The Construction Work-In-Process (WIP) Is A Strategic Tool, Not Simply A Compliance Schedule

WIP Monitors KPIS and Reveals Trends

WIP monitors key performance indicators & reveals trends affecting profitability.

For contractors, the Work-In-Process (WIP) schedule is part of a fundamental dashboard used to determine revenues and gross profit that should be included in your regular, monthly reporting package. The WIP schedule provides a snapshot at a point in time of where your profitability stands on a job-by-job basis, and can provide assurance that your contract revenue, contract costs, underbillings, and overbillings reconcile to your profit & loss statement and balance sheet. But the WIP schedule can be much more than a report to track the progress and financial performance of uncompleted projects throughout a specified time. The WIP schedule provides contractors with a big picture view of performance indicators for individual contracts, and company-wide for all contracts, and can provide strategic insight for informed decision making.

The WIP schedule tracks key project data, including: contract value, costs incurred to date, total estimated costs, and project billings. Statement users (e.g. CFOs, Accountants, Bankers, Bond Agents) are able look at the WIP schedule at the end of a reporting period (monthly, quarterly, or annually) and understand a great deal about job performance/company performance and glean insight from performance indicators, such as: underbillings, overbillings, profit fade or spike, over/under applied burden, backlog on hand, as well as performance by different criteria.

The best WIPs strategically monitor key performance indicators and allow decision makers to reveal issues and trends affecting profitability.

Key performance indicators:

- Underbillings – While these are categorized as an asset on the balance sheet and are classified as “costs and estimated earnings in excess of billings on uncompleted contracts,” underbillings can be a sign of billing department issues, profit erosion not yet recognized, or unapproved change orders. There are some instances where underbillings are to be expected—typically in the early stage of a project or possibly resulting from timing issue such as delays in invoicing from subcontractor or vendors. However, as a project progresses, underbillings become more of an item to monitor because they can put contractors in a position where they are financing the project and putting a strain on cash flow.

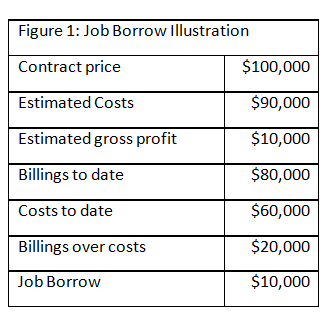

- Overbillings & job borrow – On the contrary it is better to be overbilled than underbilled. Cash flow will be healthier and contractors can avoid the need to fall back on a line of credit. Overbillings are categorized as a liability on the balance sheet and are classified as “billings in excess of costs and estimated earnings on uncompleted contracts”. However, be aware that you may be “borrowing” from the job. Job borrow is when you have billed more than the costs you have incurred to date, and the difference is in excess of the total gross profit you will earn on the project. Sureties monitor job borrow closely because they see this as a sign that you are borrowing from one job to pay for another. They compare the job borrow against your cash balance to make sure you have the cash on hand to pay for your finishing costs. For example, consider a contract price of $100,000 where you expect to make $10,000 of gross profit or 10% on a job. If you have billed $80,000 year-to-date and incurred $60,000 in costs, you have borrowed $10,000 from this job (i.e. $80,000 (billings) – $60,000 (costs to date) – $10,000 (gross profit) = job borrow of $10,000). So you have $20,000 of cash (assuming you collect your receivables) that is over and above the costs you have incurred, and of that amount $10,000 represents profit you will retain; you will need the other $10,000 for costs to finish the project. If you use this over billing on selling, general and administrative (SG&A) expenditures, you won’t have the cash to finish the project (see Job Borrow Illustration – Figure 1). Again, while you want to finance the project with as little of your own money as possible, you don’t want to find yourself constantly borrowing from one job to pay for the next. If your cash balance gets below this “job borrow” as a result of financing overhead and other projects, your surety may question your bonding capacity.

- Profit fade/spike – Profit fade is often a sign of mismanaged jobs or poor estimates. Contractors experiencing cost overruns should regularly review job cost reports to identify causes. Profit fade also results in jobs being misreported in prior periods. Surety or banking decisions may have been approved or declined based on these results. Conversely, if you are always recognizing profit spike at the end of projects, your estimates may be too conservative throughout project life cycles. Margins on open and closed jobs should be in the same ballpark. If margins on open jobs are higher than closed jobs you could be too optimistic. This can have a negative effect on the way a surety portrays your books, but it could also impact the income taxes and interests you are paying the IRS.

- Over/under applied burden – Burden represents indirect costs of performing contract work. Examples of these types of costs would be depreciation on fleet vehicles, gas, small tools, insurance, etc. It is very important to reconcile the costs in the WIP schedule back to the profit and loss statement (P&L) and analyze your over/under applied burden. Allocation of burden is critical to ensure there is an accurate depiction of the jobs in the WIP schedule. If the WIP schedule total gross profit percentage doesn’t closely mirror what is reported on the P&L your WIP loses credibility. Your WIP schedule must include realistic burden rates if it’s to be taken seriously by surety underwriters, bonding agents and bankers, and if it’s to be of strategic use to your management team.

- Backlog on hand – By rolling out the backlog on a job-by-job basis you are able to plan company results on a monthly or quarterly basis. This planning is important for management/owners to ensure they are making informed, strategic business decisions. Additionally, an accurate backlog projection is extremely useful for business development personnel as it can help them to identify peaks or valleys in workload, and they can then focus on developing business to fill those gaps. On the contrary, if you are flush with work, you may be selective and cherry pick projects or price work at a premium during peak times. If times are slow you may decide to sharpen the pencil and go in a little leaner to win work in an effort to keep your labor force busy. The performance indicators mentioned above provide validity to the backlog roll out. You can then measure actual results against the roll out to fine tune the process. Setting goals and measuring them will also help drive results and profitability. If you have problems with your WIP schedule, owners, CFOs, and CPAs will not be able to make informed decisions based on the backlog roll out projections.

The WIP schedule can be a powerful tool to reveal inefficiencies in construction operations, to better understand company performance and factors affecting profitability. Strategically-designed WIP schedules include both standard, and various descriptive columns that clearly highlight the significant details of all contracts in process, and better enable meaningful analysis. Regular WIP analyses can support construction business profitability, and help contactors focus on areas of profitability, including: projects by type, size, or location with consistent profit margins, key members of your team who contribute to profitability, contractors who are consistent and fair, and vendors who deliver value.

AAFCPAs has provided a sample WIP schedule template available by clicking here: download sample WIP schedule template,which includes some standard, predefined columns that will be helpful for many contractors to utilize in measuring and analyzing their WIP results. However, we strongly advise against a “boiler plate” WIP schedule. Based on your specific needs, the WIP should be tailored for the best and most meaningful results.

If you have any questions about your Work-in-Process Schedule or need additional information, please contact your AAF Partner, or Dan Stanhope, CPA, at 774.512.4134, dstanhope@nullaafcpa.com.

This article appeared in The Professional Contractor (TPC), a quarterly magazine published by the Association of Subcontractors of Massachusetts.