP) in March 2023, whereby banks could loan their greatly reduced bond holdings to the U.S. government in exchange for cash equivalent to full face value, that program ended last month. This put banks in an equally difficult position of waiting and hoping for lower rates by the Federal Open Market Committee.

Commercial Real Estate: A New Issue Arises

If 2023 was the year banks made headlines for their troubled balance sheets tied to under-water treasury holdings then 2024, 2025, and 2026 will likely be known for potential commercial real estate woes. Even with four years of separation from Covid lockdowns, we continue to feel its after-effects. Today, the world has moved into a new reality where many can and do work from home just as well as they had in the office—and just as they had during lockdowns.

As employers realized the cost savings attainable by giving up expensive leases in some of the world’s most prestigious cities, banks began to realize they were holding a lot of Commercial Real Estate (CRE) loans (held largely by small and regional banks) on properties that might have a hard time maintaining tenants. With this, we see why the Federal Reserve would like to lower interest rates. Not only are real estate companies faced with the grim prospect of fewer tenants willing to pay rent but also increased interest expenses as loans roll over and refinance at rates twice as high as their original financing. At the same time, the Fed is aware that lowering rates, while beneficial to banks and mortgage holders, could fan the flames of stronger inflation.

The Effect of Geopolitics

For the past two years, investors have also grappled with geopolitical unrest. This includes recent horrors that have unfolded in the Israeli/Hamas conflict, the tragedy in the ongoing Ukraine/Russia war, and recent Yemini Houthi attacks. As we have seen most recently with the Houthi attacks on shippers in the Straits of Hormuz and the Red Sea, geopolitical unrest has the ability to sow the seeds of doubt and concern in the market while driving inflation up due to supply chain disruptions, all while affecting global commerce.

While the price of oil is often associated with middle east tensions, crude has not been affected in a material way to this point. Instead, general commercial ships from the far east en route to Europe and the U.S. have been forced to find new routes to their destinations. By attacking maritime shipping routes in the Horn of Africa, Houthi forced ships to alter routes and sail around Africa, disrupting shipment timing and driving up costs.

The Effect of Elections

There’s an old adage that says: “political opinions are best expressed at the polls, not in a portfolio.” Investors would be well served to remember and abide by this as best as they can. This is because experts continue to debate whether one administration or the other would best serve the markets.

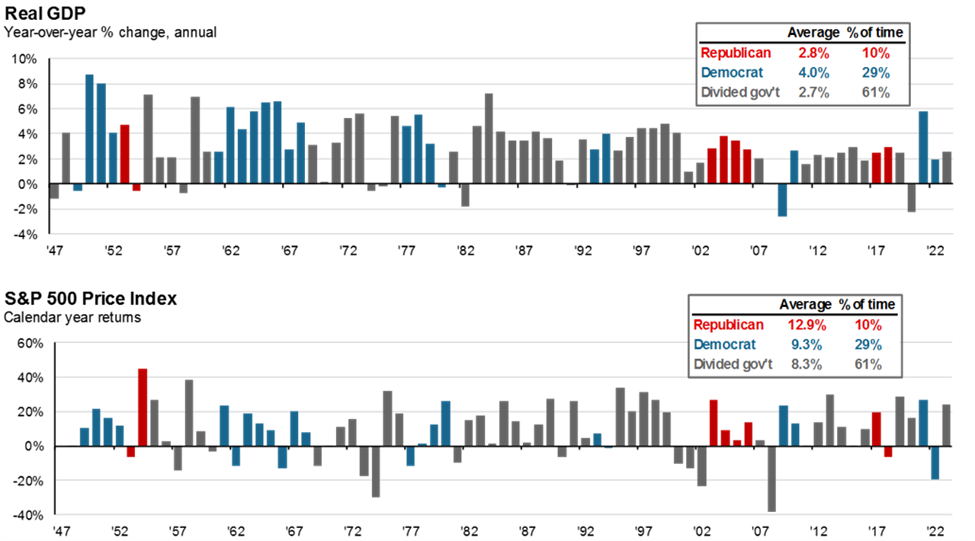

Throughout the past 30 years, markets have tended to average returns of 10.4 percent by comparison. S&P 500 returns under both the Obama and Trump administrations were nearly identical, with market performance under Obama (16.3 percent) just slightly ahead of Trump (16.0 percent). Note that these years were largely periods where interest rates were higher than they were in the last approximately 16 years. Overall, investors who let political opinions dictate their investment approach likely missed out on above-average returns during those years that didn’t coincide with the political administrations for which they might have voted.

