Top Takeaways From Our 2024 Tax Planning & Wealth Preservation Webinar

In this article:

- Tax-efficient Charitable Giving

- Health Savings Accounts

- Tax Planning for Retirement

- Estate Tax Planning

- Massachusetts State-Specific Considerations

- Transaction Advisory Strategies for Optimal Tax Efficiency

- Optimize Your Tax and Financial Position

Strategic tax planning preserves wealth and ensures a lasting legacy. During AAFCPAs’ recent Individual/Family and Wealth Preservation webinar (October 2024), Jonathan Bloom, CFP®, AIF®, Joshua England, LLM, Esq., Richard Weiner, CPA, MST, CM&AA, Daniel Seaman, CPA, and Tyler Champagne, CPA, MSA shared wealth preservation insights including strategies to help optimize your tax and financial position.

Here are the main takeaways. You may also watch the entire session as a webcast at your convenience.

Tax-Efficient Charitable Giving

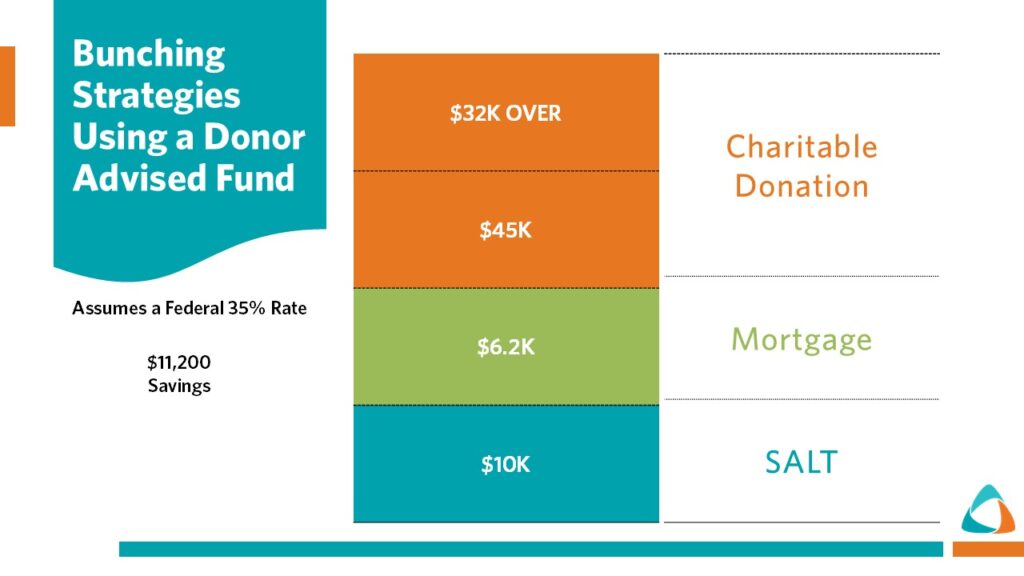

Charitable giving can reduce your tax burden. However, recent tax laws make it harder to benefit from itemized deductions. A strategic alternative is a donor-advised fund (DAF), which allows donors to stack contributions. With this approach, you may make one large, upfront contribution to claim a significant deduction in the first year while still distributing funds to charities over time.

For instance, instead of donating $15,000 to charity each year, a taxpayer might contribute $45,000 to a DAF in year one, surpassing the standard deduction and securing a tax savings of $11,200 in the first year (assuming a 35 percent federal tax rate)—compared to just $2,100 over three years using the traditional approach. This way, you achieve substantial tax savings upfront while continuing to make $15,000 annual contributions to your chosen charity from the DAF over multiple years.

For those with appreciated assets such as stocks or mutual funds, contributing them directly to a charity or DAF may unlock additional advantages. By donating appreciated assets, you sidestep capital gains taxes, which further lowers your tax obligation while maximizing the impact of your donation.

For individuals 70.5 years or older, the Qualified Charitable Distribution (QCD) offers another tax-efficient charitable giving option by allowing taxpayers to donate up to $100,000 directly from their IRA to a charity, thus bypassing the need to declare that distribution as taxable income. This approach provides significant tax relief, especially for individuals facing high required minimum distributions (RMDs). It is important to ensure that funds are transferred directly from the IRA to the charity, as using any other method would disqualify a taxpayer from receiving a tax benefit. Taxpayers should also keep track of any OCDs completed, as the IRS has no mechanism to track those, and inform your tax advisor accordingly.

Health Savings Accounts

Another strategy for tax savings is the use of Health Savings Accounts (HSAs). HSAs provide a triple tax advantage: contributions are tax-deductible, funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. Because contributions are made pre-tax, HSAs are among the most efficient ways to save for both immediate and future medical costs.

To qualify for an HSA, you must be enrolled in a high-deductible health plan (HDHP). For those meeting this requirement, annual contributions may reach up to $3,850 for individuals and $7,750 for families in 2024, with an additional $1,000 catch-up contribution available for those age 55 and older. For high-income individuals or anyone expecting significant medical expenses later in life, maximizing annual HSA contributions may provide substantial tax-free savings.

HSAs do not have a use-it-or-lose-it provision. Any unspent funds roll over each year, allowing account holders to build a balance that grows tax-free. If contributions are allowed to compound over time, an HSA may serve as a secondary retirement account. By treating it as a long-term savings vehicle rather than an account for immediate medical expenses, taxpayers could create a substantial tax-free reserve to cover healthcare costs in retirement.

