HRSA Operational Site Visits: Considerations, Risks and Common Trouble Spots

Does your Health Center have its Health Resources & Services Administration (HRSA) site visit looming? If so, or if your Center has been through a recent HRSA Operational Site Visit (OSV), you know what a daunting, stressful and time consuming process this may be. HRSA is continually refining and clarifying the 330 program compliance requirements as most recently demonstrated through the issuance of the new Draft Health Center Program Compliance Manual.

AAFCPAs advises our clients that one of the most important considerations for preparation for the 330 Grant OSV is documentation. The first step to proving compliance with any of the 19 Health Center grant program requirements is to have strong written, board approved policies. If a policy, procedure or control is not in writing, a Center may be at an immediate disadvantage from a compliance standpoint.

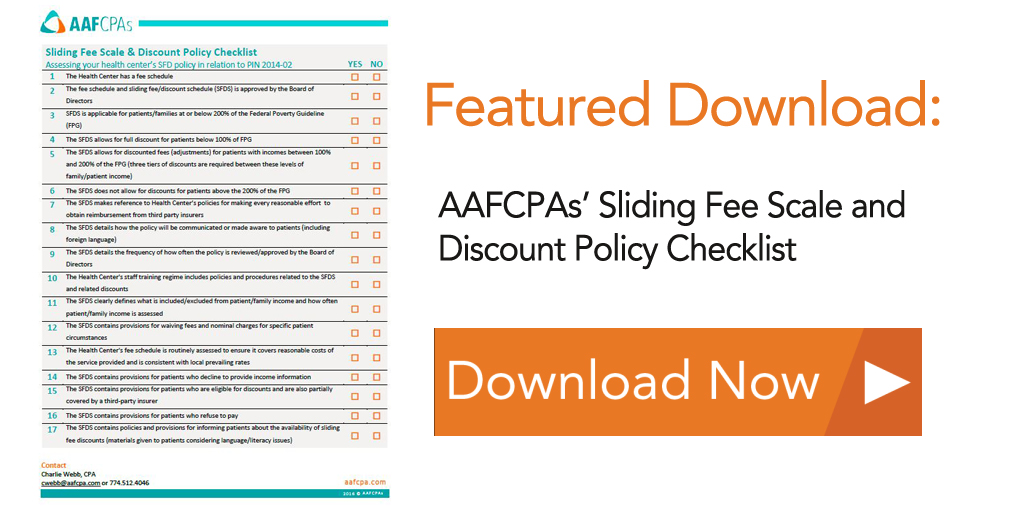

AAFCPAs has summarized below some of the most common trouble spots we have found where Health Centers have had findings or grant conditions as a result of the HRSA OSV related to financial management, billing and collections areas. We have also prepared a valuable Sliding Fee Scale and Discount Policy Checklist to assist readers in assessing your Health Center’s SFD policy in relation to PIN 2014-02. AAFCPAs can provide guidance and insight to strengthen or enhance your policies, procedures and controls, which may prevent these HRSA OSV findings.

Provision of Service

Under the Health Center grant requirements umbrella of Provision of Service, common findings and conditions often occur with the sliding fee discounts (SFD) requirement. In 2014, HRSA issued PIN 2014-02, which clarified the rules surrounding this requirement. PIN 2014-02 clearly lays out the specifics that need to be in the SFD policy.

AAFCPAs encourages Health Centers to review their SFD policy to ensure it is consistent with PIN 2014-02. It is important to document annual approval of the SFD policy including use of the most recent federal poverty guidelines. The SFD requirement may be satisfied through multiple policies. For example, one policy should outline the various thresholds and basic structure of the SFD program, which will be approved annually considering changes in the federal poverty guidelines and changes in services of the Health Center. Other policies may be established that address more ambiguous issues surrounding the SFD requirement, such as how SFDs are communicated to and utilized by providers operating under a referral or contractual arrangement with the Health Center (i.e. affiliated hospital or other contracted provider). Your policy should also address how the SFD is made available and communicated to patients, giving consideration to the patient population (language and literacy issues). Finally, there should be operating procedures within the billing and accounting procedural manuals that: instruct front desk staff regarding how to apply SFDs; how they should be incorporated into the practice management system; and defining the necessary documentation to gather that appropriately verifies income levels.