Volatility

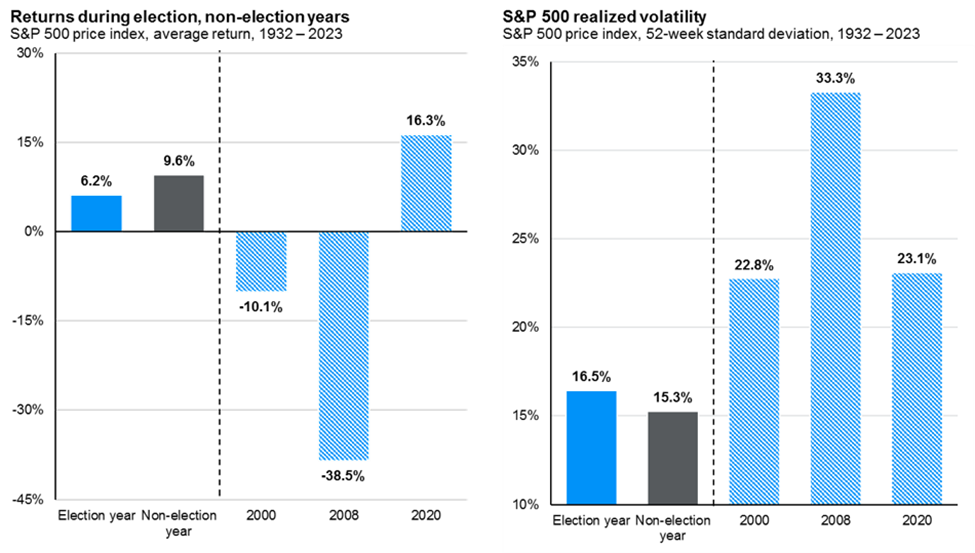

Market volatility tends to increase during election years relative to the first three years of the average presidential cycle. As noted in past newsletters, election years tend to have a high win rate percentage (83 percent), though positive returns often come with some level of increased volatility.

Historically, realized volatility has trended a full percentage point higher during election years (16.5 percent) versus non-election years (15.3 percent). Returns tend to be muted as well in the fourth year of the presidential cycle, with the S&P 500 averaging only 6.2 percent since 1932 in election years versus 9.6 percent in others. More recently during elections in the 21st century, three of the last five election years have also occurred when significant events have shaped our history, leading to poor performance and increased volatility from the norm. From the tech stock crash (2000) to the Great Financial Crisis (2008) and the COVID-19 pandemic (2020), many election years this century have delivered far lower returns than the historical average.

Overall, the markets and the economy tend to do well under both Republican and Democratic leadership. Since 1947, GDP came in higher under Democratic (4.0 percent) versus Republican (2.8 percent) administrations. However, from a market perspective, the S&P 500 has fared better under Republican (12.9 percent) versus Democratic (9.3 percent) administrations over the same period.

Outlook

AAF Wealth Management advises that investors continue to view their portfolios through the lens of a long-term approach. Consider the fact that, throughout the past 16 years, market returns have been positive under both parties. Keeping a focus on the larger picture will likely benefit one’s portfolio far beyond the noise of the next four years.

AAF Wealth Management is a boutique Registered Investment Advisor (RIA) firm serving high net worth individuals and families. As an affiliate of AAFCPAs, Inc., we leverage shared knowledge with New England’s preeminent CPA and Consulting firm to provide insightful planning that considers the full range of tax implications to our clients’ financial lives. If you have questions, please contact Kevin P. Hodson, Wealth Advisor at khodson@nullaafwealth.com or 774.512.4173—or your AAFCPAs partner.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.