Industry

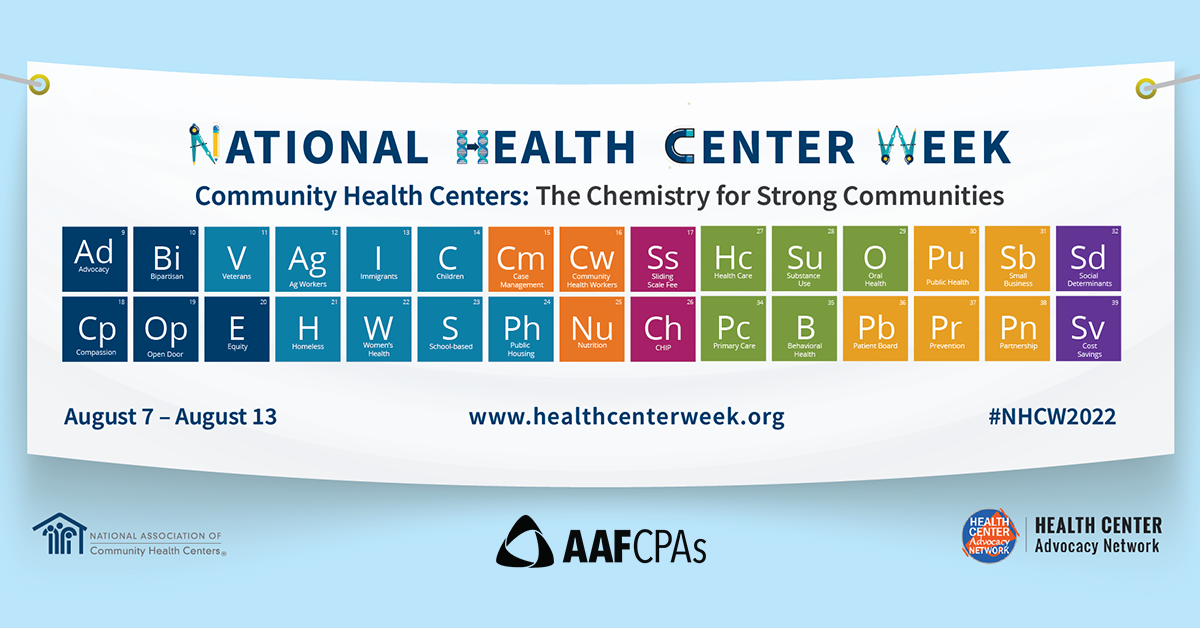

AAFCPAs Celebrates 2022 National Health Center Week

Next week, August 7-13, 2022, is National Health Center Week, and AAFCPAs invites you to join us again this year in celebrating the great work and significant impact of these organizations who serve as the chemistry for strong communities! #NHCW2022 and #ValueCHCs Friday, 8/12 – Health Center Staff Appreciation Day The incredible value Community Health […]

AAFCPAs Provides Inventory Costing and 471 Guidance at AICPA & CIMA Cannabis Conference

AAFCPAs’ Cannabis Practice Leader David McManus, CPA, CGMA will present Inventory Costing and 471 Guidance to cannabis industry experts, CPAs, Attorneys, Tax Advisors, and peers experienced and inexperienced with the sector at the Association of International Certified Professional Accountants (AICPA) & Chartered Institute of Management Accountants (CIMA) Cannabis Industry Conference on August 8th in Denver, CO and Live […]

ECF Funds May be Subject to Uniform Guidance Audit

AAFCPAs would like to make Charter School clients aware that funds received under the ECF (Emergency Connectivity Fund) Program are federal funds and must be included in the calculation for determining your need for a Uniform Guidance audit. In May 2021, the ECF program was established by the FCC (Federal Communications Commission) to distribute ARPA […]

Cannabis Business Executive: Easing the burden of cannabis state tax compliance

Cannabis Business Executive (June 16, 2022) – Keeping pace with state sales and excise tax requirements can be a significant burden for cannabis operators. Make no mistake, the tax collection is a high priority to states, and as the industry grows, penalties and fines for late payment are becoming more common.

MA UFR Extensions Must Be Submitted On the OSD website

AAFCPAs would like to make Human & Social Services clients aware that effective June 30, 2022, the Massachusetts Operational Services Division (OSD) will no longer accept extension requests for the submission of the UFR, MAB allocation requests and waiver requests through the UFR eFiling system. All requests must be submitted using OSD’s web-based system which […]

GASB Subscription Accounting Standard

Governmental Accounting Standards Board (GASB) Statement No. 96, Subscription Based Information Technology Arrangements, applies to entities following government accounting rules, including AAFCPAs’ clients in the Charter School industry, as well as other quasi-governmental organizations. This guidance applies to subscription-based technology arrangements (SBITAs), defined as a contract that conveys control of the right to use another party’s […]

GASB Lease Accounting Standard

As a reminder, Governmental Accounting Standards Board (GASB) Statement No. 87, Leases, applies to entities following government accounting rules, including AAFCPAs’ clients in the Charter School industry, as well as other quasi-governmental organizations. This guidance applies to most leases with a term of over 12 months. These leases will now be recognized on the statement […]

AAFCPAs Speaking at Illinois Cannabis Convention

AAFCPAs’ Cannabis Practice has been selected to present an educational workshop: Modeling Considerations When Entering a New Market at the Illinois Cannabis Convention, June 10th-11th, 2022, at the McCormick Place Lakeside Center, Chicago, IL. MODELING CONSIDERATIONS WHEN ENTERING A NEW MARKET Entering a new Cannabis market requires planning and adapting to regional nuances unlike almost […]

MA Votes to Decouple from Federal 280E

On May 18, 2022, in a 153-2 vote, the Massachusetts House of Representatives approved sweeping marijuana reforms, which includes two welcomed provisions for operators! MA House Votes to Decouple from Federal 280E Tax Code The House voted to amend the state’s tax code to officially decouple from the federal tax code with respect to 280E. This […]