David McManus

ESOPs May Be the Key to Operating Tax-free in the Cannabis Space

Cannabis operators focus heavily on tax mitigation, employee retention, growth strategies, and profitable exit. A properly structured ESOP is a great tool to accomplish all those goals and more. In a recent webinar, “Cannabis ESOPs – The Industry Game Changer”, AAFCPAs’ David McManus, CPA, CGMA, Tax Partner & National Cannabis Practice Leader and Joshua England, LLM, Esq., […]

Cannabis Ventures, Startup Best Practices, and Ways to Compete

Once relatively easy to break into, the cannabis industry now demands a leaner and more conservative approach to financial management along with precise forecasting and a great deal of patience. There are inherent risks, regulatory uncertainties, and financial challenges faced by new market entrants and established operators alike. As the market continues to mature, so […]

TerrAscend Corp. Joins Other Operators Changing 280E Tax Position

AAFCPAs would like to make cannabis clients aware that TerrAscend Corp., in its fourth-quarter earnings call, announced it would no longer be making tax payments under Section 280E of the Internal Revenue Code. The company’s Chief Financial Officer noted its legal basis in doing so comes from a legal interpretation based on a similar position […]

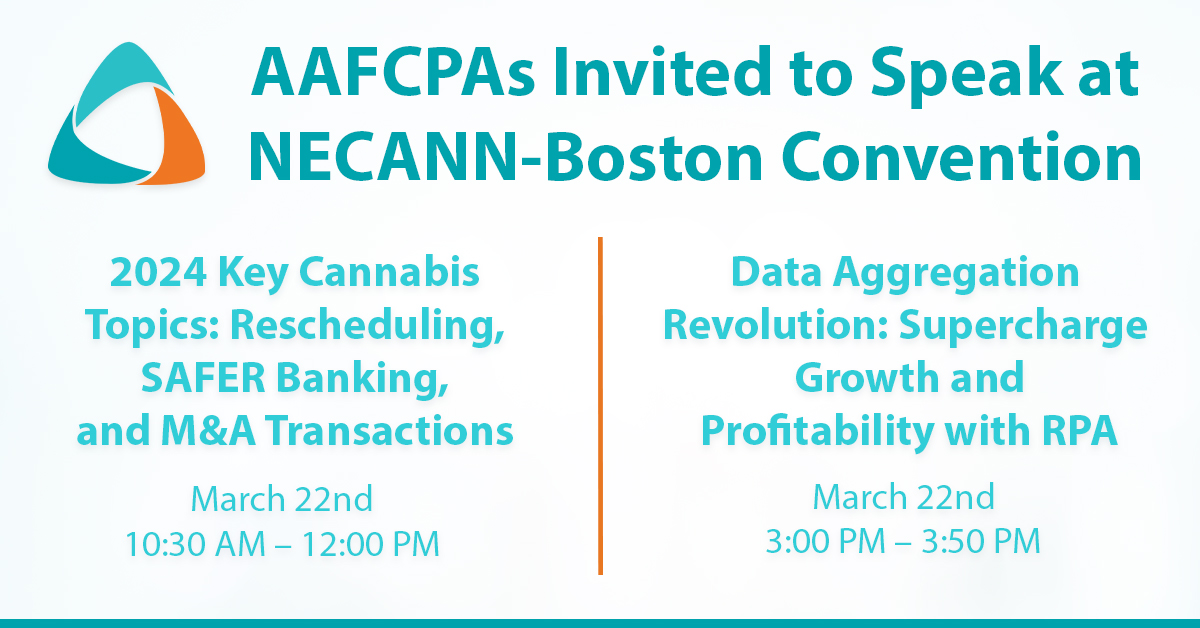

AAFCPAs Invited to Speak at NECANN-Boston Convention

AAFCPAs’ Vassilis Kontoglis, Janice O’Reilly, and Dave McManus have been invited to speak in two separate sessions at NECANN’s 2024 Boston Convention being held at the Hynes Convention Center in Boston, Massachusetts. 2024 Key Cannabis Topics: Rescheduling, SAFER Banking, and M&A Speakers: Dave McManus, Ronald Lipof, Melissa Maranda, J.D., and Michael Ross When: Friday, March […]

Lawsuit Returns $1.2M in Community Impact Fees to Cannabis Businesses

AAFCPAs would like to make Cannabis clients aware that Caroline’s Cannabis recently reached a $1.2 million settlement with the town of Uxbridge, Massachusetts contesting millions of dollars in community impact fees imposed on marijuana businesses. The lawsuit claimed that the town had not provided any documentation justifying a host community agreement (HCA) fee, which is […]

Social Equity Program Application Opening February 5th

The Massachusetts Cannabis Control Commission announced that it will begin accepting applications for the fourth cohort of its Social Equity Program (SEP) starting Monday, February 5. Applications will be accepted until April 30th, according to its press release. Applicants are eligible for the Social Equity Program (SEP) if they demonstrate they meet at least one […]

BBJ: How to apply to state cannabis grants, according to finance expert Dave McManus

Boston Business Journal (January 31, 2024) – After years of waiting, cannabis social equity companies in Massachusetts can start applying to state grants to support their businesses. Last week, the state Executive Office of Economic Development launched the “Immediate Needs Grant Program,” which is first release of grants from the state’s Cannabis Social Equity Trust […]

Immediate Needs Grant Program Funding Available, Application Due February 15th

AAFCPAs would like to make Cannabis clients aware that the Massachusetts Cannabis Control Commission announced on January 23rd the availability of financial resources with the launch of its first funding from the Cannabis Social Equity Trust Fund (Trust Fund). The Immediate Needs Grant Program will offer grants to support cannabis business license holders with urgent […]

Massachusetts’ Cannabis Social Equity Trust Fund to Soon Offer Grants

AAFCPAs would like to make clients aware that Massachusetts’ supplemental budget passed late last year includes a procedural fix to the Cannabis Social Equity Trust Fund. This means the state-wide cannabis industry, particularly communities of color, may soon gain access to millions in state funding meant to diversify entrepreneurship opportunities. One of the greatest obstacles […]