While it’s common for account holders to spend HSA funds each year on qualified medical expenses, high-net-worth individuals or those in stable financial positions may benefit from letting their HSA grow. Then at retirement, funds may be used for various qualifying expenses, including Medicare premiums, out-of-pocket medical costs, and some forms of long-term care. This flexibility makes HSAs particularly valuable for retirees who anticipate rising healthcare expenses.

HSA contributions, in most cases, must stop once an individual enrolls in Medicare, which often occurs around age 65. To make the most of this account, maximize contributions in the years leading up to Medicare eligibility. Delaying Medicare enrollment—if it fits with one’s financial and healthcare needs—may allow continued contributions to an HSA, extending the window for tax-free growth and contributions.

Tax Planning for Retirement

Contributing to retirement accounts remains a popular and effective strategy for reducing tax liability while building retirement savings. Options like 401(k)s, IRAs, and Roth IRAs allow taxpayers to defer or lower taxes as they plan for the future.

One option for high-income earners is the “backdoor” Roth IRA, a method that sidesteps income restrictions on Roth IRA contributions. Here’s how it works: taxpayers set up a traditional IRA, make a non-deductible contribution, and then quickly convert those funds to a Roth IRA. This approach allows taxpayers to benefit from Roth IRA advantages even if their income exceeds Roth contribution limits. However, it is important to exercise caution. If the taxpayer holds other IRAs, the IRS will prorate the total amount across all IRAs, which could unexpectedly increase the taxable amount of the conversion. Additionally, the strategy is only available to those with earned income, which sets the annual contribution limit.

For retirees, income levels also play a critical role in determining Medicare premiums under the Income-Related Monthly Adjustment Amount (IRMAA). Charitable giving, harvesting investment losses, and deferring income are key strategies for mitigating Medicare premium costs. In cases of significant life events, such as retirement or divorce, taxpayers may qualify for a reduction in IRMAA by making a request to the Social Security Administration.

Estate Tax Planning

Looking ahead, estate tax planning has become increasingly urgent as several provisions in the Tax Cuts and Jobs Act (TCJA), a major tax code overhaul signed into law in 2018, are set to sunset at the end of 2025. Without legislative changes, several key provisions of the TCJA will revert to pre-2018 levels including higher tax rates and a reduced estate tax exemption.

At that time, the estate tax exemption may be cut nearly in half—from $13.6 million at present to approximately $7 million per individual. For those with significant estates, it is crucial to take advantage of current higher exemptions while they are still available.

For instance, trusts may be established to maximize estate tax savings along with the use of tools like the spousal lifetime access trust (SLAT), which allows one spouse to transfer assets to a trust for the benefit of the other, thus offering ongoing access to those funds while still removing them from the taxable estate.

Massachusetts State-Specific Considerations

For Massachusetts residents, state estate taxes add another layer of complexity. The state’s $2 million estate tax exemption is much lower than the federal exemption, and the tax rate ranges from 4 to 16 percent on amounts exceeding the exemption. With proper planning, individuals may reduce or even eliminate their Massachusetts estate tax liability through the use of trusts, for example, which could help to shelter assets from estate taxes and provide significant savings for heirs.

Transaction Advisory Strategies for Optimal Tax Efficiency

For business owners preparing to sell, tax planning plays a crucial role in structuring the transaction for maximum benefit. First, understanding the tax implications of asset versus stock sales is critical. Asset sales may command a higher price due to tax advantages for buyers, such as accelerated depreciation. But they generally bring a higher tax burden for sellers compared to stock sales, which often qualify for capital gains treatment. The Qualified Small Business Stock (QSBS) exemption, for example, can allow certain small business owners to exclude up to 100 percent of gains if they hold the stock for five years, underscoring the importance of planning the sale structure well in advance.

Keeping financial records up to date is also essential. Clean, organized books increase buyer confidence and can lead to a higher sale price. AAFCPAs’ Outsourced Accounting and Fractional CFO solutions offer reliable support to meet these needs.

For owners of pass-through entities, electing a pass-through entity tax may provide additional federal tax savings. By allowing the entity to cover the state tax burden, sellers can enhance their overall deductions. But state-specific guidelines make consulting a tax advisor essential for this strategy.

The Corporate Transparency Act is another key compliance consideration. Now, business owners are required to file beneficial ownership information. Non-compliance can lead to significant penalties and potentially complicate transactions, so it is essential to ensure timely filings. Keep in mind that transaction planning is not only about achieving the highest sales price but also about minimizing tax burdens and optimizing financial outcomes.

Optimize Your Tax and Financial Position

AAFCPAs and AAF Wealth Management intimately understand the complexities of tax and wealth preservation. Our experienced team is available to help you implement effective strategies that can ensure tax efficiency, wealth preservation, and asset protection. We also advise clients on ways to navigate new tax laws and significant life events. We tailor solutions to help you take full advantage of opportunities available under current tax laws and prepare you for potential changes on the horizon.

If you have questions, please contact Jonathan Bloom, CFP®, AIF®, Partner & Wealth Advisor at 774.512.4081 or jbloom@nullaafwealth.com, Joshua England, LLM, Esq., Partner & Tax Attorney at 774.512.4109 or jengland@nullaafcpa.com, Richard Weiner, CPA, MST, CM&AA, Tax Partner at 774.512.4078 or rweiner@nullaafcpa.com, Daniel Seaman, CPA, Tax Partner at 774.512.4025 or dseaman@nullaafcpa.com, Tyler Champagne, CPA, MSA, Tax Manager at 774.512.9012 or tchampagne@nullaafcpa.com—or your AAFCPAs Partner.