Topic

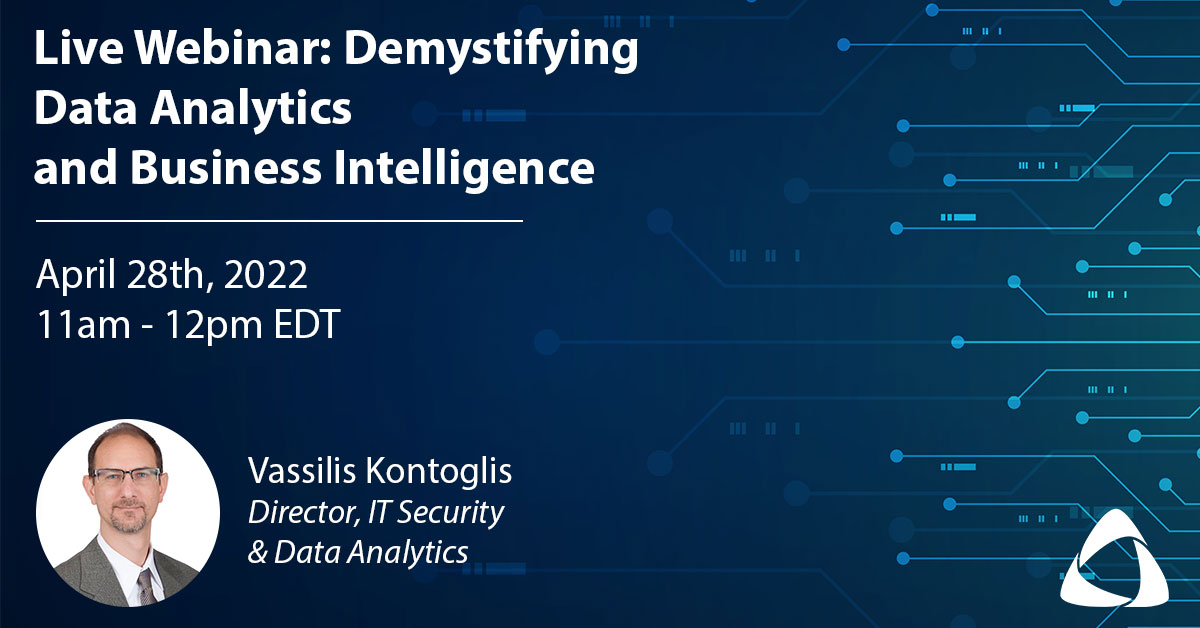

Webinar: Demystifying Data Analytics and Business Intelligence

The utilization of data has drastically evolved, and now, more than ever, it is time for organizations to collect, organize, process, and draw insight to remain relevant. However, doing so can be a challenging task without the right tools and expertise. How do you unlock the power of data quickly and efficiently to create a […]

