AAFCPAs assembled its Lease Accounting Task Force to ensure clients can implement the new ASU with efficiency and ease. We have been dedicated to interpreting and advising clients on the ASU since introduced by the FASB back in 2016.

Implementing the new lease standard is not just a one-time exercise. It requires changes to accounting processes and financial reporting controls. Accounting policy elections and practical expedients will affect the overall process and timeline—so be sure to assess them early. Effective implementation requires a thorough evaluation of resources and your organization should identify someone to take the lead for this work.

Determine process and timeline

Identify someone to take the lead and additional resources as appropriate

Key Considerations

- Define a lease

- Exceptions

- What is included in cost of right of use assets

- Types of leases

- Capitalized operating leases

- Finance leases

- Financial statement impact

- Transition issues

- Guidance for new leases

- Tax considerations

- GAAP vs. other basis of accounting

- Lessor accounting

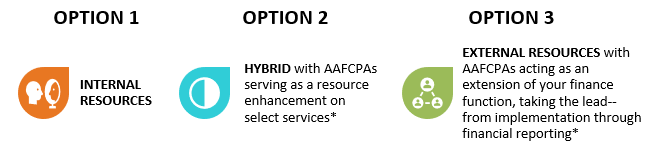

How will you approach this ASU Implementation?

AAFCPAs’ Consulting Services Include:

- Assessing the impact of the standard on the organization/company, including assisting with the inventorying of all existing leases and terms; assisting with the development of an implementation schedule to appropriately allocate internal resources to achieve compliance with the new standard; reviewing and updating accounting policies and procedures to reflect the required changes.

- Analysis of qualifying lease agreements, including any lease modifications and documentation of detailed summaries and accounting treatments; guidance on interpreting the criteria necessary to classify leases as operation or financing; guidance on bundling lease agreements and similar polices and accounting treatments with the goal of improving efficiency of analysis; and assessing the impact and desirability of electing available practical expedients.

- Assessing the impact of the new standard on debt covenants.

- Assessing the impact on drafting financial statements, footnote disclosures, including transition election and presentation.

- Lease Accounting Software Selection & Implementation: AAFCPAs will Identify the most appropriate IT solutions, including a cost/benefit analysis related to the utilization of lease software solutions and system selection including implementation support.

*For audit clients, AAFCPAs’ role remains advisory in nature and considers all appropriate safeguards to ensure an acceptable level of independence is maintained. AAFCPAs complies with applicable independence standards, rules and regulations issued by the AICPA and other regulatory agencies.

AAFCPAs Lease ASU Implementation Checklist

AAFCPAs designed a comprehensive checklist to help clients understand the scope of the ASU implementation process. Contact us to discuss how the new lease standard will impact your organization—and how we can help.