Industry

Bill Introduced to Repeal R&D Expense Capitalization

AAFCPAs provides the following update to clients with expenditures incurred in connection with your trade or business which represent research and development costs in the experimental or laboratory sense. On Thursday, March 16th, Senators Maggie Hassan (D) of New Hampshire and Todd Young (R) of Indiana reintroduced a bill to repeal the required capitalization of […]

Historic Tax Credit: Changes Proposed to Make it More Accessible, Attractive

On March 2, 2023, Senators Cardin (Maryland), Cassidy (Louisiana), Cantwell (Washington), and Collins (Maine) reintroduced the Historic Tax Credit Growth and Opportunity Act (HTC-GO). This legislation was originally proposed back in 2021. HTC-GO has many beneficial proposed changes to the current historic tax credit program. The four proposed permanent provisions are: 30% tax credit increased […]

How to Identify Areas of Improvement within Processes and Systems?

Whether caused by external forces like the pandemic or internal shifts at a specific company, there is a renewed focus on operational efficiencies. Your employee resources may be consistently frustrated by challenges such as: Extensive manual data manipulation in Excel Lack of reporting functionality in your system Information maintained in multiple systems Difficulty gaining cooperation, […]

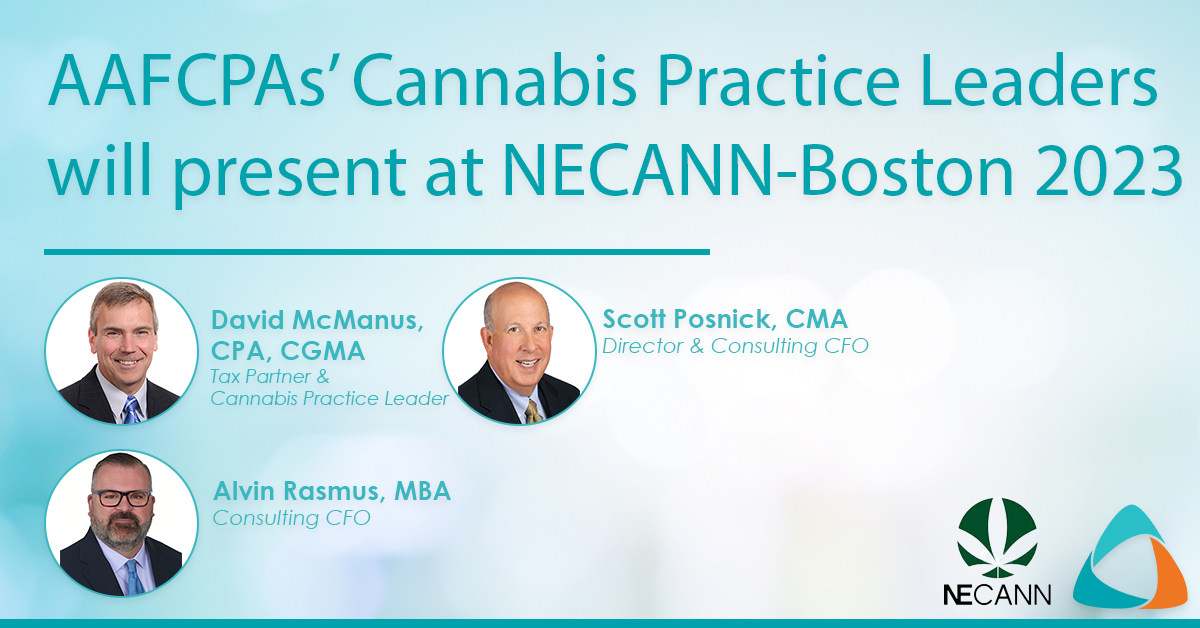

AAFCPAs’ Cannabis Practice Leaders Join NECANN-Boston Programming Schedule

AAFCPAs has been selected to present two educational workshops at NECANN Boston 2023 (The New England Cannabis Convention) scheduled for March 10-12th at the Hynes Convention Center, Boston. AAFCPAs’ Cannabis Practice has also signed on as a Sponsor for the Convention, aka “THE Annual Meeting of the East Coast Cannabis Industry!” Entrance to Exit for […]

GASB: Subscription-Based Information Technology Arrangements

AAFCPAs would like to remind entities following government accounting rules, including clients in the Charter School industry as well as other quasi-governmental organizations, of the Governmental Accounting Standards Board (GASB) Statement No. 96, Subscription Based Information Technology Arrangements, which is required to be adopted in FY 2023. GASB 96 applies to all subscription-based information technology arrangements […]

2022 HSN Supplemental Payments

AAFCPAs would like to make FQHC clients aware, as part of the Massachusetts Economic Growth and Relief Act of 2022, $20,000,000 was allocated to the Health Safety Net (HSN) Trust Fund for community health centers or hospital-licensed health centers (health centers) participating in the MassHealth program. Payments were to be made to the health centers […]

McManus Weighs in on Cannabis in 2023

Cannabis Regulator (January 23rd, 2023) – Interview: What Does 2023 Hold for Cannabis Companies? The legal cannabis industry remains fluid and growing as we head into a new year. Two more states approved recreational laws on Election Day 2022, expanding the map where marijuana is legal…

Guidance: CECL Standard for CDFIs

The long-awaited Current Expected Credit Losses (CECL) Standard, Accounting Standards Update 2016-13 – Financial Instruments-Credit Losses (Topic 326) will be effective for nonpublic business entities and not-for-profit entities for fiscal years beginning after December 15, 2022. This means CECL will be effective for the calendar year 2023 reporting period and fiscal year 2024 for off-year […]

Affordable Housing Sponsors Approaching LIHTC Property Transitions

The Low-Income Housing Tax Credit (LIHTC) program, enacted in 1987, has been paramount for financing the construction and rehabilitation of properties in low-income communities. The credits are claimed by the investor over a period of 10 years, with a 15-year Federal compliance period. Additionally, there is an overall 30-year restricted use-period with the state housing […]