Davide Villani

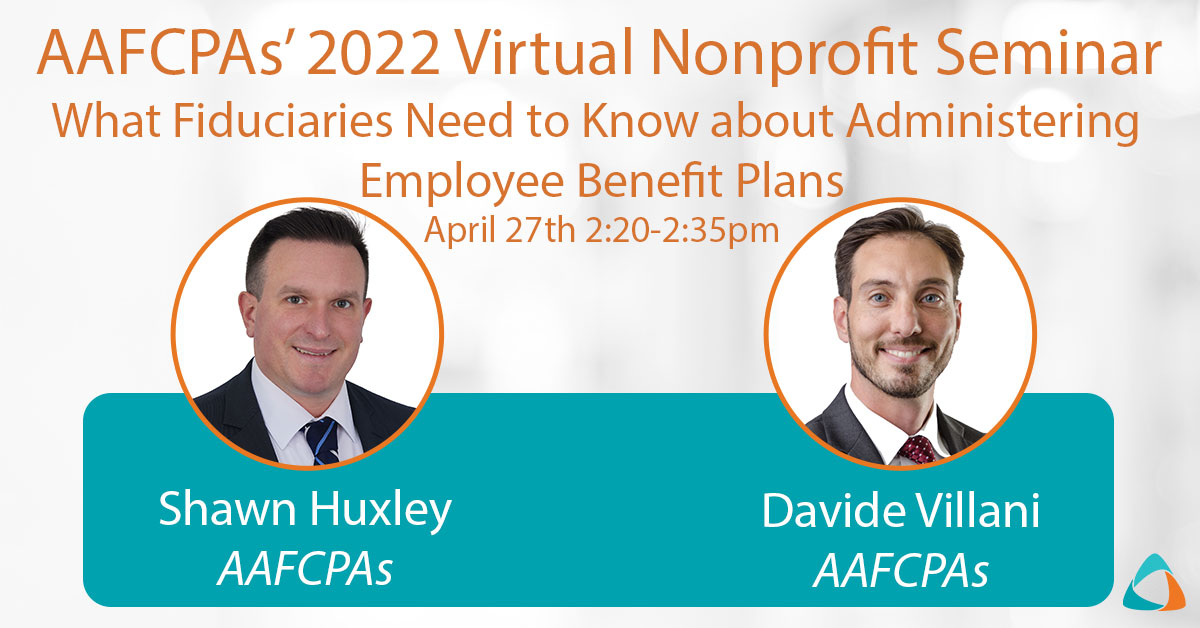

Live Session: What Fiduciaries Need to Know about Administering Employee Benefit Plans , April 27

AAFCPAs’ Annual Nonprofit Educational Seminar is Virtual Again in 2022! AAFCPAs is offering a full day of educational content (9am – 3pm) designed to educate, challenge, and inspire nonprofit professionals! As a client and/or friend of AAFCPAs, your registration is complimentary. Featured Session: What Fiduciaries Need to Know about Administering Employee Benefit Plans (2:20pm – […]

IRS Provides Guidance on Safe Harbor Plans

AAFCPAs would like to make clients aware that the Internal Revenue Service (IRS) recently issued Notice 2020-86 addressing certain provisions of the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) affecting safe harbor plans, including safe harbor 401(k) plans and certain 403(b) plans. A safe harbor 401(k) plan is similar to […]

AAFCPAs’ Davide Villani to Serve on Board of Roman Catholic Diocese of Worcester

AAFCPAs Partner Davide Villani, CPA, CGMA has been appointed and agrees to serve on the Roman Catholic Diocese of Worcester Finance Committee, Audit Committee, and Retirement Plan Committee. Davide will serve as a fiduciary of the Diocese, providing strategic direction and financial advice to help the organization achieve its vision for the future. “I am […]

Retirement Plan Provisions of the CARES Act

AAFCPAs would like to make clients aware of retirement plans provisions included in the Coronavirus Aid, Relief and Economic Stimulus (CARES) Act legislation. These provisions include expanded and penalty-free withdrawal rights, expanded loan rights, extended rights to repay loans and withdrawals, and a deferral of mandatory distributions. Coronavirus-Related Hardship Distributions The 10% early distribution penalty […]

Employee Benefit Plan Health Check

Listen to Podcasts: Performing a regular and independent assessment or “health check” of your retirement plan can ensure your organization’s plan remains properly designed for your employee population and delivering the best possible benefit with the least amount of risk & cost. Davide Villani, leader of AAFCPAs’ specialized Employee Benefit Plan Audit & Consulting Practice, outlines typical […]

AAFCPAs Promotes Four to Partner to Support Firm Growth

Westborough, MA 1/8/2019 – AAFCPAs is excited to announce the promotion of four additional Partners to our growing team: Andrew Hammond, CFP®, Carmen Grinkis, PhD, CLTC, CFP®, Matthew McGinnis, CPA, and Davide Villani, CPA, CGMA are fully engrossed in the industries we serve, and work closely together to best serve our diverse client base with the distinction of excellence. Carmen […]

Educational Podcast: Unraveling the Mysteries of Employee Benefit Plan Costs

Listen to Podcast Click here to listen to podcast or use the above media player. Clients often ask “How much does my employee benefit plan cost, and how do costs relate to compliance and risks?” Plan costs are often buried and difficult for plan sponsors to truly figure out. In order to meet their fiduciary […]

Proposed Update to Auditing Standards for Employee Benefit Plans

In an effort to improve the communicative value and relevance of the auditor’s report, the AICPA Auditing Standards Board (ASB) recently released an exposure draft of a proposed Statement on Auditing Standards (SAS), Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA. The proposed SAS would apply to audits […]

Fiduciary Responsibility for Plan Sponsors

Listen to Podcast Click here to listen to podcast or use the above media player. Today’s trustees and benefit plan sponsors face personal liability, complex laws and regulations, lack of fee transparency, conflicts of interest, and increased scrutiny by investors and regulators. AAFCPAs’ Davide Villani provides insight into key risk management considerations for Nonprofits, including […]