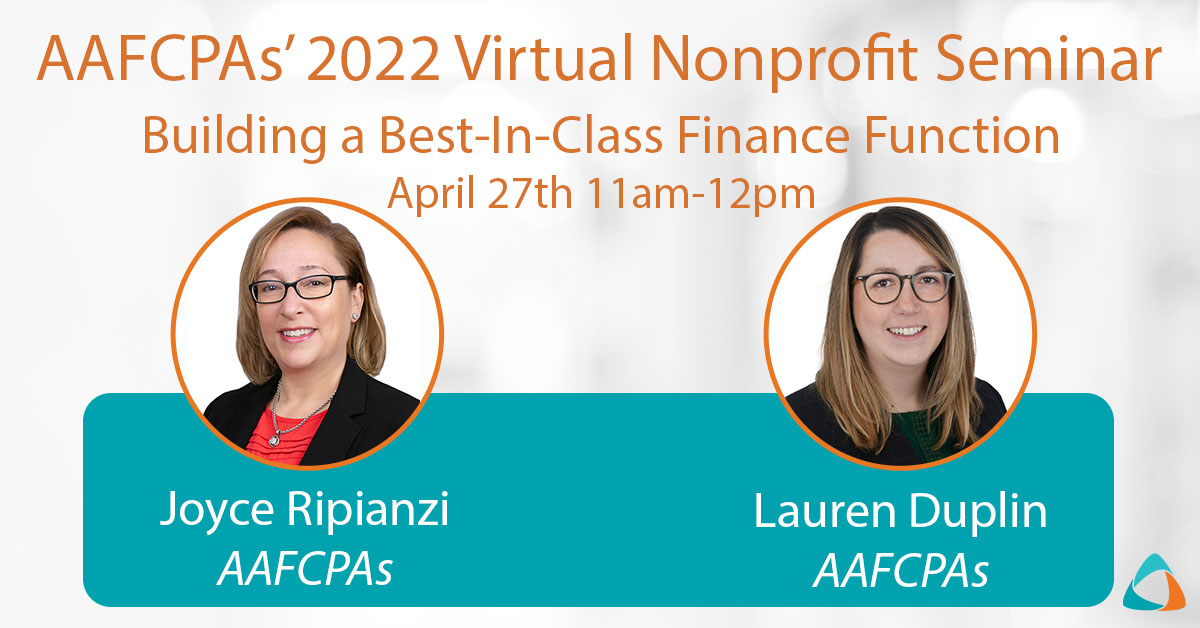

Live Session: Building a Best-In-Class Finance Function, April 27

AAFCPAs’ Annual Nonprofit Educational Seminar is Virtual Again in 2022! AAFCPAs is offering a full day of educational content (9am – 3pm) designed to educate, challenge, and inspire nonprofit professionals! As a client and/or friend of AAFCPAs, your registration is complimentary. Reserve your seat.>> Featured Session: Building a Best-In-Class Finance Function (11:05am – 11:45am) How do […]

MGCC Deploys $75 Million to Small Businesses

AAFCPAs’ client Massachusetts Growth Capital Corporation (MGCC) is offering two new grant programs for small businesses affected by the COVID-19 pandemic. These funds were appropriated through the state’s share of the American Rescue Plan Act (ARPA). There are two programs: The New Applicant Grant Program and The Inclusive Grant Program. Grants range from $10,000 – $75,000. […]

AAFCPAs’ Lease Task Force Advises: Do Not Delay!

In 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842) to increase transparency and comparability of lease transactions. Implementing FASB’s lease accounting standard will require businesses to invest considerable time and resources in gathering the information required for reporting. AAFCPAs advises clients to not delay! Lease Implementation Resources: […]

Carmen Grinkis, Leading Lady Making a Difference in Her Community

Carmen Grinkis, Ph.D, CLTC, CLU®, CFP® was recently featured in Providence Monthly, Hey Rhody, and The Bay Magazine’s Leading Ladies 2022 spotlight, which included over 100 inspiring, passionate, determined leaders who are making a difference in their Rhode Island communities. Carmen is a Wealth Advisor and Co-Managing Partner of AAF Wealth Management, a division of […]

Live Session: Lease Standard Implementation, April 27

AAFCPAs’ Annual Nonprofit Educational Seminar is Virtual Again in 2022! As a client and/or friend of AAFCPAs, your registration is complimentary. Reserve your seat.>> 9:00 am – 9:50am | Accounting Standards Update We are excited to announce the return of our highly anticipated Accounting Standards Update, featuring Matthew Hutt, CPA, CGMA, Katie Belanger, CPA, and […]

Cyberthreats Related to Russia/Ukraine Conflict

AAFCPAs reminds clients to anticipate cyberthreats as the Russia/Ukraine crisis continues to escalate. “The U.S. Cybersecurity and Infrastructure Security Agency (CISA) recently issued a warning of the risk of Russian cyberattacks spilling over onto U.S. networks, which follows previous CISA warnings on the risks posed by Russian cyberattacks for U.S. critical infrastructure,” reported Harvard Business […]

The Market’s Response to War and Uncertainty

It’s been almost two weeks since Russian troops entered Ukraine. We too watch in horror as the toll on Ukrainian civilians continues to grow. In addition to the lives lost and infrastructure destroyed, we are witnessing the fastest growing refugee crisis in Europe since World War II, according to the United Nations. “Any man’s death […]

New Schedules K-2 & K-3 affecting all flow-through entity tax returns

AAFCPAs would like to make clients aware that the IRS has released final versions of two new Schedules K-2 & K-3 that should be included with tax returns of pass-through entities. These schedules were originally perceived as being required to be filed only by entities reporting items of international relevance. However, in its recent January […]