Management and Finance

In 2012, the Government Accountability Office (GAO) issued a report assessing the effectiveness of HRSA’s site visit processes. This report also summarized the conditions imposed by HRSA by program requirement. Of the 1,017 conditions summarized in the appendix to the report, a majority (nearly 60% of the conditions) related to management and finance program requirements, with 230 being in the financial management and control policies requirement (the next highest instance of conditions was 121 – program data reporting systems). This report clearly demonstrated the need for Health Centers to have clear, accurate and comprehensive accounting policies and procedures. In many cases, these conditions could have been prevented had Health Centers invested time in creating strong, written policies and internal controls.

The HRSA’s Financial Management and Control Policies and the Program Data Reporting Systems requirements require Health Centers to have accounting and internal control systems that are appropriate for their size and complexity, and that reflect Generally Accepted Accounting Principles. AAFCPAs advises clients, as a best practice, to have procedures in place to review their accounting policies and procedures manual on a regular basis (ideally every two-to-three years, or in the event of significant management or operational changes). The accounting policies and procedures manual should be a living document that is reflective of current staffing, systems (including electronic medical records and practice management systems recently implemented), and new accounting pronouncements. Unfortunately, all too often these documents are created and then are never utilized or modified for changes in staff, controls, operations, and new procedures.

In relation to the Health Center federal grant, this area has come under further scrutiny though PIN 2013-01, which effectively requires Health Centers to track 330 grant federal expenditures as a separate cost center, class or department in the general ledger. This is further emphasized in the new HRSA Draft Health Center Compliance Manual, which states: “The Health Center’s financial management system is able to account for all Federal awards (including Federal awards made under the Health Center Program) in order to identify the source and application of funds…”. We recognize that some Health Center program grant officers and HRSA site visit reviewers have stated that it is ok to track 330 grant expenditures outside of the general ledger; however as a best practice it is strongly recommended that 330 grant revenue and expenditures be tracked in a separate cost center or department.

In accordance with the program income requirement of the Health Center program grant, Health Centers must have systems in place to make reasonable efforts to collect and receive reimbursement for its costs associated with provider services. This falls into the ‘billing and collections’ Health Center requirement of the 19 Health Center program requirements. Satisfying this requirement means having written, board approved credit and collections policies, as well as procedures and controls for following up on denied claims, approval of write-offs of claims or issues with patients refusing to pay. These policies should all be incorporated into a comprehensive accounting policies and procedures manual that also outlines policies for establishing and adjusting an allowance for doubtful accounts and contractual allowances.

Changes in a Health Center’s scope of project, including additional services, new sites, etc., may also trigger scrutiny from your HRSA OSV reviewer. Such changes should be approved and documented via the Board of Director’s minutes and should be communicated to the grant officer immediately. Furthermore, for purposes of determining and documenting allowable costs, the Health Center should clearly document what services are within its 330 scope and which are not.

Governance

Board composition – The key action item for this requirement is to clearly document who is a ‘consumer’ board member and who is not, as at least 51% of the Health Center’s board should be comprised of consumers that are representative of the Center’s target population.

Board authority – Health Center Boards should be meeting monthly, and should maintain minutes of all meetings. Furthermore, we recommend that your Board focuses on compliance related to the OSV’s commonly indicated findings, including: lack of documentation around approval of hours, new services offered, approval of policies, and operating under an organizational and governance structure that is consistent with the Center’s by-laws.

Finally, although the findings surrounding conflict of interest policies have been few, the impact of an undisclosed conflict could have significant ramifications to a Center. Health Centers should ensure that this policy is written and distributed to the Board of Directors and key management on an annual basis.

Furthermore, as a best practice, the Health Center should obtain written documentation, on an annual basis, from the Board of Directors and members of key management as to whether any conflicts exist and the nature of any such conflicts.

Conclusion

AAFCPAs has outlined for your convenience some of the common trouble spots in the finance and management area of the HRSA OSV that lead to findings or grant conditions. Many of these may be avoided by having robust, written policies. Implementing a strong set of operational manuals, and policy and procedure documents will ultimately alleviate the strenuous task of preparing for the HRSA OSV. AAFCPAs has been working with community Health Centers for over 30 years and can be of valuable assistance in developing and implementing many of the aforementioned policies.

If you have any questions about preparing for your HRSA OSV, operational manuals, or policy & procedure documents, please contact your AAFCPAs’ partner, or Charlie Webb, CPA at 774.512.4046, cwebb@nullaafcpa.com.