Topic

Develop an Individual Financial Plan That Accounts for Market Volatility

As we head into the final quarter of 2018, it is a great time to reflect on the financial markets. We have experienced the longest period of economic expansion in the nation’s history, and we have come a long way since the mortgage and housing crisis in 2008. However, as you may know from recent […]

AAFCPAs Releases 2018-2019 Tax Planning Guide for Businesses & Individuals

Looking for our latest tax guide? Click here for AAFCPAs’ 2019-2020 Tax Guide. Although you cannot avoid taxes, you can take steps to minimize them. This requires proactive tax planning, including estimating your tax liability, looking for ways to reduce it, and taking timely action. In 2018, tax planning is more complicated than usual. Most […]

AAFCPAs Outlines State Applicability, IRS Guidance Related to TCJA that Nonprofits Need to Know

AAFCPAs would like to make Tax Exempt Organizations aware of state by state applicability and recent IRS guidance on the Tax Cuts and Jobs Act, known officially as H.R. 1, (the “TCJA”) and how it pertains to charitable nonprofits. AAFCPAs has outlined the following applicability and guidance that are especially noteworthy: State by state applicability […]

AAFCPAs Welcomes New Partner Joyce Ripianzi to Support Steady Growth of the Firm

Boston, MA (October 16, 2018) – AAFCPAs, a best-in-class CPA and consulting firm known for assurance, tax, accounting, wealth management, valuation, business process, and IT advisory solutions, today announced the addition of a new Partner, Joyce Ripianzi, CPA. Joyce joins AAFCPAs as a key member of the firm’s growing Managed Accounting Solutions Practice. She will […]

AAFCPAs Wealth Management names new co-directors

AAFCPAs Wealth Management, a financial planner in Westborough, has named two new co-directors of the firm. Carmen Grinkis and Andrew Hammond are the new co-directors, taking over from founder Joel Aronson, the firm said.

IRS Issues Tax Guidance on TCJA Changes on Business Expense Deductions for Meals, Entertainment

AAFCPAs would like to make clients aware that on October 3rd, 2018, the Internal Revenue Service (IRS) issued guidance on the business expense deduction for meals and entertainment following law changes in the Tax Cuts and Jobs Act (TCJA). The 2017 TCJA eliminated the deduction for any expenses related to activities generally considered entertainment, amusement […]

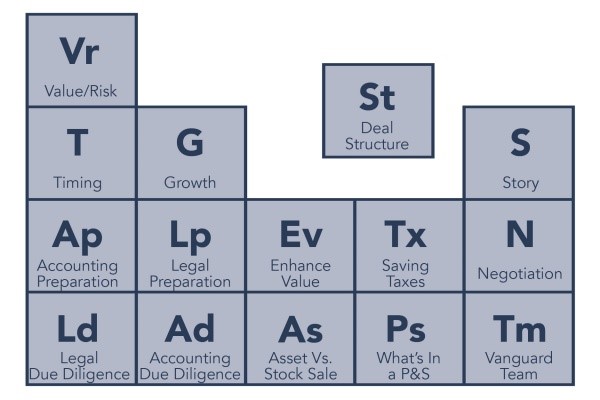

AAFCPAs’ Jack Finning and Janice O’Reilly to Present Educational Workshops on Preparing to Sell a Closely-Held Business

AAFCPAs Partners Jack Finning, CPA, CGMA and Janice O’Reilly, CPA, CGMA will present educational workshops on October 24th, providing guidance and key considerations when selling a closely-held business. These sessions are part of Beacon Equity Advisors’ annual Elements Conference, organized for the benefit of private company business owners who want to learn about: timing the […]

AAFCPAs Presents Workshop on Nonprofit Financial Statement Framework for Lawyers Clearinghouse

ASU 2016-14, Not-for-Profit Entities (Topic 958), Presentation of Financial Statements of Not-for-Profit Entities, affects substantially all nonprofits as well as creditors, donors, grantors, and others that use their financial statements. AAFCPAs’ Amanda Pelcher, CPA will provide insight to the Lawyers Clearinghouse’s network of nonprofits during a workshop she will give on Understanding the New Nonprofit Financial Statement […]

IRS Issues Proposed Regulations on Charitable Contributions and State and Local Tax Credits

The IRS recently released proposed regulations addressing the state and local itemized tax deduction, available to individual taxpayers on their Federal tax returns. The regulations also apply to trusts and decendents’ estates. Under the Tax Cuts and Jobs Act, the state and local tax deduction (consisting primarily of income, real estate and other property, and […]